Mar 16, 2021

Bridgewater Co-CIO Sees Inflation Spiral Forcing Fed Into Action

, Bloomberg News

(Bloomberg) -- The world is on the verge of a new inflationary wave that could force the Federal Reserve to raise rates earlier than planned, according to the co-chief investment officer of the world’s largest hedge fund.

The Biden administration’s “extreme” approach to fiscal stimulus looks set to turbocharge consumer prices while threatening the post-crisis bond and stock rally, Greg Jensen at Bridgewater Associates said in an interview.

“The pricing-in of inflation in markets is actually the beginning of a major secular change, not an overreaction to what’s going on,” Jensen said. “Economic conditions and inflation will adjust faster than either markets or the Fed are expecting.”

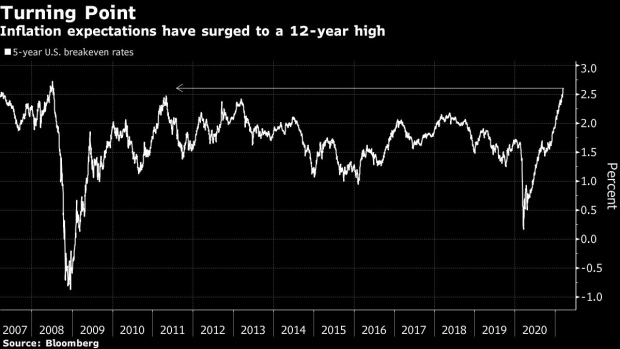

While market-derived inflation expectations have surged near a 12-year high, the Fed has signaled patience with a heating economy and projected no rate hike for the coming two years. It’s a stance policy makers are expected to reiterate at the end of their meeting Wednesday.

Dalio Says It’s Time to Buy Stuff Amid ‘Stupid’ Bond Economics

Between the upcoming $1.9 trillion stimulus program and the ending of lockdowns, traders are betting the economic revival will force the Fed’s hand sooner. Eurodollar contracts suggest a roughly 75% chance of tighter policy by December 2022.

Treasury Market’s Bears Are Set for a Reality Check From Fed

Bridgewater has long sounded the alarm over holding bonds amid rising inflation risk, something emphasized in recent days by top guns including founder Ray Dalio to co-chief investment officer Bob Prince. The $150 billion macro hedge fund last year shifted part of its All Weather portfolio from nominal government debt to inflation-linked notes and gold.

Labor-friendly policies and slowing globalization mean technological progress is the only disinflationary force around, according to Jensen. Meanwhile, fiscal and monetary policy makers are likely to offer yet-more support until breaking point.

Bridgewater aims to win big from this macro turnaround, using alternative data to map the rollout of the fiscal stimulus, which Jensen says is by nature harder to track than monetary tools. The Pure Alpha fund’s record loss last year was in part down to the fact the firm was caught off-guard by the speed of both the global lockdowns and subsequent policy support.

“If the risk to equities is higher rates, rates don’t help,” Jensen said. “The ability to use bonds to diversify has got significantly worse and obviously the ability to use bonds to get returns has got significantly worse.”

©2021 Bloomberg L.P.