Mar 15, 2022

Bridgewater Says Spending on Green Energy Is Less Inflationary

, Bloomberg News

(Bloomberg) -- Governments should subsidize green technologies and infrastructure to combat climate change, with such investments putting less upward pressure on prices than alternatives including carbon taxes, according to Bridgewater Associates, the world’s largest hedge fund.

Tax credits and other fiscal support for things such as renewable power and electric vehicles would be less inflationary than levies that would raise energy prices, Bridgewater said. Carbon taxes also can exacerbate income equality because lower- and middle-income households spend a larger portion of their income on energy, according to the Westport, Connecticut-based firm, which manages $150 billion.

With inflation at the highest level in decades and Russia’s invasion of Ukraine creating new energy-supply restrictions, “political appetite for curbing climate change by further raising energy prices will continue to decline,” Karen Karniol-Tambour and Carsten Stendevad, Bridgewater’s co-chief investment officers for sustainability, said in a LinkedIn post Tuesday. “We need tools to curb climate change other than those that raise energy prices -- tools that seek to reduce the cost of ‘green’ energy.”

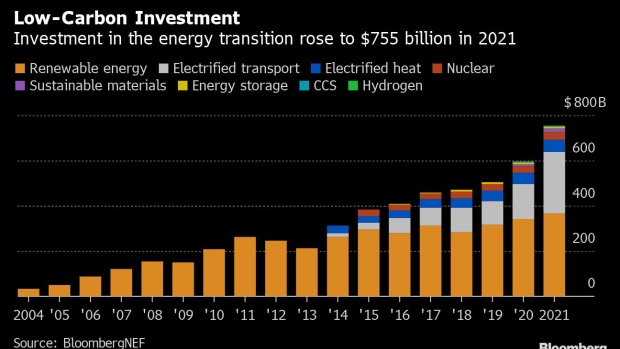

Global investments in shifting economies to cleaner fuels totaled $755 billion last year, according to BloombergNEF. Some $2.1 trillion is needed annually in the next three years to meet international goals to meet net-zero emissions by 2050, the research firm said.

While there’s ample funding of green technologies from the private sector, government support for early-stage developments is often critical as well, according to Bridgewater, founded by billionaire Ray Dalio. Significant spending by the Chinese government on subsidizing electric vehicles and solar has made it the global leader in those technologies, the firm said.

“There is significant room for western governments to finance the development of technology to curb emissions, and the sums required tend to be vastly smaller and therefore less likely to fuel inflation,” Karniol-Tambour and Stendevad wrote.

At a time of rising inflation, innovation is usually deflationary, they said, with new technologies tending to beat out older ones through better performance at lower prices.

“Previous energy transitions unfolded over long periods of time, as new capacity was built with new and cheaper technologies while old capacity gradually went offline,” Karniol-Tambour and Stendevad said. “The development of cheaper green technologies will contain the inflationary impacts of such a proactive transformation in the world energy.”

©2022 Bloomberg L.P.