UK House Prices Under Threat As Traders Pare Back Rate Cut Bets

The UK housing market recovery is threatened by investors scaling back bets on how far the Bank of England will cut interest rates, according to a new report.

Latest Videos

The information you requested is not available at this time, please check back again soon.

The UK housing market recovery is threatened by investors scaling back bets on how far the Bank of England will cut interest rates, according to a new report.

US mortgage rates increased to the highest level in five months, pushing down home-purchase applications for the fifth time in the last six weeks.

The daughter of a Chinese nickel billionaire purchased a multimillion-dollar mansion in Singapore, adding to the list of wealthy people seizing buying opportunities during the market lull.

A rash of failures of A-rated insurers points to a hidden weakness in the market, researchers say.

A new book by University of Virginia professor Andrew W. Kahrl argues that the country has weaponized tax collection against its citizens for more than a century.

Jul 8, 2020

, Bloomberg News

(Bloomberg Opinion) -- The English are obsessed with owning property but Boris Johnson’s government worries that they’ve not been buying nearly enough houses lately. As elsewhere, the U.K. housing market was put into suspended animation for several weeks to help contain Covid-19.

Now Johnson’s finance minister, Rishi Sunak, apparently plans to put a rocket under the market by temporarily scrapping transaction taxes — known as “stamp duty” — for homes that cost less than 500,000 pounds ($628,000), according to newspaper reports. The change would apply to England and Northern Ireland (Wales and Scotland have separate rules) and it’s possible the threshold and eligibility requirements could still change.

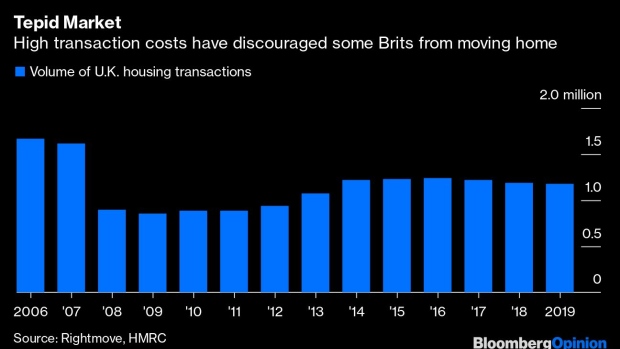

High transaction taxes constrain labor-market mobility, making people think twice before buying a property so they can switch jobs. They also stop elderly people from downsizing to smaller homes, which is a problem for a country that doesn’t have enough housing supply.

So, in theory, I’m all for cutting stamp duty, which is levied progressively at higher rates the more a home costs. However, temporary changes to property taxation risk distorting the market and creating a hangover later on. Moreover, it’s entirely rational to be cautious about buying a home right now. Britain is entering its worst recession in 300 years, and millions of workers are on furlough and don’t know whether they’ll still have a job come the autumn. Coronavirus infections could surge again, requiring lockdown measures to be reimposed.

The Bank of England’s chief economist, Andy Haldane, says uncertainty about the economy is the highest in his three-decade career, and his employer said previously that house prices could fall as much as 16%. Is it responsible for Johnson and Sunak to prod people to commit to the biggest financial commitment they’ll ever make at a time like this?

As with the government’s program of home-purchase subsidies, known as Help to Buy, this feels like another attempt to prop up high house prices by stimulating demand, even though what England needs desperately is more supply. Providing the latter might cause prices to fall and thus better help those trying to get on the property ladder.

In fairness, you can see why the government might see this as a good way to stimulate spending: English house prices are wildly over-inflated, but when they’re rising they create a certain feel-good factor for consumers. Saving your money might be the more prudent thing to do right now, but if everybody does it simultaneously, the economy will grind to a halt — a phenomenon John Maynard Keynes dubbed the “paradox of thrift.”

When people move house they tend to spend heavily on renovations and the services of estate agents and lawyers. So cutting stamp duty would probably help the economy, or at least contain some of the damage from Covid-19.

Because the impact on transaction volumes from cutting these taxes is predictable, at least in the short term, it’s been tried before. Facing a deep recession in 1991, John Major’s Conservative government raised the threshold at which people started paying stamp duty. Labour’s Gordon Brown did similar in 2008. More recently, various Tory governments have tweaked stamp duty so that first-time buyers pay less and those buying expensive properties or a second-home pay more.

But the lessons from the past aren’t uniformly positive. In 1991, stamp duty relief encouraged people to bring forward home purchases but the housing market ground to a halt again once the benefit expired. Worse, many people ended up with homes that were worth less than they’d cost.

It’s also debatable whether home buyers realize much benefit from stamp duty cuts because sellers jack up the asking price, knowing buyers can afford more.

Since the arrival of Covid-19, U.K. house prices have declined for four consecutive months, the first time that’s happened in a decade. But where they go from here is impossible to predict. Depending on Sunak’s final policy, it’s possible that a price decline of just 3% would cancel out all of the stamp duty saved on purchasing a half a million pound home.

Cutting stamp duty won’t suddenly make Britain’s high house prices a bargain and it’s no help at all if you can’t get a mortgage. Lenders have recently been withdrawing high loan-to-value deals, forcing borrowers to pay a larger deposit. This ensures that any fall in house prices is the home buyer’s problem, not the bank’s.

There are some possible upsides for the housing market from the pandemic. The experience of lockdown will have convinced many people that they need a bigger property or one with more outside space. Others may be able to work from home on a more permanent basis, meaning a shift to countryside living may be more conceivable. Those fortunate enough to have a secure white-collar job may even have built additional savings during lockdown.

But for many office workers it’s still too soon to know whether work-from-home is a viable long-term option. So waiting and seeing might be the most sensible course of action. Sunak might not want you to wait around, but moving now is a risky endeavor.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Chris Bryant is a Bloomberg Opinion columnist covering industrial companies. He previously worked for the Financial Times.

©2020 Bloomberg L.P.