Mar 2, 2023

Broadcom Gives Robust Forecast on Networking-Infrastructure Demand

, Bloomberg News

(Bloomberg) -- Broadcom Inc., one of the world’s biggest chipmakers, acknowledged that sales growth would slow in the second half of the year but predicted a “soft landing” as companies keep spending on corporate networking infrastructure.

Revenue in the fiscal second quarter will be about $8.7 billion, Broadcom said in a statement Thursday, compared with an average analyst estimate of $8.58 billion. Though the second half will bring a deceleration, Broadcom expects to see sales still grow from where they were a year earlier, Chief Executive Officer Hock Tan said on a conference call.

The outlook suggests Broadcom continues to weather a slowdown better than many of its chip peers. Tan, the company’s longtime head, has sought to avoid an inventory glut by carefully managing supplies, relying in part on strict policies that prevent customers from canceling orders.

Broadcom still has full order books for the rest of the fiscal year. Though some customers have asked to delay shipments, that hasn’t had a material impact on the company’s earnings, Broadcom said.

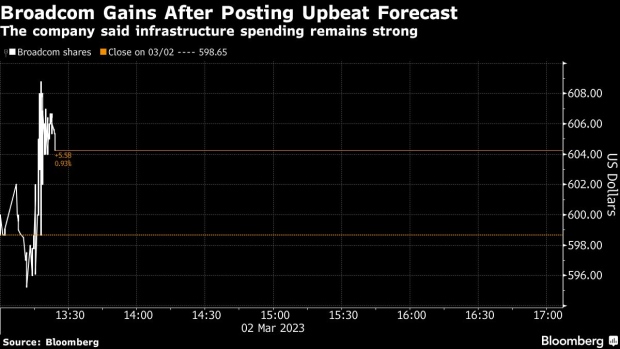

The shares were little changed in late trading after the report was released. They had closed at $598.65 in New York.

Broadcom outshined Marvell Technology Inc., another chipmaker that reported earnings on Thursday afternoon. It plunged more than 9% in extended trading after projecting weaker profit margins than analysts anticipated.

Broadcom’s semiconductors and software go into a wide range of products, which has also helped make it more stable. It supplies chips to Apple Inc. for the iPhone and high-end networking chips used in the data centers of companies such as Amazon.com Inc.

Broadcom’s CEO was bullish about demand for networking chips and custom products used to help build the giant computing arrays needed to power artificial intelligence systems such as ChatGPT. Customers have become more excited about that area and are demanding new products for that use, he said.

Separately, the company’s wireless unit showed only moderate growth in the quarter and will likely suffer a sales decline in the current period compared with a year earlier. Growth last quarter got a boost from the company’s large North American customer — the term he typically uses to describe Apple.

Broadcom shares had outperformed those of its chip peers in 2022, though they’ve lost some of their luster this year. The stock is up 7% in 2023, compared with 18% for the benchmark Philadelphia Stock Exchange Semiconductor Index.

Broadcom, based in San Jose, California, also has branched out into enterprise software by acquiring security and mainframe capabilities. And it’s trying to extend that run with a $61 billion purchase of VMware Inc., a transaction announced in May. The two companies recently extended the time needed to complete the deal until May 26 as regulatory approval drags on.

Broadcom is still making progress in persuading regulators to sign off on the deal and expects to close the transaction this fiscal year, Tan said on the call.

In the first quarter, which ended Jan. 29, Broadcom’s profit was $10.33 a share, excluding some items. Revenue rose 16% to $8.92 billion. Analysts had predicted earnings of $10.16 a share and sales of $8.9 billion.

The company’s chip business had sales of $7.1 billion in the quarter, a gain of 21% from a year ago. That beat some estimates. Infrastructure software shrank 1% to $1.8 billion and fell short of projections.

The company has reported year-over-year revenue growth for almost a decade.

The chip industry enjoyed a dramatic boom during the pandemic, when the work-from-home shift fueled demand for technology. In the long run, Tan has said that the market will return to annual growth of about 5% or less — sticking with a more conservative outlook than many of his peers.

©2023 Bloomberg L.P.