Jul 1, 2019

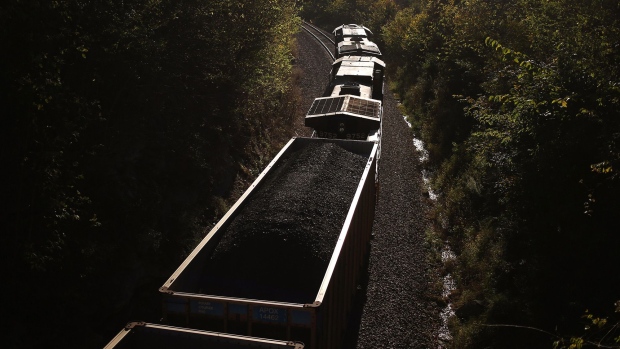

Brookfield buys rail operator Genesee for US$8.4 billion

, Bloomberg News

An affiliate of Brookfield Asset Management Inc. agreed to buy Genesee & Wyoming Inc. for US$8.4 billion including debt to expand its global portfolio of rail companies with a 120-line network spanning North America, Europe and Australia.

Brookfield will pay US$112 a share in cash, a 39.5 per cent premium from G&W’s close on March 8, the last day of trading before Bloomberg News reported that the railroad was exploring a possible sale.

Buying G&W will hand Brookfield more than 3,000 customers, alongside a resilient cash flow. The company, which already attracted activist investor Blue Harbour Group LP, doesn’t compete directly with the largest North American railroads such as Union Pacific Corp., CSX Corp. and Canadian National Railway Co. It also has operations in Australia, the U.K. and continental Europe.

“This is a rare opportunity to acquire a large-scale transport infrastructure business in North America,” said Sam Pollock, chief executive of Brookfield Infrastructure. “G&W will be a significant addition to our global rail platform and will expand our presence in this sector to four continents.”

The shares have risen 35 per cent in the year to date, compared with a 17 per cent gain in the Standard and Poor’s Midcap 400 Index. The stock is valued at 23 times estimated earnings, compared with the industry gauge, which is trading at 16.6 times.

The transaction is expected to close by early 2020.