Mar 6, 2022

Brookfield Consortium’s Improved Offer for AGL Is Rejected

, Bloomberg News

(Bloomberg) -- Australian utility AGL Energy Ltd. rejected an improved multibillion-dollar takeover approach from Brookfield Asset Management Inc. and billionaire Mike Cannon-Brookes, who wanted to accelerate the firm’s transition to net-zero emissions by more than a decade.

The consortium made a second offer of A$8.25 ($6.08) a share -- an 11% premium to Friday’s close of A$7.43, and higher than the A$7.50 tabled last month, Cannon-Brookes said Sunday in a Tweet. He indicated that another proposal probably won’t be forthcoming.

The consortium of Brookfield and Cannon-Brookes’ Grok Ventures “is putting our pens down - with great sadness,” he said. Cannon-Brookes, a co-founder of software developer Atlassian Corp., is Australia’s fourth-richest person.

Brookfield and AGL declined to comment. Details of the new approach were first reported by the Sydney Morning Herald.

Sydney-based AGL rejected the new offer as too low and the company plans to comment publicly on its reasons on Monday, according to people familiar with the decision, who requested anonymity to discuss private details. The consortium’s earlier, lower offer had valued AGL’s equity at A$5 billion.

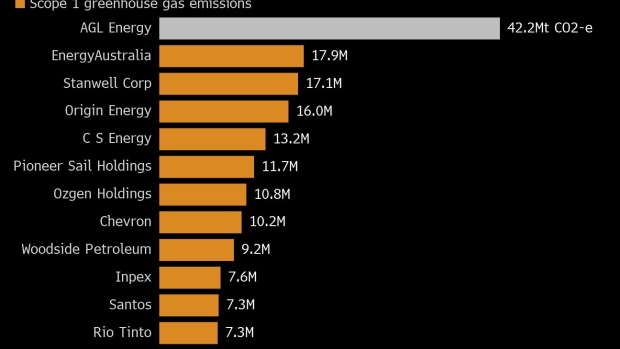

AGL, formed in 1837, is responsible for the largest share of Australia’s scope-one greenhouse gas emissions, and has faced criticism over its plans to continue operating giant coal plants into the 2040s. The company is seeking to separate its power generation assets and electricity retailing business via a demerger.

Brookfield insisted it could generate more value by abandoning AGL’s existing strategy, and pledged to deliver a A$20 billion transition plan to close down the coal plants more quickly and replace them with renewable energy.

The plan would have enabled the company to hit net-zero emissions by 2035 -- 12 years earlier than its current proposals, the bidders said.

©2022 Bloomberg L.P.