Chinese Firms Are Investing Abroad at Fastest Pace in Eight Years

China’s overseas investment is heading for an eight-year high as its dominant firms build more factories abroad, a shift that could soften criticism of Beijing’s export drive.

Latest Videos

The information you requested is not available at this time, please check back again soon.

China’s overseas investment is heading for an eight-year high as its dominant firms build more factories abroad, a shift that could soften criticism of Beijing’s export drive.

The Related Cos. founder is following the money flowing south by bringing his influence to everything from real estate to schools and health care.

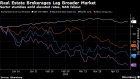

Real estate brokerage stocks tumbled Thursday on waning expectations for Federal Reserve interest-rate cuts, and as a disappointing earnings release raised concern about the sector’s outlook.

Initial data on US gross domestic product for the first quarter of 2024 is set to confirm an ongoing economic boom amid a tailwind from surging immigration.

A South Florida office skyscraper from Related Cos. landed new finance tenants, including a John Paulson business and a private equity firm that counts Mark Bezos as a founding partner.

Jun 7, 2018

, Bloomberg News

Brookfield Asset Management Inc. is weighing a sale of its North American industrial-property business IDI Logistics, according to people with knowledge of the matter.

The Canadian investment firm has interviewed banks to advise it on a sale of the company, which could fetch US$5 billion, according to the people, who asked not to be named because the matter is private. The business is owned by Brookfield’s real estate arm, Brookfield Property Partners LP.

A deal for IDI Logistics would follow Brookfield’s sale last year of its European warehouse business, Gazeley, for US$2.8 billion to Singapore’s Global Logistics Properties Ltd. IDI Logistics has 33 million square feet (3.1 million square meters) of assets under management as well as sites to develop an additional 20 million square feet of distribution facilities, according to a press release last month.

The shift toward online shopping is luring investors into industrial real estate at a time when sales of other types of properties have slowed. Purchases of industrial buildings surged 34 per cent in the first quarter from a year earlier, to US$20.9 billion, according to research firm Real Capital Analytics Inc. Since then, deals have included Blackstone Group LP’s agreement last month to buy Gramercy Property Trust and Prologis Inc.’s proposed acquisition of DCT Industrial Trust Inc.

Brookfield bought IDI’s predecessor, IDI Developments International Inc., for US$1.1 billion in 2013.