Feb 20, 2022

Brookfield spurned in US$14B plan to close coal plants

, Bloomberg News

Christine Poole discusses Brookfield Asset Management

Australian utility AGL Energy Ltd. rejected a multibillion-dollar takeover bid from Brookfield Asset Management Inc. and technology billionaire Mike Cannon-Brookes, who plan to accelerate the closure of the company’s polluting coal-fired power plants.

Brookfield and Cannon-Brookes’s investment firm Grok Ventures have a A$20 billion (US$14 billion) transition plan to shift AGL to clean energy and “remains optimistic that an agreement can be reached,” the consortium said in a statement. AGL shares jumped 11 per cent to close at the highest since July.

“The board should continue to engage with Brookfield and Cannon-Brookes, however they will need to considerably increase the offer if they want to get the investment community onboard, even though we agree with the ideals they propose,” said Jamie Hannah, deputy head of investments and capital markets at Van Eck Associates Corp, which owns shares in AGL.

A proposal of A$7.50 a share, a 4.7 per cent premium to Friday’s closing price, “materially undervalues” the company, Sydney-based AGL said in a statement. The company’s own plan to split off its coal assets into a separate unit would deliver better shareholder value, and offers a more responsible path to decarbonization, the utility said.

Public debate on climate change in Australia and the role of coal, which still provides most of the country’s electricity, intensified after wildfires in late 2019 and early 2020. Though Prime Minister Scott Morrison set a net-zero emissions target last year, his government has been criticized for favoring a slower energy transition. He has been pushed by some investors to exploit the nation’s abundant sun and wind to more rapidly build out a green power industry.

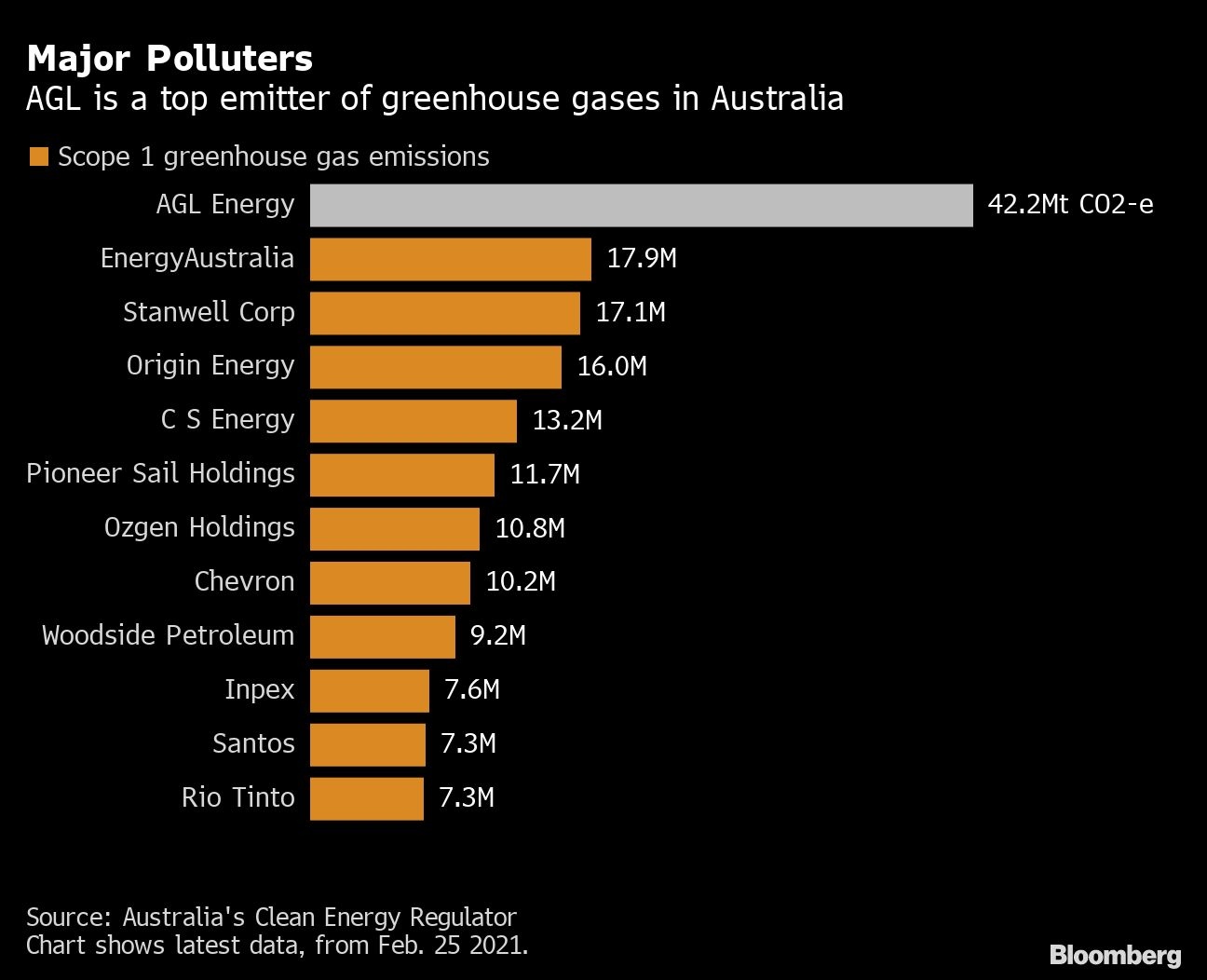

AGL, formed in 1837, is responsible for the largest share of Australia’s scope one greenhouse gas emissions, and this month disappointed climate campaigners when it announced plans to bring forward the decommissioning of two giant coal plants by only a few years.

“If successful, this will be one of the biggest decarbonization projects in the world,” said Cannon-Brookes, co-founder of software developer Atlassian Corp. and Australia’s fourth-richest person. AGL accounts for more than 8 per cent of Australia’s emissions, he said. “This proposal will mean cheaper, cleaner and more reliable energy for customers.”

Brookfield’s plan would replace seven gigawatts of AGL’s fossil fuel generation capacity with at least eight gigawatts of clean energy and storage capacity, enabling the utility to hit net zero emissions by 2035, according to the consortium.

AGL’s existing plans would keep two key coal-fired plants running into 2033 and 2045 respectively. Under its proposed demerger, Accel Energy, which will house the company’s fossil fuel generation assets, would target a cut in scope one and two greenhouse gas emissions by as much as 60 per cent by 2034.

The firm’s value almost halved last year as it was hit by plunging costs of wind and solar generation that have dragged down power prices, and waning investor appetite for polluting assets. Utilities globally are attempting to respond to an accelerating energy transition, and AGL previously outlined its proposal to split off its coal-fired power plants into a separate unit and repurpose some sites as low-carbon energy hubs.

Brookfield plans to invest via its Brookfield Global Transition Fund, which is in the final stages of raising about US$15 billion. It values AGL’s equity at A$5 billion (US$3.6 billion). The deal would provide an opportunity to build a dominant position as a clean energy generator in Australia and to secure an electricity retailer that serves about 4.5 million customers.

Rival Origin Energy Ltd. said last week that its Eraring coal plant could retire in 2025, seven years earlier than previously planned. The faster exit of power assets has drawn criticism from Morrison’s government, which argues the moves could put the affordability and reliability of Australia’s electricity supplies at risk.

“Our government is very committed to ensure we sweat those assets for their life to ensure that businesses can get access to the electricity and the energy they need at affordable prices,” Morrison said Monday.