Jan 13, 2021

Buddhist Monks Are Snapping Up ESG Bonds in Japan

, Bloomberg News

(Bloomberg) -- ESG investing is so popular in Japan that even Buddhist monks are getting into it.

One of the new investors is Tokuunin, a Zen Buddhist temple in central Tokyo. The religious group wanted to make more money for building repairs and maintenance over the coming decades, so it bought 40-year social bonds sold by the University of Tokyo, according to Yuzan Yamamoto, its chief priest.

“At a time when we can barely get any returns from long-term savings, we’re happy that we can contribute to helping society while earning enough returns to cover inflation,” Yamamoto said.

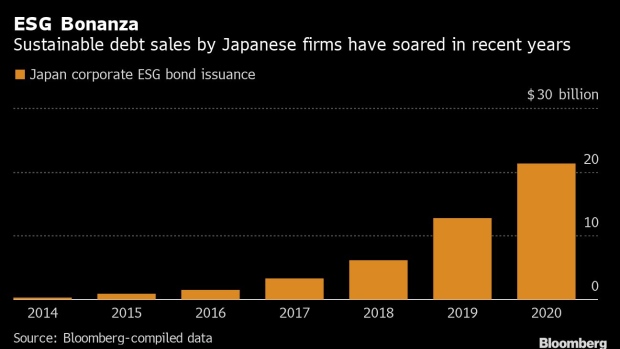

He’s not alone. Nomura Securities Co. has been finding that more and more Buddhist temples and Shinto shrines are interested in buying environmental, social and governance bonds, according to Satoshi Tsukazaki, who consults religious organizations at the brokerage. It’s another reflection of the sustainable investing boom in Japan that saw sales of ESG notes jump 68% to a record $21 billion in 2020, as demand for such debt surges worldwide.

Religious groups overseas are also getting more involved in sustainability projects. The Vatican said last month it’s joining executives including Bank of America Corp.’s Brian Moynihan and Salesforce.com Inc.’s Marc Benioff in a group that seeks to create “a more equitable and sustainable economic system.” Minneapolis-based Thrivent Financial for Lutherans has a fund that invests in companies based on ESG criteria.

Japanese religious organizations are also under pressure to earn more from investing because a shrinking population in the country is reducing the number of their followers that can pay for their operations. Membership in religious groups has dropped about 12% in the decade to 2019, according to government data.

The coronavirus pandemic is taking its toll as well. In normal years people flock to Japan’s about 160,000 shrines and temples at the start of the year, but many have stayed away this year due to the virus, depriving religious groups of some income from donations.

Those developments have prompted temples and shrines to rethink a bit what they do with cash raised from followers that in the past they kept in conservative investments such as bank savings and government bonds.

“They’ve started taking various risks such as on currencies and interest rates, and began buying ESG bonds,” said Tsukazaki at Nomura. “They think ESG investing is an appropriate way of using their followers’ money.”

©2021 Bloomberg L.P.