Jan 3, 2019

Buffett's buybacks make a weak floor as Berkshire drops through

, Bloomberg News

Warren Buffett’s revamped stock-repurchase policy can’t seem to keep Berkshire Hathaway Inc. from falling.

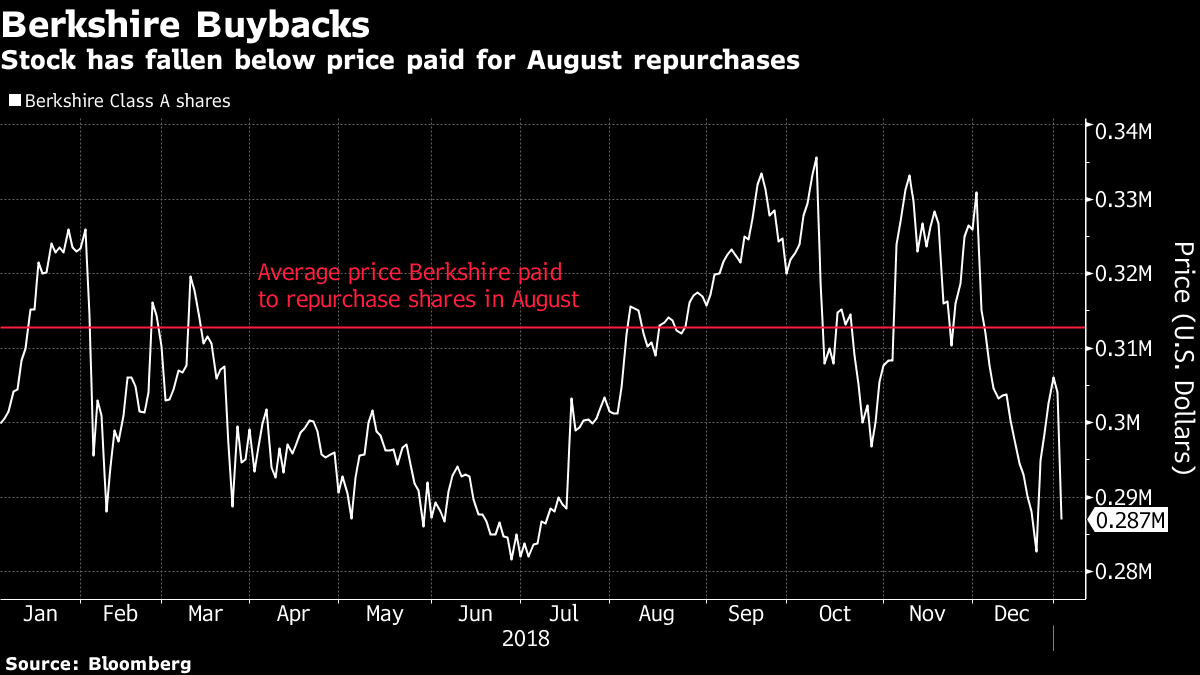

Berkshire’s stock (BRKa.N) fell the most in 11 months on Thursday as some of its biggest equity holdings, Apple Inc. and Delta Air Lines Inc., cut revenue forecasts. The closing price has spent nearly a month below US$312,806 -- the average price Buffett paid for repurchases in August. The Class A shares fell to US$287,000 on Thursday, the lowest since February.

Berkshire’s board loosened the buyback policy last year, allowing Buffett and Vice Chairman Charles Munger to repurchase the shares whenever they felt prices fell below intrinsic value. They had previously been limited to buying back stock only when the price was less than a 20 per cent premium to book value.