Feb 15, 2019

Buffett's oil bet not a rallying cry for frackers: Liam Denning

, Bloomberg News

Warren Buffett showing up in your share register can be a bittersweet affair. It confers a certain halo around your stock but also brings confirmation that it had gone to a dark place indeed. Such is the way to read Berkshire Hathaway Inc.’s just-disclosed stake in Suncor Energy Inc.

Understanding why Suncor might attract the attention of the Omaha crew requires looking at two charts. The first is Suncor’s stock price:

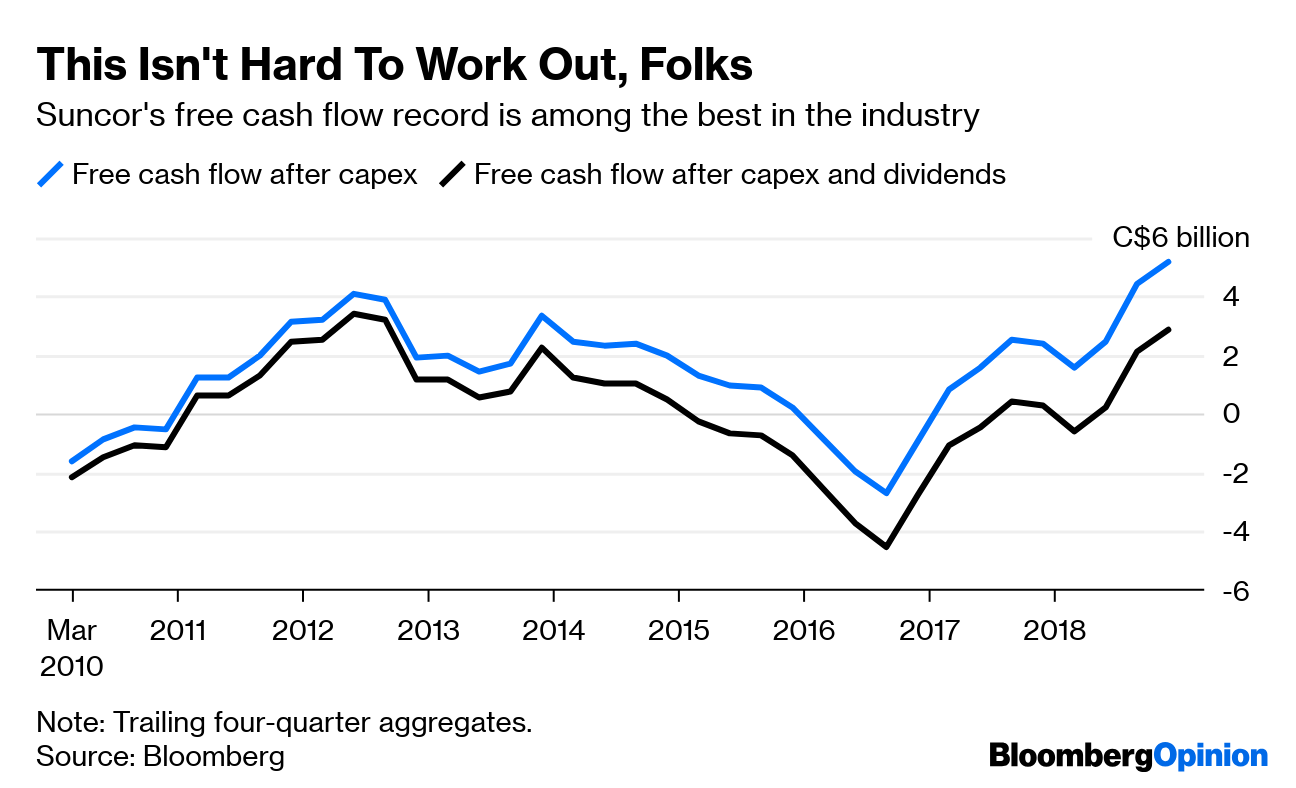

The second is Suncor’s free cash flow, after deducting capital expenditure and dividends:

Unlike many other oil producers, Suncor has stuck pretty doggedly to a mantra of living within its means, covering not just capex from internal cash flow, but dividends too (it has also thrown in buybacks of late). It dipped into negative territory during the crash, but then so did everyone else. More importantly, as the second chart shows, Suncor kept its head during the years leading up to 2014, when most of the industry took US$100-a-barrel oil as a signal to spend US$120 a barrel. Combine that sort of record with a sharp sell-off taking down the entire sector, and you’d be surprised if Buffett didn’t take a look.

How should this be read for energy stocks in general? The hopeful interpretation is that a generalist – and not just any generalist – has found something to like in a sector where generalists have all but vanished. Unfortunately, it’s an interpretation that doesn’t really hold up.

Energy isn’t a big part of Berkshire’s portfolio in general, and Suncor’s weakened stock price, strong cash management and vertical integration in Canada’s oil sands make it a special case. That integration is why it has been able to weather savage price discounts for Canadian barrels resulting from Alberta’s pipeline bottlenecks (see this). It’s interesting to note that Buffett’s other energy bets in the past decade have tended to focus on large, integrated companies – ConocoPhillips before it split (and retaining Phillips 66 afterward) and Exxon Mobil Corp. Berkshire did also make a foray into pipelines giant Kinder Morgan Inc. in late 2015, but was gone within a year.

There is precious little to read across from all this to the exploration and production stocks struggling to gain traction. They lack Suncor’s integration and track record of doing right by shareholders. They operate in a relatively fragmented part of the business – U.S. shale – that is much more exposed to the swings of the oil price and where just managing to not spend every dollar that comes in counts as shareholder friendly.

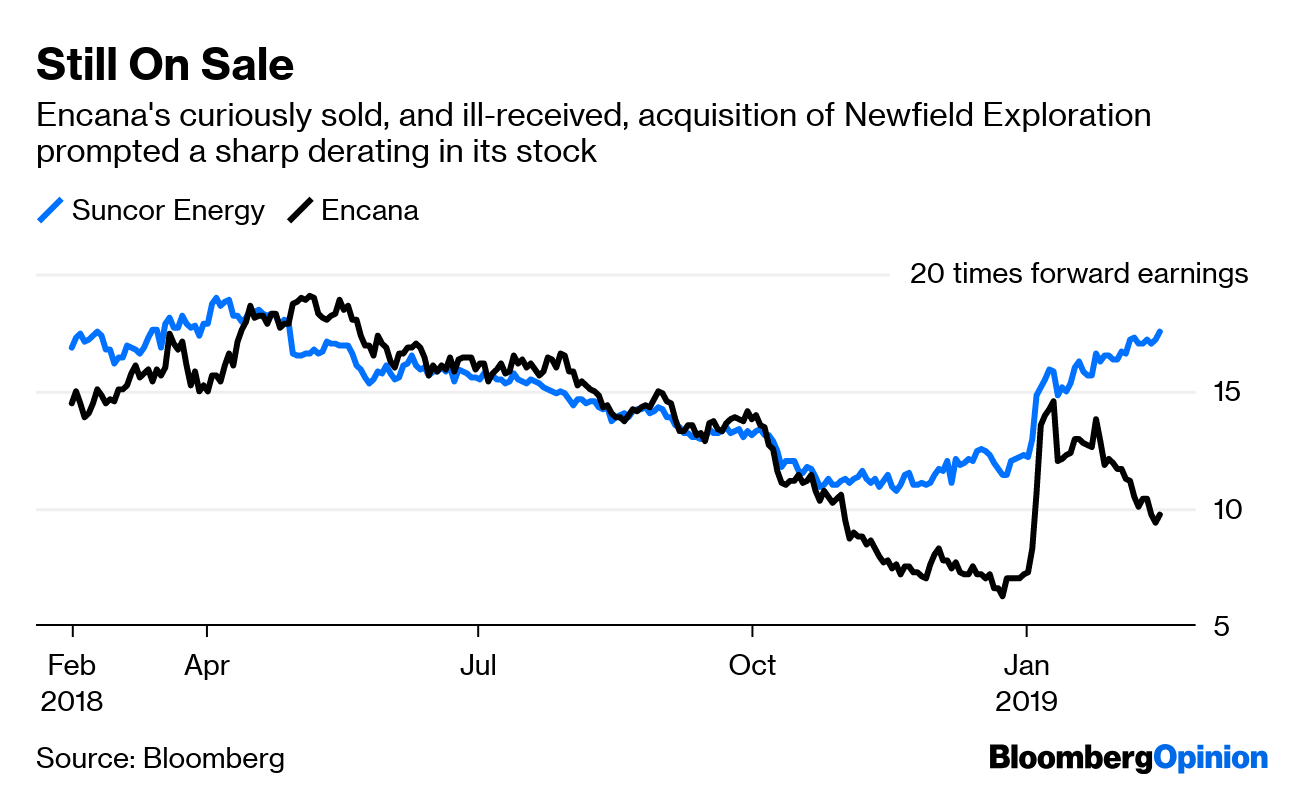

There are temptingly low multiples to be found. Fellow Canadian Encana Corp., for example, dipped down to just six times forward earnings in the fourth quarter, while Suncor dipped to just 11 times. But then you remember that Encana did stuff like this, and, as with many of its peers, you realize the stock is cheap for a reason. The one thing E&P companies can take away from Buffett’s bet on Suncor is that maybe Suncor does a few things worth emulating.

Liam Denning is a Bloomberg Opinion columnist covering energy, mining and commodities. He previously was editor of the Wall Street Journal's Heard on the Street column and wrote for the Financial Times' Lex column. He was also an investment banker.