Mar 27, 2020

Bull-Market Gain in Stocks Seen as Trivial Without Sustained Buying

, Bloomberg News

(Bloomberg) -- After meltdowns and lockdowns, some Asian equity markets are inching close to breaking out of bear territory. But the rebound doesn’t mean much without seeing sustained buying, market participants say.

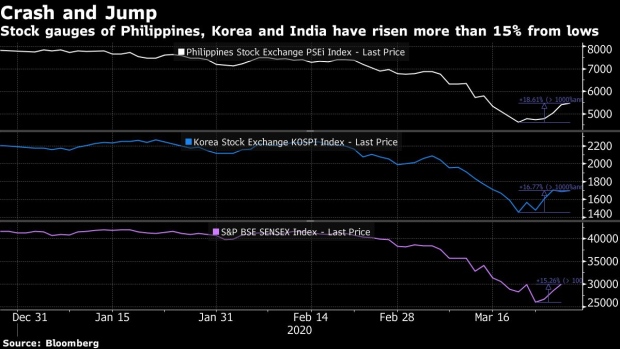

Asian stocks rose again on Friday, following the U.S. higher after the Dow Jones Industrial Average climbed out of its bear market overnight. The MSCI Asia Pacific index has risen 13% from its March low after losing about a third of its value from a record high in January. Benchmark gauges in the Philippines, South Korea and India have all advanced more than 15% from recent lows, drawing closer to a 20% gain defined as a bull market. Japan’s Topix closed at 18% above its March low on Friday.

“The 20% yardstick does not matter unless we start seeing higher highs and sustainable buying at lows,” said Jaiganesh Balasubramaniam, a market technician at Cashthechaos.com. “We need higher highs and higher lows on different time frames before we can say that we are out of bear markets.”

Balasubramaniam added that the S&P 500 Index has yet to mark a 20% gain from its recent trough so “investors should not go berserk about attaching bull market titles.”

Meanwhile, some investors have been hunting for bargains after historic drops in the region’s equities. The Asian gauge is set for its fourth straight day of gains amid unprecedented monetary and fiscal stimulus across the globe in a bid to contain the economic damage caused by the coronavirus pandemic.

Volatility, however, remains high, with the 10-day realized measure on the Asian equity benchmark still around the highest since data going back to 2010.

“It’s foolhardy to jump into a volatile market that has only risen for a few days after falling so heavily,” said Dale Gillham, chief analyst at Wealth Within. “It is very dangerous.”

©2020 Bloomberg L.P.