Oct 8, 2021

'Bumps up the risks' of early rate hike: Reaction to Canada's jobs recovery

By Noah Zivitz

Canada's job market is heading in the right direction: Allan Meyer

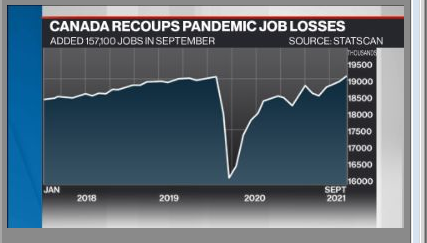

Sometimes a picture doesn't speak a thousand words. This one speaks one: recovery.

After adding 157,100 net new jobs in September, Canada's economy has recouped all of the positions that were lost to date in the pandemic, as employment returns to levels last seen in February 2020.

It's a remarkable recovery, after almost three million jobs were wiped in just a two-month span early last year.

The labour update from Statistics Canada on Friday prompted reflection on Bay Street and beyond about where Canada's economy is heading, and how the Bank of Canada might respond.

Here's some of the analysis that's being sent around by top economists to their clients.

"The headline job gain likely seals the deal for another Bank of Canada taper later this month. That said, even though employment has now reattained its pre-pandemic level, a notable milestone, there remains a ways to go before the labour market is fully healed."

-Royce Mendes, Executive Director of Economics, CIBC Capital Markets

"There is still little evidence of upward pressure on wages. While average hourly earnings have risen in the past couple of months, that is mostly due to the changing composition of employment. ... We would need to see wage growth of closer to four per cent before the Bank became concerned that above-target inflation might be sustained."

-Capital Economics Senior Canada Economist Stephen Brown

"Just because employment has now returned to pre-pandemic levels does not mean that labour markets have recovered. The unemployment rate is still more than a percentage point above February 2020 levels. Employment in higher-contact service sectors is still running more than 200,000 below pre-shock levels, even as government support programs begin to unwind. But labour market improvement in the summer has looked notably stronger than early GDP data."

-RBC Economics Senior Economist Nathan Janzen

"The recovery, while clearly bumpy at times, took a mere 17 months, which frankly was undoubtedly much faster than almost anyone would have dared predict in those dark days. As a side note, female employment led the way last month with a huge 99,700 jump, and is now well above pre-pandemic levels (whereas employment for males is not quite back to those levels yet). ... Still, this strong result all but locks in a further tapering by the Bank of Canada at the meeting later this month (Oct. 27), and bumps up the risks of the first rate hike arriving earlier than our call of next October."

-BMO Economics Chief Economist Doug Porter

"Unemployment only fell by 20,000, and long-term unemployed workers — those who have been without work for 27 weeks or longer — was little changed. This could be reflecting the difficulties faced by long-term unemployed Canadians in finding new jobs, perhaps due to a deterioration of skillsets. That said, ongoing income support programs, such as the Canada Recovery Benefit, may also be a contributing factor. This program, among others, is expiring at the end of the month, which could lead to more people rejoining the workforce in October, that is, unless it is extended."

-TD Economics Senior Economist Sri Thanabalasingam