Jun 17, 2019

Burned bets on Fed 'patiencel leads to surge in rates volatility

, Bloomberg News

Volatility in interest-rate options is spiking as traders scramble to cover short positions before this week’s Federal Reserve decision. The turnaround reflects the market switching to price in rate cuts from earlier expectations policy makers would stay on hold.

A combination of investors bailing out of short volatility positions and demand for hedges from dealers stuck on the wrong side of long-volatility bets has led to the squeeze, traders say. The moves have been exacerbated by a lack of liquidity caused by a number of market makers closing their books due to the swings in Fed pricing, according to the traders who asked not to be named as they are not authorized to speak publicly.

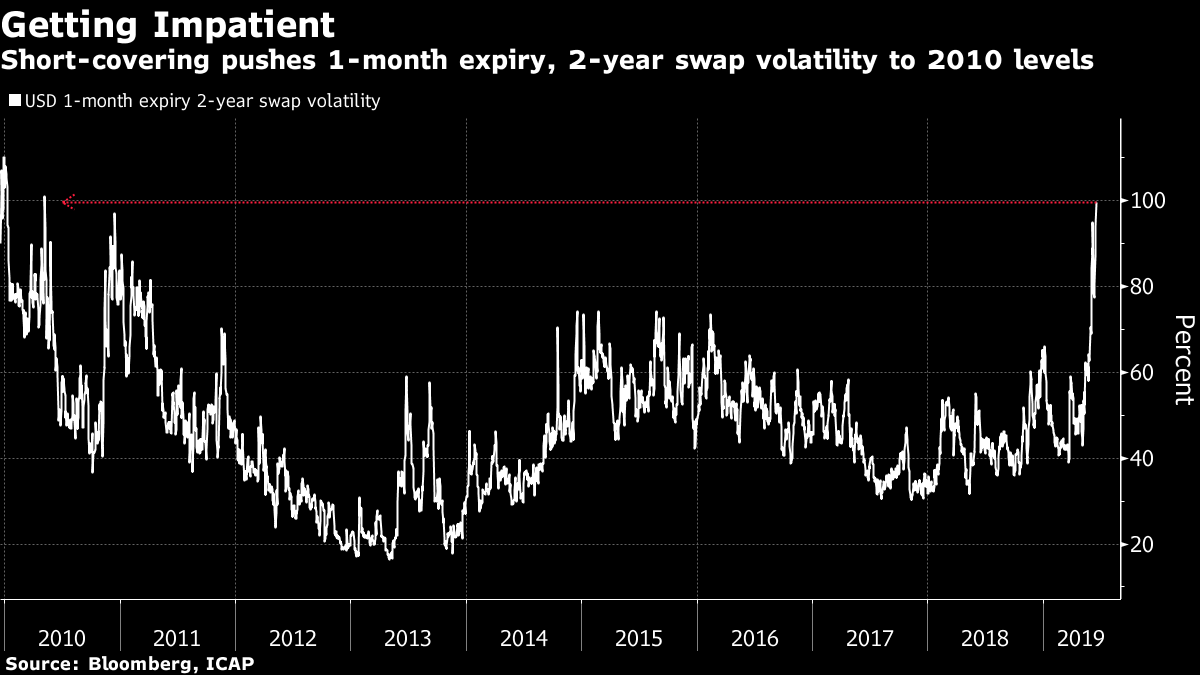

In one example of the recent market ructions, volatility in one-month expiry two-year swap rates jumped to the highest level since 2010, according to data from ICAP.

When some investors bought options wagering interest rates were too high, dealers were happy to take the other side of the trade. Betting borrowing costs would stay steady seemed logical with a promise of policy patience from the Fed since January, according to the traders.

The probability of a shift in Fed language has mounted in recent weeks due to an escalation of the U.S.-China trade war and disappointing economic data, leading to the short-term volatility spike and a rush to hedge exposed positions, they said.

Bank of America Corp.’s MOVE Index, a measure of anticipated price swings in Treasuries, jumped last week to the highest since December 2016. The surge is being fueled by increasing volatility in shorter maturities, which are a popular way to bet on the outlook for Fed policy.