Jul 17, 2018

Bus maker NFI keeping ‘brainy jobs’ in Canada in face of ‘Buy America,’ CEO says

The chief executive of NFI Group Inc. says concerns over the impact of U.S. tariffs on the Canadian bus maker are “over-exaggerated,” adding that the company is focused on keeping “brainy jobs” north of the border in the face of the “Buy America” movement.

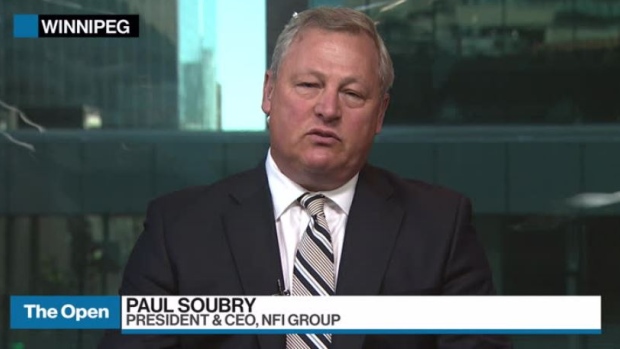

Paul Soubry, president and CEO of Winnipeg-based NFI, said in an interview with BNN Bloomberg that U.S. tariffs on Canadian metals imports won’t affect the company because it already largely purchases U.S. steel.

“To quote Mark Twain, the rumours of our demise are greatly exaggerated,” Soubry said Tuesday.

NFI has already had to adapt to rising U.S. content requirements that will climb to 70 per cent in 2020, up from 60 per cent imposed in 2015 under the Fixing America’s Service Transportation (FAST) Act, Soubry added.

“Like it or not that’s the reality – U.S. taxpayers’ dollars are at play buying our products… So we’ve adapted our business. We’ve migrated things to the U.S.,” he said.

Currently, about 70 per cent of NFI’s work force is in the U.S., not only as a result of the “Buy America” movement but also because that’s where the most revenue opportunity lies for the company, Soubry said.

Still, U.S. protectionism has mainly focused on certain types of jobs, he added.

“’Buy America’ is really around direct labour to do certain functions and material content,” Soubry said.

“But what we want to do in Canada is to keep the brainy jobs north of the border – whether it’s engineering, accountants, sales and marketing, logistics and supply chain professionals – that’s proved to be successful model for our company.”