Aug 3, 2020

‘Buy Bunds in August and Go Away’ Mantra Is About to Be Tested

, Bloomberg News

(Bloomberg) -- German 10-year bonds may extend their back-to-back monthly gains in August -- albeit at a more muted pace -- if seasonality is anything to go by.

Bunds yields declined almost eight basis points through June and July to -0.524%, compared with fair value of -0.34% on a modeled curve, based on an expected real rate and estimated inflation together with real and inflation risk premiums.

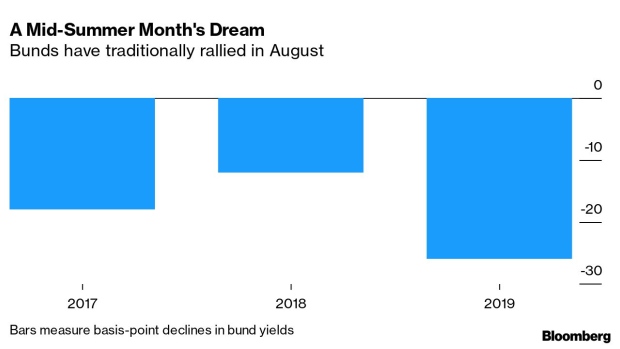

While yields on this point of the curve have fallen 19 basis points on average for the past three Augusts, any encore this year runs into a massive increase in net supply and levels that are starting to look deeply expensive.

The European Central Bank’s presence in the market may have been a possible catalyst behind the decline in bund yields. Indeed, the ECB bought almost EUR47 billion worth of German bonds from March through May under its pandemic emergency purchase program alone to spur a recovery in the euro-area economy that has been veritably hobbled by the pandemic. All that has meant that bund yields closed below the ECB’s deposit rate in July.

Even so, the favorable August seasonality in bunds may collide with increased supply stemming from the euro area’s ambitious recovery plan that EU leaders agreed on last month. Net bond supply by the biggest sovereign issuers in the region will total about EUR74 billion in August, almost three times the amount this month last year, according to UBS’s Rohan Khanna. He estimates net supply from Germany to account for about a third of the total.

NOTE: Ven Ram is a currency and rates strategist for Bloomberg’s Markets Live. The observations are his own and not intended as investment advice.

©2020 Bloomberg L.P.