Sep 13, 2021

Buyers Are So Hungry for LNG That Tankers Are Lining Up Off Qatar

, Bloomberg News

(Bloomberg) --

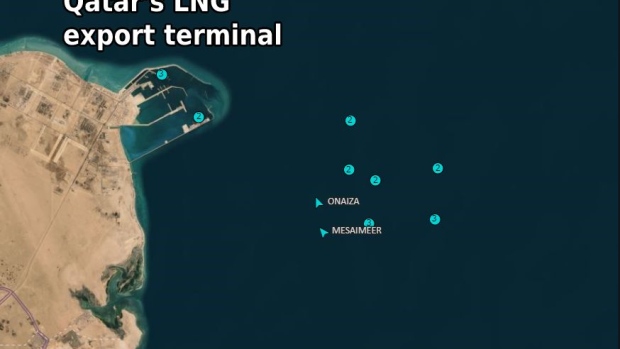

More than a dozen liquefied natural gas tankers are waiting their turn to fill up at Qatar’s port of Ras Laffan in a clear sign of how tight the global gas market has become.

South Korean and Pakistani buyers are among those seeking to maximize shipments under long-term supply contracts with the Middle Eastern emirate, one of the world’s biggest natural gas exporters, according to traders with knowledge of the matter. The cargoes are linked to oil prices and cost about half of the current rate in spot gas markets, where a global supply crunch has seen prices rise to seasonal highs.

Qatar Petroleum, which markets the nation’s fuel, and Qatargas, which operates the facilities, didn’t immediately respond to a request for comment.

Utilities and city gas suppliers around the world are vying to lock in a finite amount of natural gas before the winter, when demand for the fuel peaks in the northern hemisphere. Qatar is seeking to sign more contracts to underpin a massive expansion and has been more willing than its rivals to adjust contracted volumes, whether up as currently or down as during the peak of demand destruction because of the coronavirus epidemic.

Over a dozen ballast liquefied natural gas carriers are offshore Qatar’s coast, while another five are currently loading, according to ship-tracking data compiled by Bloomberg. Seasonally low output has also resulted in the lines, BloombergNEF analysts said last month.

©2021 Bloomberg L.P.