Nov 23, 2022

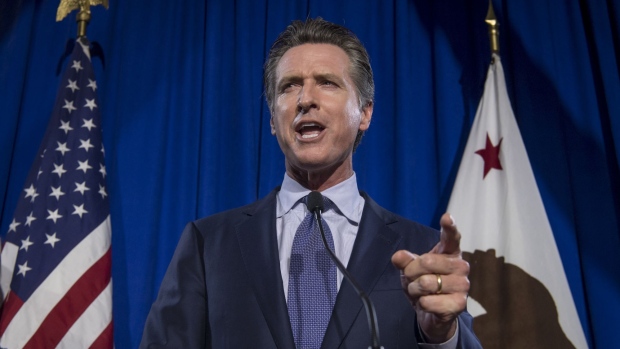

California Governor Accused of Playing Politics on Gasoline Prices

, Bloomberg News

(Bloomberg) -- Refiner PBF Energy Inc. has rejected a request from California energy regulators to testify at a hearing next week on gasoline price spikes, citing Governor Gavin Newsom’s “politicization of this issue” and failure to heed a year of warnings about the state’s fuel supply.

In a letter to Newsom, the refiner said it would provide only written comments to the California Energy Commission, in light of the governor’s approach to the issue and what the company called “misleading information” about its third-quarter earnings. “Refining is an extremely capital-intensive business,” PBF said, and “California’s regulatory environment is putting future investment in refining and fuel manufacturing at risk in the state.”

Marathon Petroleum Corp. also declined to testify, saying it had concerns about being able to share information amid federal antitrust laws. Phillips 66 cited the same concern in recommending testimony instead from the Western States Petroleum Association, which has volunteered to represent invited refiners and participate in the hearing.

“It’s not surprising that oil companies want to dodge questions about their record profits while Californians pay the price at the pump,” said Alex Stack, a Newsom spokesperson. “Californians have been held hostage to the oil industry and the gas prices they charge us, and now that we’re asking them to answer basic questions they won’t show up.”

The planned hearing comes amid persistently high gasoline prices in California, where the average for a gallon of unleaded gasoline was $5.157 on Wednesday, according to AAA. Newsom has singled out PBF while accusing oil companies of being “greedy” and making “record-high profits.”

PBF is on track to make nearly $3 billion in profits this year, according to the median of analyst estimates compiled by Bloomberg. But like other oil companies, the recent profits come after shortfalls during the pandemic, when fuel demand cratered and refiners lost billions. For instance, PBF’s $1.4 billion loss in 2020 erased all the previous annual gains accumulated since 2012 and put the company on the verge of bankruptcy. Now, the company said in its letter to Newsom, it’s using 2022 earnings to pay down “the exorbitant debt” it took on to survive pandemic lockdowns.

In previous meetings and correspondence with California officials, PBF warned that by 2023, the state was on track to lose 20% of its 2019 gasoline production -- even though demand is set to decline just 8% -- amid a refinery closure, the halt of gasoline production at a Phillips 66 facility and challenged crude imports.

--With assistance from Gerson Freitas Jr..

(Updates with comment from Newsom’s office in fourth paragraph.)

©2022 Bloomberg L.P.