Dec 13, 2019

California Governor Rejects PG&E’s Restructuring Proposal

, Bloomberg News

(Bloomberg) -- California Governor Gavin Newsom rejected PG&E Corp. proposed restructuring plan on Friday, dealing a major blow to the power giant as it tries to exit the biggest utility bankruptcy in U.S. history.

Newsom said in a letter to PG&E Chief Executive Officer Bill Johnson that the utility giant’s restructuring plan falls “woefully short” of the state’s requirements. The governor said any reorganization of the San Francisco-based power company would require a better financing plan, an entirely new board and the option of a government takeover should PG&E fail to meet safety performance metrics.

Newsom’s support is crucial to PG&E’s restructuring. The company declared bankruptcy in January after its equipment was blamed for starting catastrophic blazes in 2017 and 2018, saddling it with an estimated $30 billion in liabilities. The utility has spent months trying to cobble together a viable restructuring plan as shareholders and bondholders fight for control of it.

PG&E’s bankruptcy punctuates “more than two decades of mismanagement, misconduct, and failed efforts to improve its safety culture,” Newsom said. “It is against this backdrop that compliance with” state law must be measured, he said.

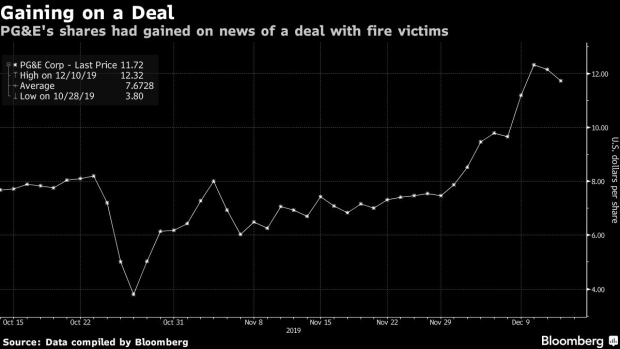

PG&E didn’t immediately respond to a request for comment. The rejection is a major setback for PG&E just a week after it reached a $13.5 billion settlement to resolve claims from victims affected by the fires its equipment caused. Newsom must sign off on that deal, too, but didn’t say in his letter whether he supported it.

Based on a provision in the settlement, the governor had to find that the plan complies with state legislation passed in July. The law required PG&E to settle past fire liabilities and resolve its bankruptcy by June if it wants to participate in a newly established wildfire insurance fund and avoid future damages tied to catastrophic fires.

Read More: Elliott Bashes PG&E Plan, Says It Would Be Junk-Bond Issuer

Newsom’s demands could give activist investor Elliott Management Corp. and Pacific Investment Management Co. another shot at rallying support around a rival restructuring plan. They’re leading a group of bondholders that have offered to inject $20 billion in cash into PG&E in exchange for most of the equity in the company.

The bondholders were, in fact, the first to reach a deal with wildfire victims, agreeing to pay them $13.5 billion while PG&E initially proposed just $8.4 billion. But the utility later raised its offer and won over fire victims, announcing a settlement last week.

Junk Bonds

In a statement Thursday, Elliott said PG&E’s own restructuring proposal would saddle the company with an additional $10 billion in debt, limit its safety investments and turn the utility into a “junk-bond issuer.”

In his letter, Newsom similarly said the company’s plan to use a combination of debt, secured debt, securitization and monetization of its net operating losses would leave the company “with limited ability to withstand future financial and operational headwinds.” He said he’s also concerned that the company would rely on expensive and short-term bridge financing.

PG&E described Elliott’s rival plan as “a last-ditch effort to derail the wildfire victims’ settlements, and force costly, uncertain and protracted litigation.” The company said the bondholders’ proposal only stands to “enrich those firms backing it” and said the group would actually charge interest rates on debt that are above market rate.

The utility filed a new restructuring plan late Thursday that included the $13.5 billion deal with wildfire victims. It also issued statements from victims’ attorneys backing the settlement.

Read More: PG&E Could Have Prevented Deadly California Fire, State Says

In a rare display of solidarity with the company, consumer advocate Erin Brokovich -- best known for her success in a court case against PG&E over water contamination in the 1990s -- voiced support for the deal, saying it would “fairly and justly compensate wildfire victims in a timely manner.”

PG&E’s equipment was identified as the cause of the November 2018 Camp Fire that killed 85 people, burned down tens of thousands of homes and all but destroyed the Northern California town of Paradise.

(Updates with quote in fourth paragraph)

To contact the reporters on this story: Steven Church in Wilmington, Delaware at schurch3@bloomberg.net;Mark Chediak in San Francisco at mchediak@bloomberg.net

To contact the editors responsible for this story: Rick Green at rgreen18@bloomberg.net, Lynn Doan

©2019 Bloomberg L.P.