May 25, 2022

California’s $98 Billion Surplus Comes as Warning Signs Loom

, Bloomberg News

(Bloomberg) -- Wall Street’s market turmoil is exposing the pitfalls California faces for banking on the investment fortunes of the state’s wealthiest residents to fill its coffers.

While capital gains from booming stocks helped the most populous US state to amass a record $97.5 billion budget surplus -- about half of which Governor Gavin Newsom says is available to spend for any purpose -- the S&P 500 and the Nasdaq Composite are off abut 17% and 28% this year in reaction to rising inflation, monetary tightening and a land war in Europe.

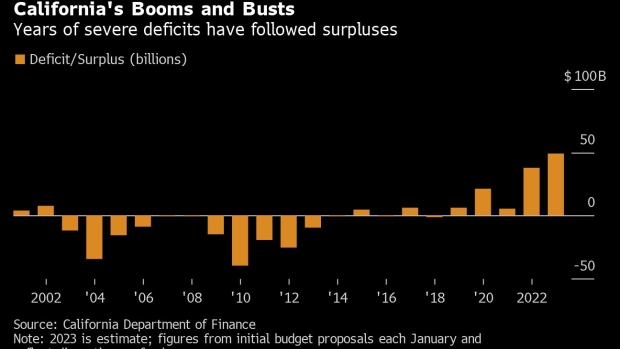

The stock declines and corresponding concerns of a US recession raise the prospect that the spigot of wealth will soon slow in California, long prone to booms and crippling deficits because of the sensitivity of its revenue to markets. Municipal-bond analysts and the legislature’s adviser would like to see more caution in the spending plan that lawmakers must approve by June 15.

“They’re going to need more reserves than the typical state that doesn’t experience quite the volatility in their tax collections during good times and bad,” said Ty Schoback, a senior analyst for Columbia Threadneedle Investments.

The budget proposal Newsom laid out earlier this month says the state expects a record $291 billion for 2021 from capital gains. Recent market losses could mean lower tax collections ahead.

Meanwhile, the odds of recession over the next 12 months have climbed to the highest since 2020, and economists predict faster inflation at year-end. Based on the past recessionary experiences, the state could see revenue drop by as much as $40 billion annually for several years, according to a January budget document.

The state’s nonpartisan Legislative Analyst’s Office said Tuesday that the budget was barely balanced and recommended lawmakers boost reserves and reduce revenue estimates to stave off any cuts in the future given economic indicators “suggest a heightened risk of a recession within two years.”

Newsom’s plan anticipates stashing $37.1 billion in reserves and directs 90% of the surplus to one-time expenses, said H.D. Palmer, a spokesperson for the finance department. “The governor has put forward what he believes to be a responsible and balanced path forward in the budget,” he said.

In addition, Newsom proposes paying off $3.5 billion of bonds early -- an idea pitched by Wall Street -- and using cash instead of selling debt to finance some capital projects. That would provide the state more flexibility by reducing fixed costs.

And in contrast to the dot-com bubble, California now has a constitutionally-mandated rainy-day fund. Ratings companies have rewarded the state for socking money away and paying down liabilities by upgrading its debt to the highest ratings in about 20 years.

Still, many residents are feeling squeezed in California, home to the country’s most expensive residential markets, one of the worst unemployment rates, the largest percentage of those in poverty, and some of the highest gasoline prices. Newsom, up for re-election this year, has proposed $11.5 billion in rebates to help defray gas costs.

“The hardest thing to argue against in politics is tax relief in times of a surplus,” said Thad Kousser, political science professor at the University of California, San Diego. “There’s nothing like a tax rebate or stimulus check to make people know that their government’s responding to their demand.”

California has grown more reliant on the rich over the years. The top 1% of earners pay nearly half of personal income taxes. Capital gains realizations as a share of the personal-income collections are the highest since the level shortly before the dot-com bust.

There are warning signs ahead. So far this year, 57 companies have raised $4.8 billion in US IPOs, the worst annual start since 2016, according to data compiled by Bloomberg. The picture is particularly bleak for the technology and related listings that give the biggest boost to the state’s coffers from Silicon Valley’s investors and employees. This year’s $385 million from such companies is only 1.3% of the $29.4 billion at this point in 2021.

See also: High-Flying Startups Feel the Pain of Long-Predicted Downturn

California also is home to more billionaires than any other US state, and their collective fortunes have swooned with the market. Meta Platforms Inc.’s Mark Zuckerberg, for instance, has lost more than $58 billion in wealth this year, according to the Bloomberg Billionaires Index, while Alphabet Inc. founders Larry Page and Sergey Brin have each seen more than $30 billion erased.

While Newsom’s budget expects collections from three major sources to dip in the year beginning in July, it projects revenue will climb 9.9% by the end of fiscal 2025. In contrast, Franklin Templeton, which holds more than $61 billion of municipal bonds, models flat revenue figures for California through the same period.

“We’ve had some extraordinary years,” said Jennifer Johnston, director of research for Franklin Templeton Fixed Income’s municipal-bond team. “It is probably not going to continue, and to assume strong growth moving forward, I think, is probably not conservative enough.”

David Crane, an adviser to former Governor Arnold Schwarzenegger, criticized the budget for not showing decreased revenue projections given recent market moves, while taking into account the windfall from the current fiscal year.

“To me, it was a very clear sign that it was a political budget where somebody is looking for a reason to say, we can spend a lot of money on inflation relief,” said Crane, president of Govern For California, which funds state lawmakers’ campaigns. “Then next year, when the revenues evaporate, they can say, oh my God, the revenues evaporated, and everybody will forget.”

Crane said all excess cash should be saved to avoid crippling cuts in a downturn. The state has pressing needs -- from drought to soaring consumer costs -- that must be addressed now, countered Palmer.

“What do you do, ignore a surplus? No, it’s there,” Palmer said. “The question is, how do you responsibly allocate it? In terms of providing immediate relief to Californians who are on the receiving end of higher gas and food prices, we make no apologies for a proposal to provide them with immediate relief from the cost of inflation.”

©2022 Bloomberg L.P.