Dec 14, 2022

Canada consumer-debt payments higher now than when rates were 13%

, Bloomberg News

Total consumer debt climbs to $2.36T as consumers lean on credit cards

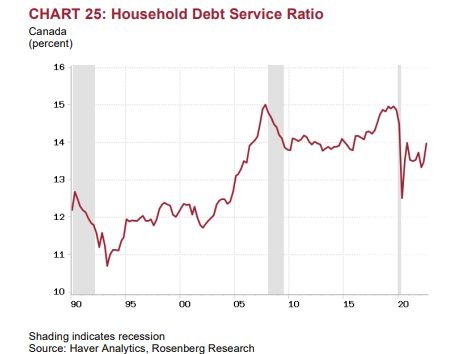

Consumer debt payments in Canada are significantly higher today than when interest rates were in the low teens in 1990, a sign of the economy’s “extreme level” of indebtedness, economist David Rosenberg said.

The household debt service ratio, which plunged two years ago as rates fell and governments paid out Covid-19 aid, is rising again because of the Bank of Canada’s decision to sharply increase borrowing costs to cool inflation.

“Think about that for a minute. Consumers are shelling out more in total debt-service payments out of after-tax income today at a 4.25 per cent BOC policy rate than they were three decades ago when the policy rate was 13 per cent,” Rosenberg said in a report to investors Wednesday.

Canadian commercial banks raised their prime lending rates to 6.45 per cent last week after the central bank increased its overnight rate by 50 basis points to the highest since early 2008. Millions of households have variable-rate mortgages or home-equity credit lines for which the interest rate adjusts automatically with the prime rate.

“You can’t paint any lipstick on what is happening here in terms of the direction of Canadian consumer credit quality,” Rosenberg.