Apr 19, 2022

Canada dodges the worst as IMF slashes global growth outlook

, BNN Bloomberg

IMF slashes global growth outlook on 'seismic waves' from Ukraine invasion

The International Monetary Fund (IMF) slashed its growth forecast for the global economy Tuesday, but Canada managed to escape with only a modest downward revision to its GDP outlook.

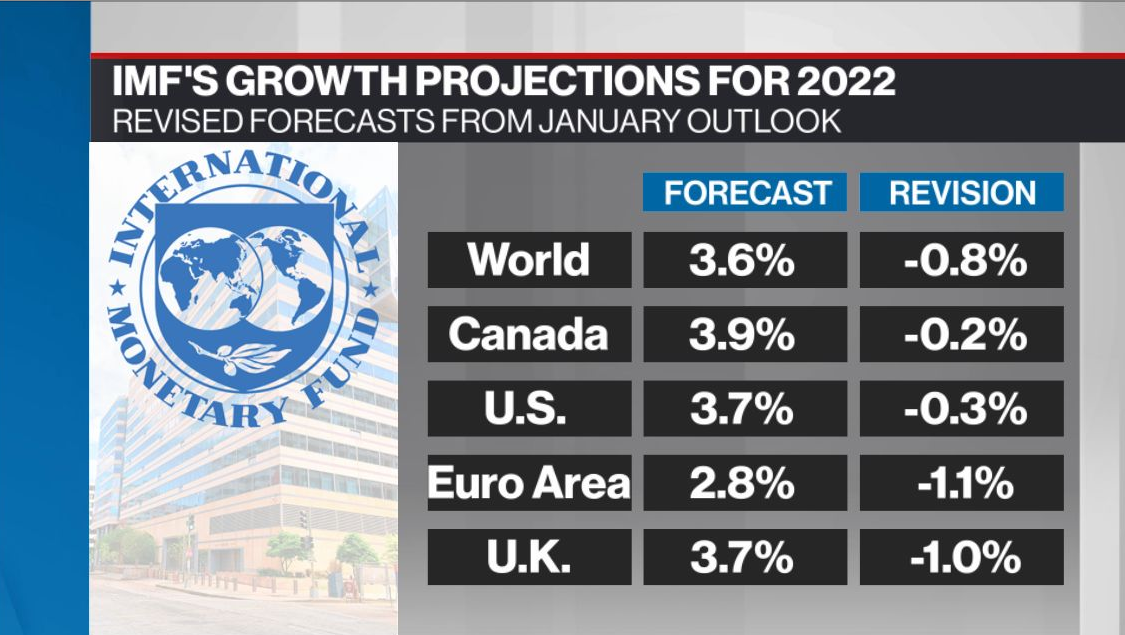

In its World Economic Outlook, the IMF said it now sees the global economy growing 3.6 per cent in 2022 and 2023, marking 0.8 per cent and 0.2 per cent decreases from its January projections. The forecast cut is largely the result of the impact of Russia’s invasion of Ukraine.

In January, the IMF said the global economy was on the mend from the pandemic. But since then, “the outlook has deteriorated,” Pierre-Olivier Gourinchas, economic counsellor and director of research at the IMF, said in the report.

“The economic effects of the war are spreading far and wide — like seismic waves that emanate from the epicenter of an earthquake — mainly through commodity markets, trade and financial linkages,” he said.

Other factors at play in the revised outlooks are renewed COVID-related lockdowns in China and a more aggressive tightening of monetary policy by central banks around the world.

“Overall risks to economic prospects have risen sharply and policy trade-offs have become ever more challenging,” Gourinchas wrote.

Canada escaped relatively unscathed. The IMF lowered its growth forecast for this country by two-tenths of a percentage point to 3.9 per cent — that’s the smallest downward revision of all advanced economies. The organization maintained its projection for 2.8 per cent growth in Canada next year.

The IMF pointed out Canada’s economic links with Russia are “limited,” and that Canada’s revised outlook mostly reflects rising interest rates and expected weaker demand from the United States, which it said outweigh improved terms of trade.

The Bank of Canada raised its benchmark lending rate by a half-percentage point last week, bringing it to 1.0 per cent. It was the largest hike in 22 years, and the central bank signalled that more were on the horizon in order to tamp down runaway inflation.

“There is a rising risk that inflation expectations become de-anchored, prompting a more aggressive tightening response from central banks,” Gourinchas said.

Surging consumer prices around the world were already a concern as the pandemic wreaked havoc on supply chains, and the invasion of Ukraine has amplified those price pressures.

The IMF warned certain supply shortages won’t abate any time soon, heightening the risk that inflation expectations become de-anchored and central banks tighten more aggressively.

“Although bottlenecks are expected to eventually ease as production elsewhere responds to higher prices and new capacity becomes operational, supply shortages in some sectors are expected to last into 2023,” Gourinchas said.

“As a result, inflation is now projected to remain elevated for much longer than in our previous forecast, in both advanced and emerging market and developing economies.”

The IMF said effective national policies will be key in determining economic outcomes and that governments shouldn’t shy away from providing support to households that are struggling to cope with high food and fuel costs.