Apr 20, 2021

Canada M&A Triples to $184 Billion as Railroad Bidding Heats Up

, Bloomberg News

(Bloomberg) -- Canadian dealmaking is extending its boom, as a potential bidding war between two railway operators contributes to a tripling in mergers and acquisitions volumes.

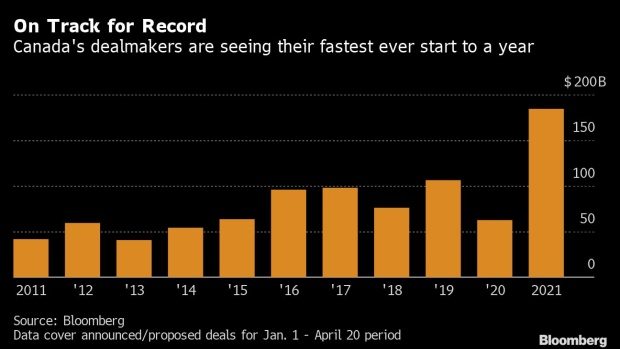

Companies from Canada have been involved in $184 billion of transactions this year, including agreed deals and more preliminary proposals, according to data compiled by Bloomberg. That’s up 198% on the same point in 2020 and the most for any corresponding period on record, the data show.

The latest blockbuster bid came Tuesday, when Canadian National Railway Co. made a $30 billion offer for Kansas City Southern to gain a sprawling transport network connecting U.S. farms to ports on the Gulf of Mexico. It’s seeking to snatch a deal away from rival Canadian Pacific Railway Ltd., which agreed last month to buy Kansas City Southern for about $25 billion.

Brookfield Asset Management Inc., one of Canada’s most active dealmakers, reached a $6.5 billion agreement earlier this month to buy out minority investors in its listed real estate arm. Just last week, Bank of Montreal announced the sale of some overseas asset-management operations to Ameriprise Financial Inc. for 615 million pounds ($859 million).

More deals are in the works. A consortium including Canadian pension fund Caisse de Depot et Placement du Quebec is nearing an agreement to acquire French state railway company SNCF’s leasing unit Ermewa Group, people familiar with the matter said this week. A transaction deal could value Ermewa at more than 3 billion euros ($3.6 billion), according to the people.

©2021 Bloomberg L.P.