Feb 28, 2023

Canada’s Economy Starts Year Strong After Surprise Quarterly Stall

, Bloomberg News

(Bloomberg) -- Canada’s economy unexpectedly stalled at the end of last year, but a strong start to 2023 adds to confusion about when growth will rapidly gear down in the face of the highest interest rates in 15 years.

Preliminary data suggest gross domestic product expanded 0.3% in January, Statistics Canada reported Tuesday in Ottawa, led higher by oil and gas extraction and wholesale trade. That followed 0.1% contraction in the previous month, missing expectations for a flat reading in a Bloomberg survey of economists.

Growth in the fourth quarter was zero, far below a consensus estimate of 1.6% annualized, as inventories dragged on the economy by the most in 40 years outside the pandemic. Business investment declined, falling 5.5% — also the most since Covid-19 hit.

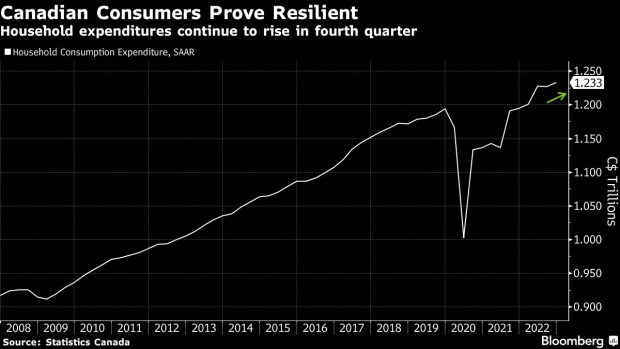

Still, the quarterly data suggest Canada’s highly indebted consumers are unbowed by borrowing costs. Consumption rebounded at the end of last year on higher incomes and savings. Household spending rose 2% annualized in the fourth quarter, with disposable income up 12.4%, and the household savings rate reaching 6%, from 5% previously.

The muddled picture all but cements bets that policymakers will keep to the sidelines and hold the benchmark interest rate at 4.5% at the Bank of Canada’s decision on March 8. It also supports Governor Tiff Macklem’s intention to pause and assess how the economy responds to its aggressive hikes so far.

“Today’s result simply reaffirms that the BoC will be on hold at next week’s decision, and if growth remains below potential — as we expect — they will likely stay on the sidelines,” Doug Porter, chief economist with Bank of Montreal said in a report to investors. “The key for the Bank will be whether the bounce in January GDP was the start of a trend, or a one-off weather-related fluke.”

The Canadian dollar is down about 0.3% since the data release to C$1.3611 per US dollar at 10:52 a.m. Ottawa time. Bonds rallied, pushing yields on benchmark two-year debt down to 4.237%.

The Bank of Canada had forecast GDP would grow at a 1.3% annualized pace in the last three months of the year. The statistics agency also revised the third-quarter expansion down to 2.3% from 2.9%.

Tuesday’s report is the latest in a run of mixed data. In January, employment surged 10-fold past expectations while consumers kept spending, but inflation decelerated further. The Bank of Canada sees the economy stalling in the first three quarters of this year as the lagged effects of higher borrowing costs start to crimp demand.

Sectors more sensitive to higher borrowing costs continue to weaken — investment in residential structures fell 8.8% annualized in the fourth quarter, coinciding with a 15% price correction in the country’s housing market since last year’s peak.

In December, unplanned maintenance constrained the production and export of crude oil and adverse weather hampered the transportation industry. Decreases of 4% and 1% in those sectors contributed to an overall contraction on the month. The public sector rose 0.4%, and retail trade grew 0.8%.

“The latest readings on Canadian GDP will allow the Bank of Canada to defend its pause next week with credible evidence that inflation and the economy are slowing,” Royce Mendes, head of macro strategy at Desjardins Securities, said in a report to investors. “However, the data won’t be enough to see rate hike bets for later in the year evaporate just yet.”

(Updates throughout)

©2023 Bloomberg L.P.