Jan 20, 2022

Canada's energy patch sees 'significant' boost in investment

, Bloomberg News

Oil and gas investment to increase 22% this year: Canadian Association of Petroleum Producers

Investment in Canada’s oil and natural gas industry will rise 22 per cent this year to $32.8 billion (US$26.3 billion) amid higher prices for hydrocarbons, according to the Canadian Association of Petroleum Producers.

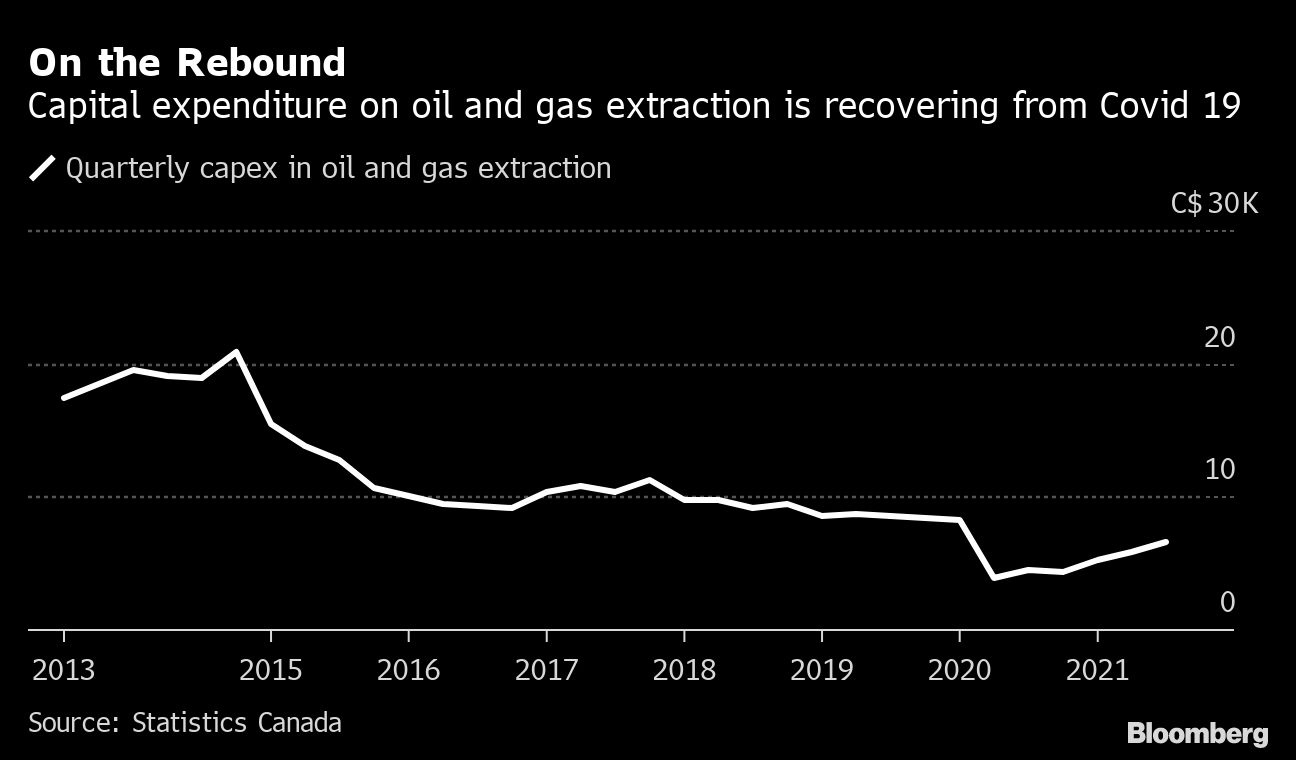

The $6 billion gain in investment marks the second straight year of “significant” increases, the oil and gas industry association said Thursday in a report. Spending on Canadian energy is rising as U.S. oil prices surge to their highest in seven years. West Texas Intermediate futures are trading at more than US$85 a barrel and natural gas up about 60 per cent in the last year amid an energy demand recovery from the COVID-19 pandemic.

Investment in Canadian oil sands, the world’s third largest oil reserves, will jump by a third to $11.6 billion while investment in conventional oil and gas will climb 17 per cent to $21.2 billion from last year.

Still, CAPP warned that Canada is losing out to other energy-producing regions. Canada was viewed as a “top tier” jurisdiction for international investment in 2014, when it attracted $81 billion or more than 10 per cent of global upstream gas and oil investment. Forecasts suggest Canada’s market share has fallen to 6 per cent -- a drop that represents more than US$21 billion in potential investment.

This year’s investment growth will leave the industry about where it was in 2018, before the pandemic slashed demand, Tim McMillan, CAPP’s president and chief executive officer, said by phone.

Many Canadian energy companies, similar to their U.S. peers, are paying down debt and returning cash windfalls from oil price gains to shareholders through stock buybacks and higher dividends as investors seek higher returns over growth. Meanwhile, concern about the impact of higher-than-average carbon emissions from Canada’s oil sands prompted some banks and funds to pull investment from the industry in recent years.

“There has been pressure put on the banking industry and through other mechanisms, which is pushing investment to other jurisdictions,” McMillan said.

Investment in Newfoundland and Labrador’s offshore oil industry will rise about 6.7 per cent to $1.6 billion this year, according to CAPP. In comparison, the Gulf of Mexico’s offshore investment is expected to jump 21 per cent to $13.1 billion this year.