Jul 8, 2022

Canada's jobless rate hits record low on labour force exodus

, Bloomberg News

Labour participation will be a growing constraint: Indeed.com Economist

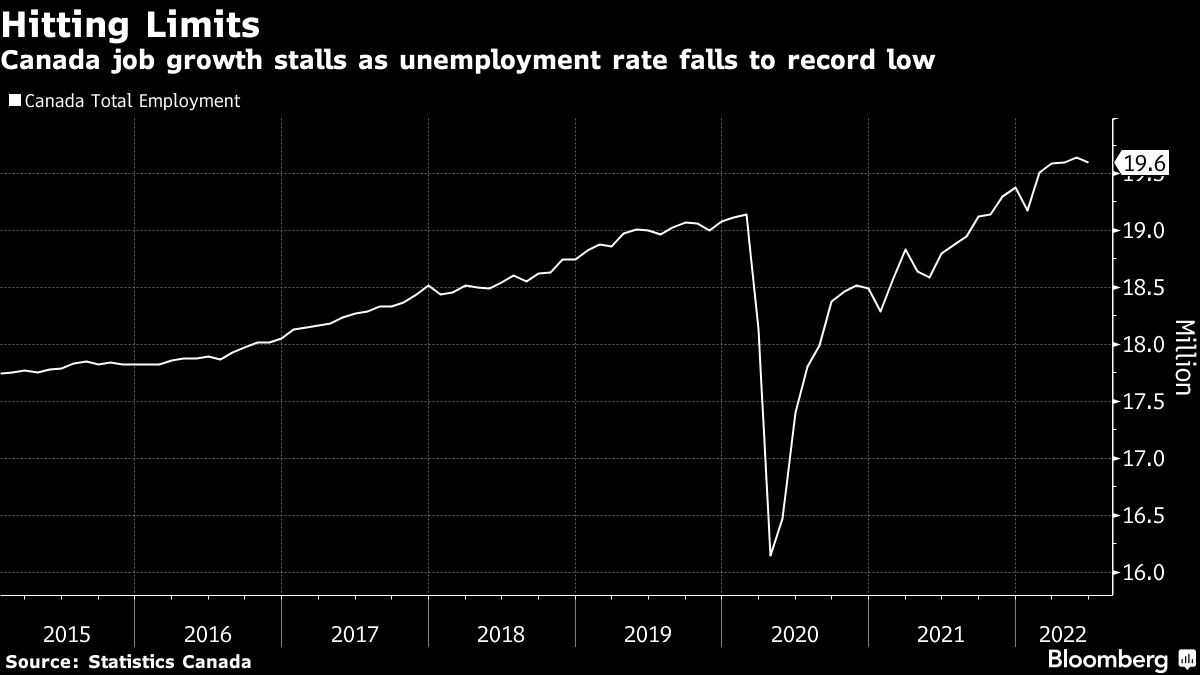

Canada’s jobs market showed signs of extreme tightening, with the unemployment rate falling to a record low, wage gains accelerating and large numbers of workers dropping out of the labor force.

The economy shed 43,200 jobs in June, Statistics Canada reported Friday in Ottawa, a surprise negative reading compared to the 22,500 gain anticipated by economists. But the drop appears to reflect the voluntary exit of workers from the labor force, which contracted by nearly 100,000 -- the biggest one-month decline on record outside of the pandemic.

The shrinking workforce pushed the unemployment rate down to 4.9 per cent, a low in data going back to 1976.

Reflecting the dearth of workers, the average hourly wage rate shot up 5.2 per cent from a year ago, an acceleration from 3.9 per cent in May. That too is the fastest increase in records dating to 1997, outside of the pandemic.

The numbers illustrate the extent to which Canada’s economy has run up against maximum employment, and will struggle to grow further without continuing to fuel wage gains.

“The low unemployment rate suggests that the labor market is extremely tight,” Royce Mendes, head of macro strategy at Desjardins Securities Inc., said in a report to investors. “That was clear in the wage growth numbers, which sailed past some heady expectations for a healthy acceleration.”

The imbalance between demand and supply of jobs is a primary reason why the Bank of Canada is tightening monetary policy so aggressively, with markets pricing in an additional 75 basis point hike in its policy interest rate next week. Traders expect the benchmark to reach 3.25 per cent by the end of this year, from 1.5 per cent currently.

Canada’s currency was little changed at $1.2966 per U.S. dollar at 9:38 a.m. in Toronto trading. Yields on Canadian government two-year bonds jumped 5 basis points to 3.24 per cent.

The employment decline was all self-employed workers, with their numbers falling by 59,200. Losses were concentrated in the retail and wholesale sectors. The drops in both employment and labor force were led by youth, and older workers.

Canada’s labor force participation rate fell to 64.9 per cent in June, from 65.3 per cent -- also one of the biggest one-month declines on record.

The drop in employment coincided with a decline in the number of unemployed Canadians. At exactly 1 million, there are fewer workers in the jobless ranks than at any time since 1981.

Workers, meanwhile, appear to be scoring big wage gains -- perhaps the biggest indicator of a tightening labor market. Wage growth for permanent workers, a key gauge for the Bank of Canada, rose to 5.6 per cent, from 4.5 per cent in May.

Hours worked climbed 1.3 per cent last month, the first gain since March. Part-time employment fell by 39,100, while the number of full-time jobs was down by 4,000.

The labor-market numbers are consistent with a survey of executives released by the Bank of Canada earlier this week that paints a picture of an economy still struggling with capacity limits.