New US Home Sales Jump to Highest Level Since September

Sales of new homes in the US bounced back in March in a broad advance as prospective buyers toughed out high mortgage rates.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Sales of new homes in the US bounced back in March in a broad advance as prospective buyers toughed out high mortgage rates.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

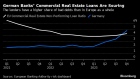

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Chinese mainland investors increased their portion of total turnover of Hong Kong stocks to a record daily average in April, with the latest measures to bolster the city’s position potentially boosting their purchases.

Feb 23, 2023

, BNN Bloomberg

Canada’s largest apartment landlord is reporting record rent turnovers in its latest quarter.

In a press release on Wednesday, Canadian Apartment Properties Real Estate Investment Trust (CAPREIT) reported a record 24.3 per cent average rent increase on turnover in the fourth quarter. This beat the company’s previous rent turnover peak of 14.2 per cent in 2019.

Rent turnover refers to the price that companies are increasing rent by for the next tenant, after the previous individual moves out.

CAPREIT owns or has interests in “approximately 67,000 residential apartment suites, townhomes and manufactured home community sites well-located across Canada and the Netherlands”, according to the release.

The Canadian real estate company also reported operating revenue of $256.9 million in the latest quarter, compared to $240.7 million a year ago.

'HIGHER-QUALITY BEAT'

In a note to clients on Wednesday, Kyle Stanley, director and equity research analyst at Desjardins Capital Markets, said this quarter was “a higher-quality beat in our books.”

Stanley said their overall takeaway for the earnings release is positive, with the company reporting blended leasing spreads up 7.1 per cent in its Canadian portfolio and an increase of 5.0 per cent in same property net operating income.

Stanley has a buy rating on the stock, with a price target of $54.50. CAPREIT shares jumped 1.35 per cent after the opening bells on Thursday to $49.45.

RISING RENT PRICES

Several Canadians have chosen to rent, as elevated home prices and high interest rates keep many individuals priced out of the housing market.

But the higher demand for rental properties has pushed up prices and many experts don’t see it slowing down anytime soon.

According to a report by Canada Mortgage and Housing Corporation, after a tenant moves out of a two-bedroom apartment, the average rent increases 18.2 per cent.

Another report released by Urbanation.Inc said as high immigration levels and home affordability issues continue, there will be “strong upward pressure on rents.”

“While a record high anticipated for combined condominium and purpose-built rental apartment completions in 2023 will bring more availability to the market, it will be met with strong demand as immigration continues to rise and homeownership affordability remains low, supporting further rent increases,” it said in the report.