Feb 28, 2020

Canada's output stalls as exports and business investment drop

, Bloomberg News

A December pickup in Canadian economic growth

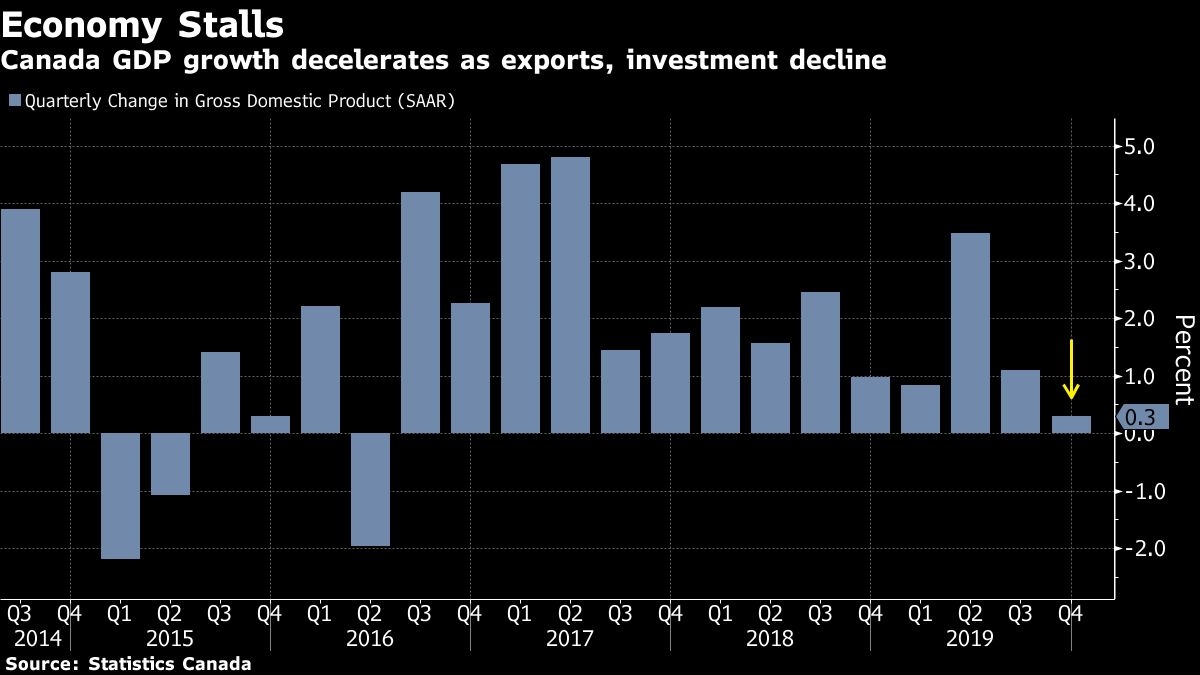

Canada’s economy slid to a near halt in the fourth quarter, as exports dropped by the most since 2017 and business investment declined, but December came in stronger-than-expected, suggesting the economy had a bit of momentum going into 2020 before the coronavirus concerns.

Gross domestic product grew at an annualized pace of 0.3 per cent -- essentially a stall -- in the three months ended December, in line with economist and Bank of Canada estimates, the federal statistics agency reported Friday. That was down from a revised 1.1 per cent pace in the previous quarter, making it the second-straight quarterly deceleration and slowest pace of growth since 2016.

The period ended on a higher note than most analysts anticipated with a monthly expansion of 0.3 per cent in December, the fastest pace of growth since May. This brings the annual growth rate of Canada’s real GDP to 1.6 per cent for 2019, down from two per cent in 2018, and lower than the U.S., which posted a 2.3 per cent increase in real GDP, the agency said.

The Canadian dollar was down 0.4 per cent to $1.3438 against its U.S. counterpart at 8:37 a.m. Toronto time. Bets that the Bank of Canada will cut interest rates at the March 4 meeting rose to more than 50 per cent, from 36 per cent on Thursday.

Key Insights

-The slowdown in the fourth quarter was largely expected as a series of temporary factors including a week-long rail strike, manufacturing plant disruptions and pipeline shutdowns stunted growth. The quarter started off weak with most of the temporary factors occurring during the first two months of the period. And while December recouped some of the losses, this still doesn’t change the picture that Canada’s economy remains in a fragile position and the Bank of Canada could cut rates, especially in light of the recent impacts from the coronavirus and domestic rail disruptions

-The saving grace for the economy was household spending, -- a reflection of a strong labor market -- up two per cent annualized on the quarter. But Canadians are largely buying non-durable goods and services -- which suggests they may be wary of big ticket items. Another indicator of caution is that the household savings rate rose to three per cent in the fourth quarter

-Businesses had a tough quarter, perhaps reflecting the heightened global trade tensions at the end of the year. The drop in exports was the biggest downward contributor to 4Q output, falling 5.1 per cent annualized, the biggest drop since 2017. Business investment contracted three per cent in the fourth quarter after an 8.4 per cent expansion in the prior quarter. Investment in machinery and equipment fell 13.5

Get More

-Supply chain disruptions drove business inventories higher in 4Q, contributing 0.6% to the annualized growth rate. This suggests that if businesses had chosen not to increase inventories, the economy would have contracted. This could potentially drag on 2020 growth if firms decide to meet demand by drawing down stockpiles.

-Residential investment decelerated to an annualized pace of 1.1 per cent in the fourth quarter from 13 per cent in the prior quarter. Non-residential investment shrunk by an annualized 6.3 per cent, more than offsetting the pickup in capital spending in the third quarter

-Overall, domestic demand -- which excludes the trade sector and inventories -- remained sluggish, growing at just 0.7 per cent on an annualized basis

-The housing market softened in the 4Q as investment in new construction decelerated

-Third quarter GDP was revised down to an annualized 1.1 per cent, from an initial estimate of 1.3 per cent

--With assistance from Erik Hertzberg.