New US Home Sales Jump to Highest Level Since September

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Chinese mainland investors increased their portion of total turnover of Hong Kong stocks to a record daily average in April, with the latest measures to bolster the city’s position potentially boosting their purchases.

Nov 8, 2022

, Bloomberg News

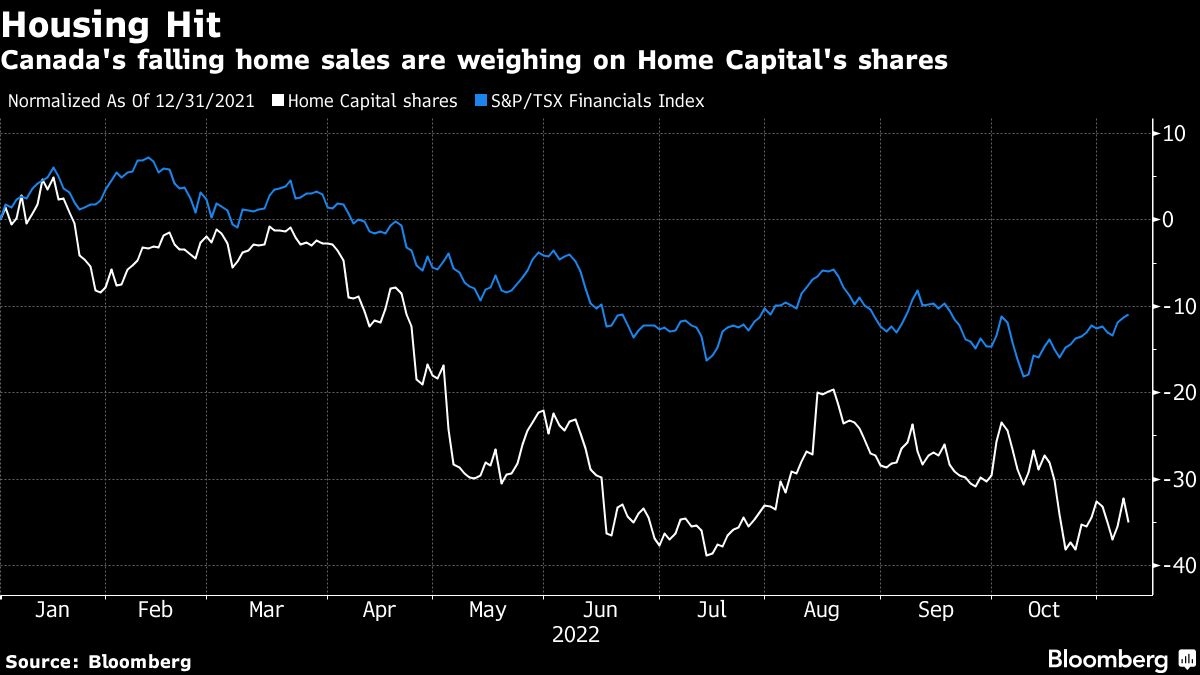

The tumult in Canada’s housing market is starting to take its toll on lenders, with Home Capital Group Inc. reporting a plunge in third-quarter originations.

Home Capital, which lends largely to borrowers considered somewhat riskier than prime customers, said Tuesday that single-family mortgage originations plummeted 28 per cent from a year earlier. The lender’s so-called Alt-A borrowers include self-employed workers or those who are new to Canada and don’t have extensive credit histories. Total mortgage originations fell 23 per cent to $1.85 billion (US$1.38 billion), missing the $2.5 billion estimate of Royal Bank of Canada analyst Geoffrey Kwan.

Sales activity in Canada’s housing market has slowed, with transactions down 32 per cent in September from a year earlier, as the Bank of Canada’s aggressive rate-hiking campaign ratchets up mortgage costs. Prices have fallen for seven straight months, and are down almost 9 per cent from their peak.

The market spiral had yet to make its way to lenders’ results, with Canada’s biggest banks all reporting growth in their mortgage books in their most recent earnings. Home Capital’s results provide a window into a segment of borrowers who are considered riskier than those the big banks typically take on, and therefore pay more to borrow.

“The housing market is currently in a period of transition as buyers and sellers adjust to a higher-interest-rate environment,” Home Capital Chief Executive Officer Yousry Bissada said in a statement, adding that the Toronto-based company expects “softer market conditions to persist in the near term.”

The drop in originations contributed to Home Capital’s net income falling 43 per cent to $31 million, or 77 cents a share. Excluding some items, profit was 95 cents a share, matching analysts’ estimates.

Home Capital’s shares fell 4.8 per cent to $25.23 at 10:32 a.m. in Toronto, bringing their decline this year to 35 per cent. That’s the fourth-worst performance in the 29-company S&P/TSX Financials Index.

Despite the market turmoil, Home Capital’s borrowers have continued to make payments on their mortgages. Net non-performing loans accounted for 0.16 per cent of gross loans last quarter. That compares with 0.15 per cent a year earlier and 0.47 per cent in the same period in 2020.