Mar 22, 2021

Canada Sets the Dealmaking Pace With Record $102 Billion Haul

, Bloomberg News

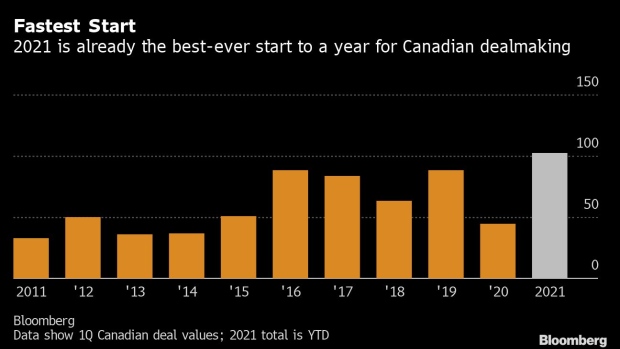

(Bloomberg) -- A week of blockbuster deals has propelled Canada to its best-ever start to a year for mergers and acquisitions, with little sign of any slowdown moving into the second quarter.

Transactions valued at $102 billion have been announced by Canadian companies this year, up 143% from the same point in 2020, according to data compiled by Bloomberg. That’s already the most for a first quarter on record and compares with a 67% year-on-year increase in U.S. deal values, 36% across Europe and 21% in Asia Pacific, the data show.

The latest bumper deal came on Sunday, when Canadian Pacific Railway Ltd. agreed to buy Kansas City Southern for $25 billion, seeking to create a 20,000-mile (32,000-kilometer) rail network linking the U.S., Mexico and Canada. The transaction came less than a week after Canada’s Rogers Communications Inc. said it would buy domestic rival Shaw Communications Inc. in a $16 billion tie-up.

The appetite for dealmaking among Canadian companies shows scant evidence of being sated.

Convenience store operator Alimentation Couche-Tard Inc. remains on the hunt for acquisitions, having seen a $20 billion bid for French grocer Carrefour SA shot down by politicians in January. Couche-Tard Chief Executive Officer Brian Hannasch said at the time that the company had a “robust” set of other acquisitions to examine as it pursues a goal of doubling profit by 2023.

Elsewhere, Inter Pipeline Ltd. has said it will start a review of options including a potential sale after receiving a hostile takeover bid from Brookfield Infrastructure Partners LP.

©2021 Bloomberg L.P.