Nov 5, 2018

Canadian consumers shake off months of NAFTA-negotiation anxiety

, Bloomberg News

Those summertime trade blues are over for Canada’s consumer.

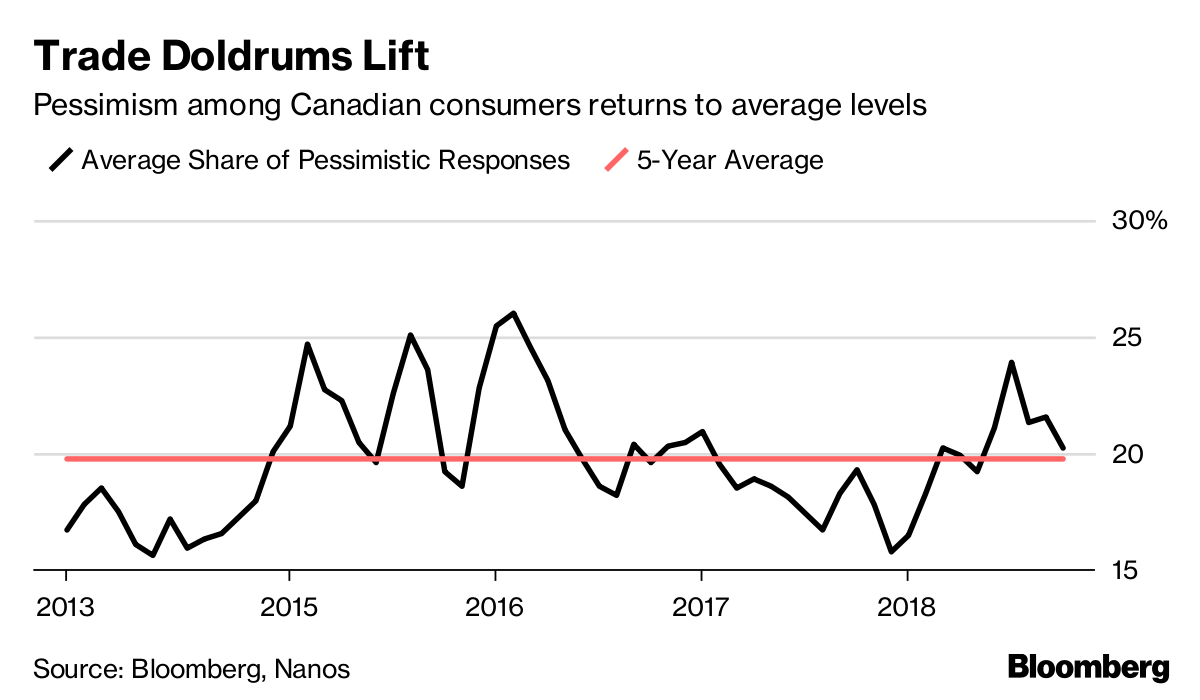

Polling by Nanos Research for Bloomberg News shows household sentiment gauges have fully recovered from a four-month lull that coincided with often testy negotiations to update the North American Free Trade Agreement. Prime Minister Justin Trudeau and President Donald Trump agreed to terms on a new deal in late September.

The change in sentiment highlights just how much the trade friction with the U.S. had been weighing on the Canadian economy, crimping confidence among both households and businesses, and suggests the potential for upside surprises now that uncertainty is receding. The data show the improvement has been most acute in Canadians’ expectations for growth, which had fallen to the lowest in years amid concerns trade talks would falter.

Every week, Nanos Research asks 250 Canadians for their views on personal finances, job security, the outlook for the economy and where real estate prices are headed. Bloomberg publishes four-week rolling averages of the 1,000 telephone responses. A composite indicator -- the Bloomberg Nanos Canadian Confidence Index -- is also calculated from the rolling averages of the four questions.

The overall index averaged 57.01 last month, which was the strongest level since May. The index hit its lowest levels this year in July, when frictions between Canada and U.S. were at their worst.

Here are some of the survey highlights from last month’s polling:

- The percentage of Canadians giving the most pessimistic responses fell to 20.2 per cent in October, versus 21.6 per cent in September. That gauge hit 23.9 per cent in July, which was the highest since March 2016.

- The share of Canadians anticipating the economy will weaken averaged 31.5 per cent last month, down from 36.3 per cent in September and as high as 45.6 per cent in July. The share expecting an improvement rose to 19.4 per cent, up five percentage points from the previous month

- Ontario and British Columbia posted the biggest improvements in sentiment last month

The rebound in confidence has essentially brought consumer confidence levels back to average levels over the past four years, but still well below elevated levels recorded at the end of last year. The drop in household sentiment from 2017 is largely consistent with a slowdown in the economy over the past year.