Oct 3, 2018

Canadian crude's discount to WTI hits US$40 as oil pain grows

, Bloomberg News

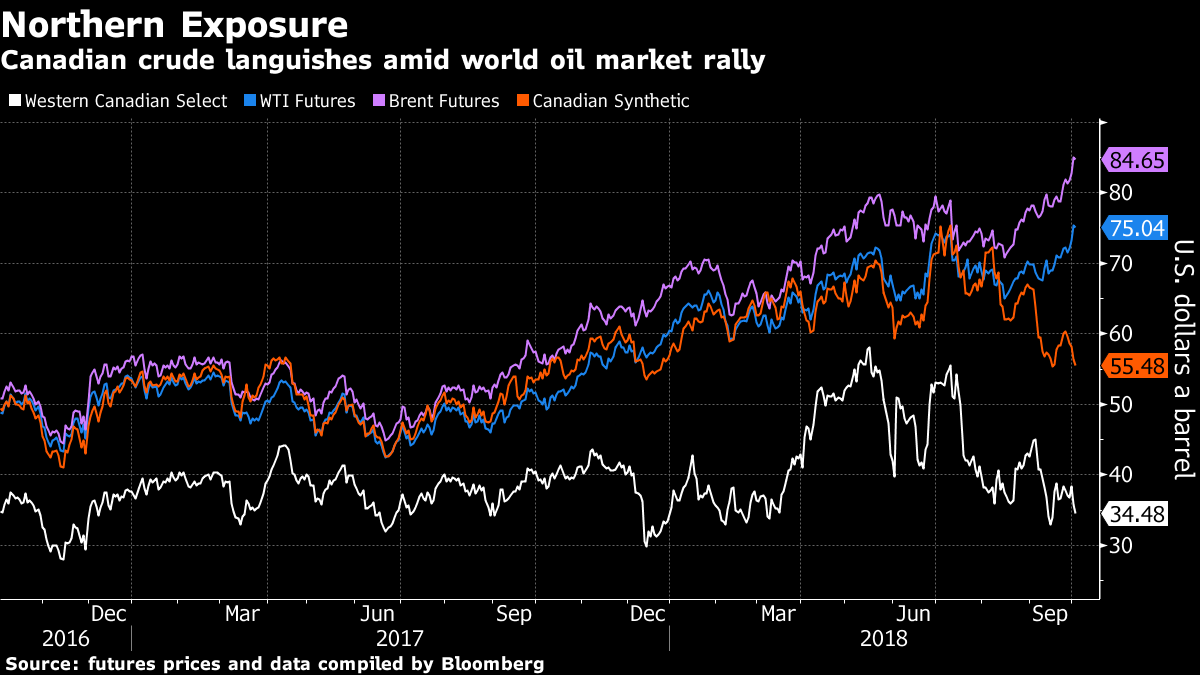

Canadian heavy crude’s discount to West Texas Intermediate futures increased to the widest in almost five years, raising the specter of local oil producers curtailing operations.

Western Canadian Select’s discount for November widened US$1 to US$41.75 a barrel Wednesday, the biggest since November 2013, data compiled by Bloomberg show. The discount deepened as new supply from Suncor Energy Inc.’s Fort Hills mine helps to fill pipelines to capacity.

“If you get this sustained wide differential, you are going to see these guys start to ramp down production,” Mike Walls, a Genscape Inc. analyst, said by phone.

When discounts widened to US$30 a barrel early this year on the back of a pipeline outage, companies including Cenovus Energy Inc. and Canadian Natural Resources Ltd. said they were cutting some production or starting maintenance earlier than planned. Yet, with oil-sands maintenance soon to wind down and further work not planned until next spring, there is “no relief valve for the next two to four months,” according to Walls.

Other grades of Canadian crude are also suffering. Light synthetic crude, produced from bitumen processed in an oil-sands upgrader, fell to a US$21-a-barrel discount to New York futures on Wednesday, the widest in six years, as Syncrude Canada Ltd. prepared to ramp its upgrader back to full production after a plant-wide shutdown in June. New pipeline projects, including the Trans Mountain LP expansion to the Vancouver area, have been stymied by court-imposed delays.

Existing pipelines including the Enbridge Inc. Mainline and the Keystone pipeline are at or near capacity, according to Genscape. Utilization on monitored pipelines by Genscape averaged 97 per cent for the week ending Sept. 28 and “remained near that level through Oct. 2.”

Western Canadian oil inventories are declining and crude-by-rail shipments are picking up. Stockpiles at storage facilities fell below 60 per cent of capacity last week amid oil-sands maintenance after rising to a record in mid-September, according to Genscape.

Crude-by-rail loadings in Western Canada reached a record above 220,000 barrels a day the week ended Sept. 28, according to Genscape, which monitors about 50 per cent of rail loading capacity in Western Canada.

While increasing volumes of oil are being shifted onto rail cars, the pickup hasn’t been fast enough, Walls said. Cenovus said last month it signed oil-by-rail agreements to ship about 100,000 barrels a day on tracks but the agreements won’t go into full effect until the second quarter next year.

“There’s no margin for error,” Clay Siegle, managing director of oil and alternatives at Genscape, said in an email. “If in the coming days or weeks we do experience a transportation problem, or oil operators produce more supply than the pipes can handle, then the overhang will worsen in Canada.”

The prospect of plants shutting down is not imminent, Kevin Birn, a director on the North American crude oil markets team at IHS Markit, said by phone. Although Canadian crudes are weak, absolute prices for the year are higher than the cost of operating the facilities.

Companies need WCS to be at US$25-US$30 a barrel and synthetic crude at US$38-US$42 to remain profitable, Birn said. In early 2016, even when synthetic crude outright prices were around US$14 and WCS at under US$30, there weren’t any material shutdowns, he said.

Not all barrels are exposed to the current prices. “Many companies have take-or-pay agreement for supplies to customers, Birn said. “We think the majority of production should be getting out, avoiding the deeply discounted spot market, and seeing higher prices.”