Dec 3, 2018

Canadian heavy crude surges after Alberta imposes cuts

, Bloomberg News

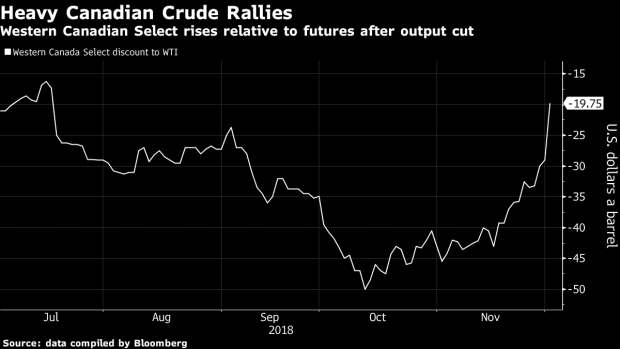

Canadian heavy crude strengthened the most since June after the Alberta government mandated production cuts across the province.

The discount of Western Canadian Select crude to U.S. benchmark West Texas Intermediate oil narrowed to US$23.23 a barrel as of 4 p.m. New York time Monday. WTI itself climbed to US$53.18 a barrel.

Alberta announced late Sunday that oil producers will have to collectively cut output by 325,000 barrels a day, or 8.7 per cent, starting in January to alleviate rising inventories and pipeline bottlenecks. The reduction would drop to 95,000 barrels a day by the end of next year.

A surge of production from oil sands projects such as Suncor Energy Inc.’s Fort Hills mine earlier this year ran into limited pipeline space, causing inventories to rise and prices to decline. WCS’s discount to futures fell to US$50 a barrel in October amid refinery maintenance in the U.S. Midwest.

Already, Canadian oil producers including Canadian Natural Resources Ltd. and Cenovus Energy Inc. announced that they had curtailed output. Those cuts added up to about 150,000 barrels a day, according to Explorers and Producers Association of Canada.

The province is producing 190,000 barrels a day more than can be shipped out and inventories are “nearing capacity,” Alberta’s government said in a release Sunday. The cuts will reduce volatility and narrow the Canadian crude differential by US$4 a barrel relative to what it would otherwise have been.

Other Canadian crudes also rose on the announcement. The discount for Edmonton Mixed Sweet to futures narrowed US$7 to US$16 a barrel and synthetic crude’s discount shrank US$3.50 to US$15 a barrel, data compiled by Bloomberg show.

--With assistance from Joe Aboussleman.