Jan 25, 2023

Canadian Hedge Fund That Dodged Pain Says Credit Is Still Too Expensive

, Bloomberg News

(Bloomberg) -- Risk premiums are still too tight even as they are wider than before major central banks started raising rates and Russia invaded Ukraine, according to the portfolio manager of a hedge fund that dodged the worst corporate bond returns in decades last year.

Risk premiums are about 50% wider than late 2021, before monetary policy makers including the Bank of Canada, began a series of rate hikes. Still, spreads need to widen more to become attractive, said Andrew Labbad, who manages Amplus Credit Income Fund, one of the investment vehicles of Toronto-based Wealhouse Capital Management.

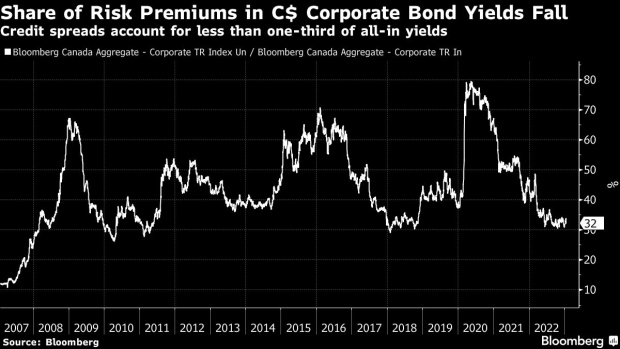

Canadian-dollar investment-grade corporate bonds are yielding 4.75%, according to a Bloomberg index, of which less than one-third is coming from the extra yield investors get for the risk of lending to companies instead of investing in top-rated government securities. In 2020, credit spreads accounted for as much as 79% of corporate bond yields after central banks cut rates and put in place asset purchase programs to shore up financial markets amid the Covid-19 crisis.

“Why take on more credit exposure when so much of it can just be made through the risk-free rate,” said Toronto-based Labbad in an interview. “We have an overweight on interest rate exposure because it makes relatively way more of the all-in component. And I think that’s a great way to capture yield.”

Amplus returned 8.49% in 2022, after expenses, compared to negative 9.5% for the Bloomberg index compiling Canadian-dollar investment-grade corporate bonds, the worst performance going back to 2002. The fund is one of the investment vehicles managed by Wealhouse, which has C$1.4 billion ($1 billion) of assets under management.

The credit spread of the Bloomberg Canada Aggregate Corporate Total Return Index was at 153.3 basis points as of Tuesday, compared to around 99 basis points in November 2021. The metric reached as wide as 179.5 basis points in October 2022.

The fund outperformed the market last year by hedging out interest rate risk as central banks raised rates, owning energy bonds from companies such as Cenovus Energy Inc. and Suncor Energy Inc., which carried out bond tenders that in turn bolstered their securities’ prices. It was also focused on adding paper that matured later in the year, allowing the fund to add corporate bonds before the credit spread rally that took place in the last quarter.

This year, Labbad said the fund is reducing the share of their credit portfolio that has its rates risk hedged out compared to previous years, and continues owning “high-quality liquid credits.”

In particular, it’s holding debt of banks whose spreads underperformed the market last year in part due to the record volume of issuance, said Labbad, who previously worked as a credit trader at TD Securities Inc, adding most of that exposure is via senior bail-in bonds rather than subordinated instruments. Also, he says it’s likely that Cenovus pushes ahead with a fresh debt tender this year.

Overall, Amplus remains relatively defensive by using less leverage than it can raise, and using it to purchase short-term securities.

“I don’t see spreads going to where they were pre-Russia/Ukraine, or even post Covid simply because we’re not seeing the same level of central bank support,” said Labbad. Also, “there’s obviously geopolitical risk. That’s the worst it’s been since almost like the Cold War era.”

(Adds detail on credit spread in second graph under the chart. A previous version of this story corrected the second deck headline to say 2022.)

©2023 Bloomberg L.P.