Nov 10, 2017

Canadian wireless market still growing rapidly after all these years

By Paul Bagnell

We’ve heard it referred to as a maturing market, and we’ve heard it referred to as an ultra-competitive market.

But the third-quarter numbers from Canada’s big wireless incumbents clearly showed that Canada’s wireless market is still – after all these years - a rapidly growing market.

Rogers (RCIb.TO), Bell (BCE.TO) and Telus (T.TO), in that order, all reported big gains in new wireless subscribers. The numbers were stronger than analysts had expected and churn – the percentage of the customer base that quits and goes somewhere else – came down.

What’s going on?

The country’s wireless market may be in a sweet spot right now.

Phillip Huang, an analyst at Barclays Capital, sees a market characterized by disciplined competition and strong pricing power.

In other words, the Big Three are not slashing prices in a bid to boost market share. Canadians seem eager to keep buying new phones, and that gives the companies the ability to remain firm on prices. Competition from smaller players hasn’t become material yet.

“We believe the overall wireless market remained quite healthy through Q3,” Huang wrote before the quarter began – a prediction that was soon to be proven correct.

For the telcos, it becomes a virtuous circle. Strong wireless additions and firm pricing means profit growth. And profit growth gives them the flexibility to reinvest in customer retention. That makes it more likely that churn will be reduced.

Let’s review the numbers from the third quarter.

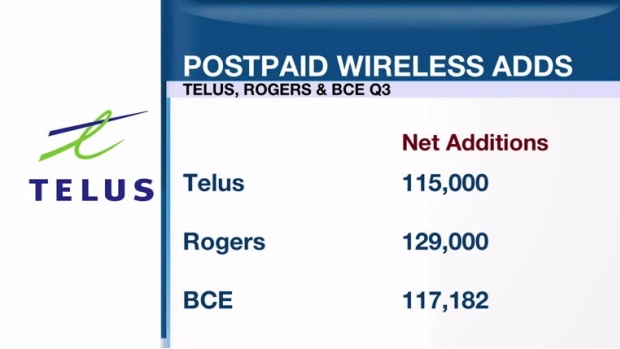

- Rogers reported 129,000 net new postpaid wireless subscribers, 10,000 more than analysts expected. Churn fell to 1.16 per cent from 1.26 per cent a year earlier and wireless operating profit, or EBITDA, grew by 9 per cent to $964 million.

- BCE added 117,182 net new postpaid wireless subscribers. That was 6,000 more than expected. Like Rogers, BCE saw churn drop to 1.16 per cent from 1.26 per cent and adjusted EBITDA in the wireless segment grew by 9.4 per cent to $871 million.

- Telus closed out the quarter with 115,000 net new postpaid wireless subscribers – an attention-grabbing 29,000 more than analysts had expected. As is common at Telus, churn was below 1.0 per cent at 0.86 per cent. Adjusted EBITDA rose by 5 per cent to $812 million.

Those certainly look like sweet spot numbers.

Sweet spots don’t last forever, though, and the big three are probably already girding for more challenging times ahead.

As noted, competition from the likes of Shaw in the west, Quebecor in Quebec and Freedom Mobile across the country is still relatively tame. But that won’t last. When those new entrants become more of a threat, Rogers, BCE and Telus may be forced to cut prices.

And the stock market is always about growth. A year from now, these third-quarter numbers may be a double-edged sword. They will have the bar high enough to make big year-over-year gains difficult to achieve.

BNN is a division of BCE through its Bell Media division.