Dec 6, 2021

Canadians lack confidence in fight to curb inflation: Poll

, Bloomberg News

For one of the first times, consumers are aware of higher prices: HRC Advisory president

Canadians are unconvinced that policy makers will be able to rein inflation back to pre-pandemic levels, a worrying development that could reinforce the need for the Bank of Canada to be vigilant about price pressures.

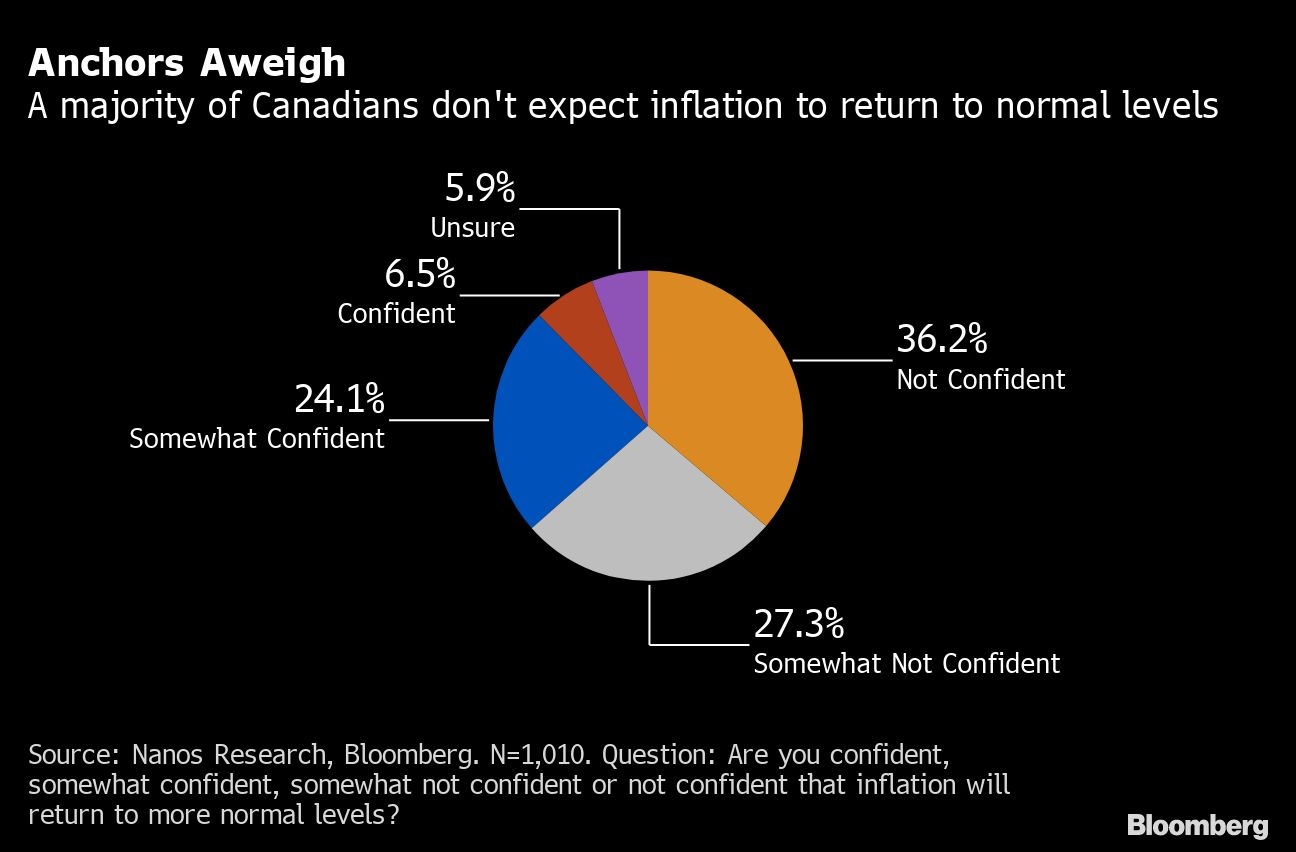

A large majority of Canadians, or 63.5 per cent, say they lack confidence that inflation will return to more normal levels, according to a survey by Nanos Research Group for Bloomberg News.

Just under a third, or 30.6 per cent, believe that price increases -- currently running at a yearly clip of 4.7 per cent, the highest since 2003 -- will come down to pre-pandemic trends, while 5.9 per cent are unsure.

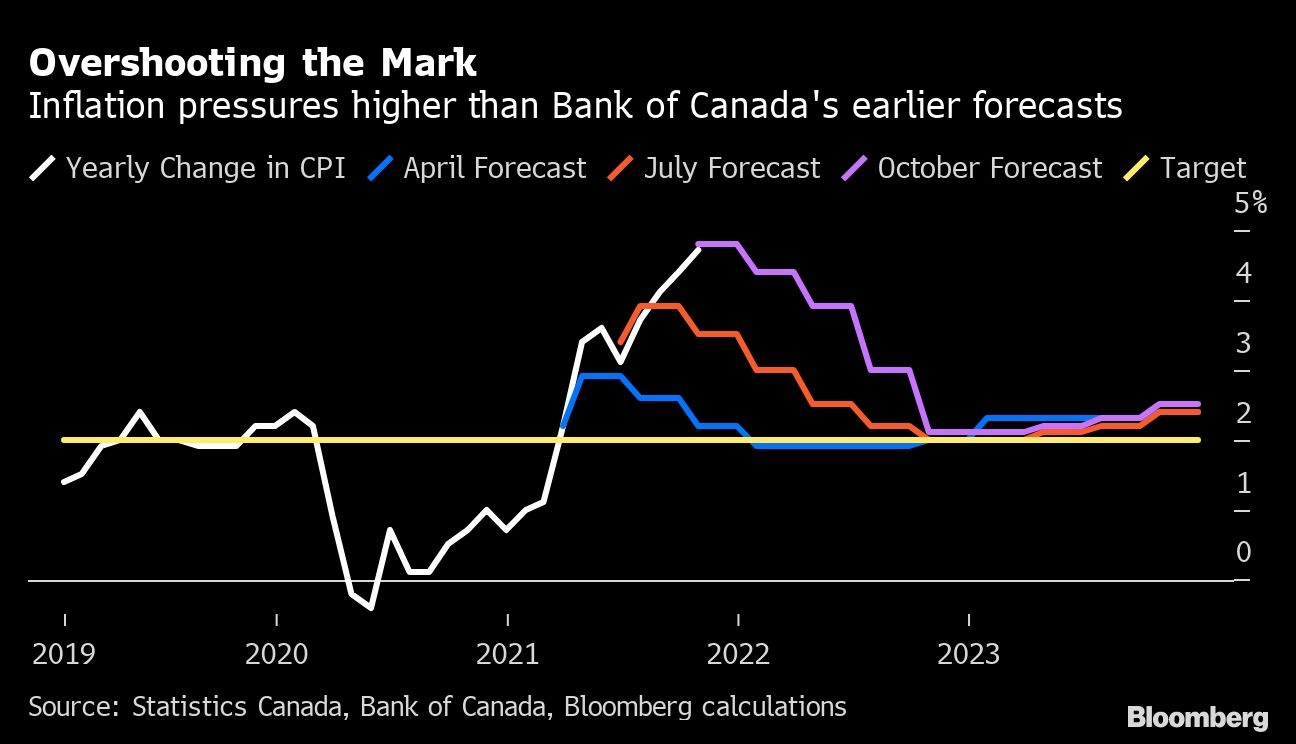

Any sign of rising inflation expectations would be a major concern for the Bank of Canada, making it harder for the central bank to rein in price pressures. Policy makers led by Governor Tiff Macklem are already poised to raise interest rates by more than a full percentage point next year, in part to ensure expectations don’t deanchor from their 2 per cent inflation target.

The Bank of Canada’s next policy decision -- and last of 2021 -- is on Wednesday.

Expected inflation is a major determinant of actual inflation since businesses increase prices and workers seek pay raises in part on what they anticipate prices will look like going forward.

“Things can spiral out of control if those expectations aren’t managed,” Mikal Skuterud, a professor of labor economics at the University of Waterloo, said in a phone interview. “Your expectations affect your behavior. That isn’t just something you can blow off as being not important.”

In theory, the higher that inflation expectations are above the central bank’s target, the tighter policy needs to be in order to return to it.

The Bank of Canada’s mandate requires it to keep inflation within its 1 per cent to 3 per cent control range as much as possible. Operationally, that has meant aiming for a 2 per cent target. Annual inflation has come in above 3 per cent for seven straight months.

The Nanos survey is consistent with results from the Bank of Canada’s own survey of consumer expectations, which showed short-term inflation expectations already accelerating, though things look more anchored when it comes to longer-term expectations.

It’s the first time Bloomberg has surveyed on this question, so there is also no historical comparison. One caveat with the survey is that there is evidence that Canadians often tend to perceive inflation is higher than the actual measured rate.

Still, recent data suggests risks are on the upside. Wage gains are accelerating and companies are preparing for sharp price increases. In its latest monthly survey of members, the Canadian Federation of Independent Business found firms see employee compensation rising by 3.1 per cent over the next year, the highest in data back to 2009. The historical average is 1.6 per cent.

That’s why Macklem has identified inflation and wage expectations as something the Bank of Canada needs to closely monitor, and has gone on a public-relations offensive to convince Canadians he is serious about curbing price increases.

The Nanos poll is a hybrid telephone and online survey of 1,010 Canadians, with a margin of error of 3.1 percentage points, taken between Nov. 27 and 29.