Nov 17, 2020

Canadians sitting on largest cash hoard ever recorded: CIBC

, BNN Bloomberg

Ottawa knows aid programs are full of holes, but won't tax Canadians now: CIBC's Tal

Sign up for BNN Bloomberg's new weekly newsletter, Home Economics, here: https://www.bnnbloomberg.ca/subscribe

The COVID-19 pandemic has pushed Canadians to accumulate the largest amount of cash ever recorded, according to a new CIBC report released Tuesday.

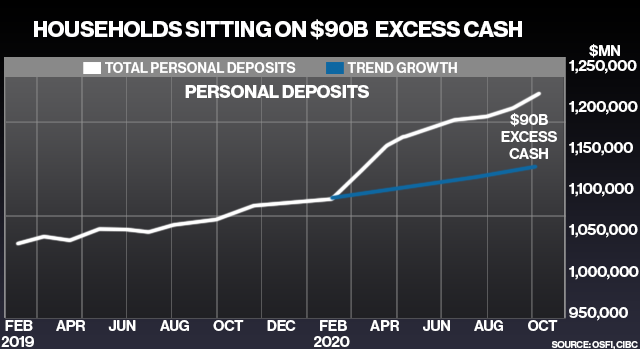

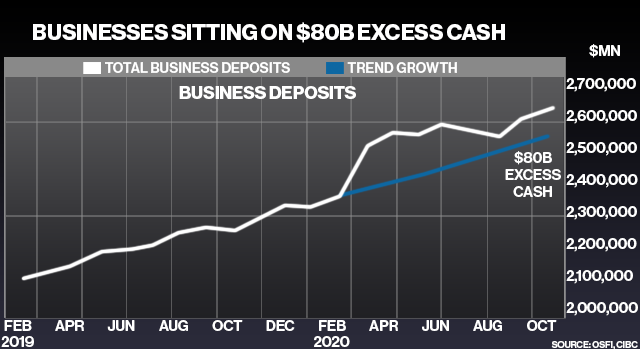

Canadian households and businesses are holding on to more than $170 billion in excess cash, the report estimated. Households are sitting on $90 billion, which is equal to four per cent of consumer spending, while businesses are holding on to no less than $80 billion.

“We’re seeing a situation where the savings rate is going up, spending went down dramatically, but income actually went up because of government support and the fact that many people did not see their income going down,” said Benjamin Tal, CIBC deputy chief economist and co-author of the report, in an interview Monday.

“We're in a very weird situation in which the economy is down, but the level of cash in the economy is rising.”

The report also said the savings rate for households was likely about 13 per cent in the third quarter, compared to about 3.6 per cent before the pandemic.

Tal also forecast that households’ cash hoards are expected to grow further. The report said consumer spending is set to slow down in the coming four to five months with the pandemic overlapping with flu season.

“Maybe [a vaccine] will be the green light for people to actually start redeploying the mountain of cash they’re sitting on,” Tal said.

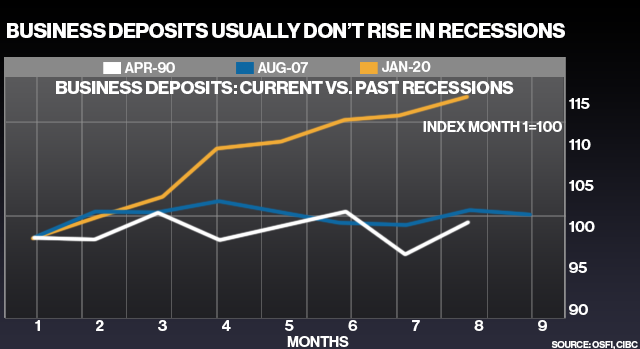

Meanwhile, Canadian businesses are growing their cash positions by almost 15 per cent year-over-year, the report said. The government’s Canada Emergency Business Account loan program is also boosting firms’ cash hoards, with many companies keeping the money in deposit accounts and possibly using it as insurance.

“I think a lot of this cash is held by companies and sectors that are not impacted directly by the crisis. In fact, they’re benefiting from it,” Tal said.

“At the same time, they’re not in the mood to invest when the economy is down, so they’re sitting on this cash – waiting, looking for direction – and this cash will be utilized the minute they see the light because it’s really sub-optimal for them … not to invest.”