Sep 10, 2021

Cannabis Canada Weekly: Aurora faces lawsuit, early August data shows market remains fragmented

, BNN Bloomberg

Aurora CEO stresses medical cannabis strength 'as a target or a standalone company'

Aurora Cannabis, former executives accused of "sham" sales to artificially boost earnings, lawsuit alleges

Aurora Cannabis Inc. and several of its former and current executives allegedly inflated one of its quarterly earnings results in 2019 through a fraudulent scheme that involved selling $21.7 million worth of cannabis back to itself through a company it had significant influence over, according to a lawsuit filed in a U.S. federal court.

The class-action lawsuit, which was filed in a U.S. District Court in New Jersey on Tuesday, alleged that Aurora and its executives engineered a way to artificially inflate the company's fiscal 2019 fourth-quarter adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) by selling $21.7 million worth of dried cannabis to Radient Technologies Inc. in June 2019 in a deal that "lacked commercial substance". The filing further alleged that Aurora later repurchased that same amount of dried flower back from Radient, an Edmonton-based cannabis extraction firm in which Aurora has a 12 per cent ownership stake as well as control of one board seat.

While the class action has yet to be certified by a U.S. federal judge and the claims have not been tested in court, the allegations highlight the operational challenges that many Canadian cannabis producers undertook in the early days of Canada's recreational marijuana market, some of which ran afoul of regulations in order to meet the high consumer demand for those legal products and lofty investor expectations.

The plaintiffs allege that as the defendants continued to misrepresent the true condition of Aurora’s business, the company's stock was trading at "artificially inflated prices", which have subsequently plunged by more than 90 per cent since mid-2019. The plaintiffs for the lawsuit allege Aurora violated two counts of the U.S. Exchange Act and requested a trial by jury.

Other defendants named in the lawsuit include former chief executive officer Terry Booth, former president and board member Stephen Dobler, chief financial officer Glen Ibbott, former chief corporate officer Cam Battley, executive chairman Michael Singer, board member Jason Dyck and former chief operating officer Allan Cleiren, who also sat on Radient's board.

In a statement, an Aurora spokesperson said that the company doesn't comment on legal matters. "We maintain our standard of business practice is in accordance with all relevant securities law and fulfill any obligation to respond accordingly," the spokesperson said.

Booth, Dobler, Battley, and Cleiren didn't immediately respond to multiple requests for comment on the lawsuit's allegations. A representative from Radient wasn't immediately available.

The lawsuit claims that Aurora allegedly conducted its "roundtrip sale" of dried cannabis as the company was increasingly unable to meet financial targets that its executives stated it would hit during the early months of cannabis legalization in Canada when supply issues weighed on several marijuana producers' bottom lines.

As those supply issues mounted, Aurora moved to further increase the size of its production capacity to a level that surpassed the actual annual demand believed to exist in the Canadian recreational market, the lawsuit alleges. As the company began to suffer financially from sluggish cannabis sales, the defendants allegedly devised a scheme that would ensure Aurora would meet projections of positive adjusted EBITDA by the end of its fiscal 2019 through a "sham, round-trip wholesale cannabis transaction with a related party."

As a result of the "roundtrip sale", Aurora reported a negative adjusted EBITDA of $11.7 million in its fiscal 2019 fourth quarter despite several executives, including Ibbott and Battley, claiming the company would be in positive EBITDA territory by the end of its fiscal 2019. That negative adjusted EBITDA was allegedly understated by a further $10.5 million and that "but for the sham transaction, Aurora would have missed its projection by a much wider margin", the lawsuit claims.

According to comments provided by four former Radient employees contained in the filing, there was no plausible business reason for the cannabis processor to buy $21.7 million of cannabis from Aurora. One former employee alleged in the filing that Radient's operations were not large enough to process so much cannabis in a reasonable amount of time, while another former staffer alleged it made "no sense" for Radient to make that purchase as the company itself was having trouble paying its day-to-day operating expenses and its extraction technology was still in the testing stage at that time.

The lawsuit alleges that the cannabis material was stored in a warehouse until it was subsequently returned to Aurora, which should not have recorded any revenue from the deal, according to international accounting standards.

Aurora's "roundtrip sale" of cannabis to Radient was first highlighted in several research reports authored by Craig Wiggins of the cannabis industry research group The Cannalysts and first reported by Yahoo Finance Canada. In an Oct. 2019 report, which was included in the court filing, Wiggins raised the possibility that Aurora and Radient were engaged in financial engineering if the two companies were circumventing a service agreement to artificially boost their revenue.

"If Radient was an arm’s length company, not reliant on Aurora economically, then this would not be as big a potential issue," Wiggins said in the report.

THIS WEEK'S TOP STORIES

McMaster researchers show some chronic pain may be relieved from medical cannabis

A new research paper by McMaster University researchers found that some people living with chronic pain may find some relief from using cannabis with minimal side effects. The study, published in the British Medical Journal, incorporated four systematic reviews summarising the current body of evidence for benefits and harms of using medical cannabis to treat chronic pain. The researchers concluded that non-inhaled medical cannabis or cannabinoids could be used in addition to standard care for people living with chronic cancer or non-cancer pain. While there has been a limited amount of peer-reviewed research studies into cannabis, the drug's legalization in Canada and momentum in the U.S. has allowed more opportunities to better study the effects of marijuana for a wide range of medical purposes.

Valens strikes global medical cannabis supply deal with Australian firm

Cannabis extractor and distributor The Valens Company announced a supply deal with an Australian firm to sell and manufacture the company's products throughout the world. Valens said it struck a partnership with Epsilon Healthcare to use its facility to ship Valens-branded medical cannabis products to markets in Latin America, Europe, U.K. and Asia-Pacific regions. As part of the deal, Valens will fund all capital expenditures for Epsilon's Southport Facility in Queesland in return for up to 85 per cent of the operational capacity of the plant over the next five years, with an option for the next six years. It will also provide operational and management consultancy support at the Epsilon facility. In return, Epsilon will receive a royalty of 2.5 per cent to 4 per cent of sales revenue for all Valens customer products.

Consumers largely unhappy with rollout of legal cannabis in Ontario: study

There was "significant consumer discontent" during the first year of cannabis legalization, according to a study by a group of Ryerson researchers that examined the social media response in the Ontario legal market over a one-year period. The research highlights the successes and failures of the retail rollout in Ontario for both residents and the provincial and federal government. One conclusion found that Twitter users said that the restrictive purchasing options (due to government policy) created a shortage of point-of-sale locations in Ontario, leaving consumers unable to purchase their desired products. In order to combat these supply shortages, the provincial government removed much of the red tape associated with licensing protocols for brick-and-mortar stores, the study found. The researchers concluded that as a practical implication, the findings can be leveraged to inform future government policies and decisions around legal retail cannabis business practices.

Sanders says Congress making progress on ending U.S. drug war as legalization bill looms

U.S. Senator Bernie Sanders said that Congress is “making progress” toward ending the drug war and federally legalizing marijuana, Marijuana Moment reports. Sanders, who spoke during a town hall event earlier this week, gave his remarks following an audience question on when federal authorities would end the "racist, idiotic drug war". "What you are now seeing is a radical change of consciousness with regard to that war. You are seeing state after state after state legalizing marijuana," Sanders said, adding that "I would legalize marijuana nationally. I am supportive of that." A broad-ranging cannabis reform bill that would legalize the drug federally was drafted in July by a group of Senators led by Senate Majority Leader Chuck Schumer. A public comment period to get input on the bill closed last week, with Marijuana Moment reporting much of the feedback focused on issues of social equity, licensing, tax policy and interstate commerce.

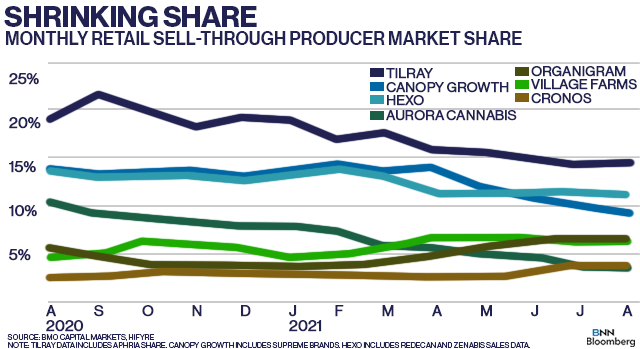

ANALYST NOTE - BMO Capital Markets, Cantor Fitzgerald on August Hifyre sales figures

A pair of analysts look into projected August sales figures from Hifyre, which tracks roughly 80 per cent of the country's cannabis market. BMO Capital Markets Analyst Tamy Chen sees the Canadian market remaining "fragmented and highly competitive" despite sales rising by two per cent from the prior month to nearly $350 million. The top nine licensed producers tracked in August 2020 represented 78 per cent of the Canadian market, but now account for 61.5 per cent, Chen noted. Chen also highlighted how Aurora Cannabis and Canopy Growth are all poised to see sales declines in their current quarter given the various challenges in the retail space. Cantor Fitzgerald's Pablo Zuanic highlights recent sales growth by Organigram and Auxly, two smaller producers which have gained market share at the expense of bigger operators. Zuanic sees Organigram on pace for a significant sales beat when reporting its summer financial quarter, while Hexo and Tilray point to low single-digit growth. Also of note was the rise in sales of pre-rolls, which were up 27 per cent in the combined July-August months, outpacing the overall market growth of 10 per cent.

CANNABIS SPOT PRICE: $5.17 per gram — This week's price is down 0.2 per cent from the prior week, according to the Cannabis Benchmark’s Canada Cannabis Spot Index. This equates to US$1,860 per pound at current exchange rates.

WEEKLY BUZZ:

5

– The maximum number of cannabis-infused 355 millilitre beverages Canadians are allowed to purchase at a legal retail store due to regulations that limit customers to no more than 30 grams of dried cannabis or its liquid equivalent, 2.1 litres.