Apr 30, 2021

Cannabis Canada Weekly: Canadian producers' first U.S. steps tied to CBD; February sales fall 6.3%

, BNN Bloomberg

Canadian pot firms eye well-trodden path to U.S. through CBD sales

As the U.S. cannabis market remains closed due to the drug still illegal federally – though more than half of the country's states have passed measures allowing its sale for either medical or recreational purposes – Canadian companies have begun to move in earnest to establish a U.S. presence solely in the CBD space.

Products containing only CBD, the chemical compound derived from the cannabis plant that doesn't impair users, have been allowed for sale across the U.S. in the wake of the passage of the 2018 Farm Bill. The U.S. Food and Drug Administration (FDA) is also investigating how to regulate CBD for ingestible use, although it's unclear when it plans to make a formal decision.

"Our intention is to go down there, optimise a few of their opportunities and then basically build around that management team to continue to basically forge forward until THC becomes legal in the U.S.," said Tyler Robson, Chief Executive Officer at Valens in a phone interview.

"We believe the opportunity in Canada is still big, but the U.S. is bigger."

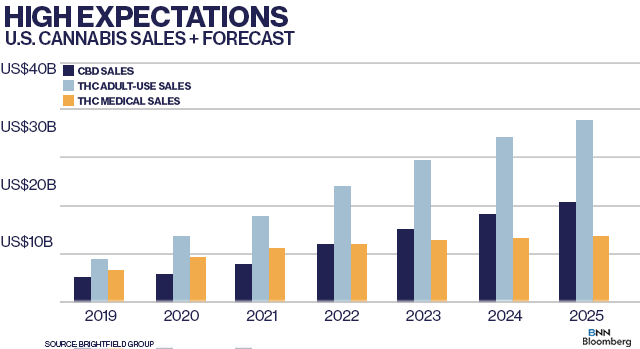

But the U.S. CBD market isn't a guaranteed home run for some market entrants. While sales of CBD products in the U.S. are expected to rise to US$16.8 billion by 2025 from US$4.7 billion last year, the market has roughly 1,500 brands offering a relatively commoditized product, making it somewhat difficult for some companies to stand out, said Bethany Gomez, managing director of Brightfield Group, a cannabis consultancy.

"The Canadian market is more constrained than what many companies initially thought with some well-capitalized producers duking it out for a relatively small pool. The CBD market gives them the ability to add more revenue to their top line," Gomez said in a phone interview.

Click here to read the rest of this article.

Cannabis added $17.1B in economic activity in February: StatsCan

Canada's cannabis industry contributed $17.1 billion in economic activity in February, an increase from the $11.9 billion in output recorded a year earlier, according to Statistics Canada. The country's legal cannabis market representated about $11.7 billion in gross domestic product, nearly double the amount reported back in February 2020, StatsCan found. The illicit market continued to trend downward from recent month to $3.69 billion from $4.18 billion a year ago. Canada's cannabis industry contributes more to the country's GDP than its pharmaceutical industry, plastics manufacturing, motor vehicles and parts manufacturing, health and personal care retailers, rail transportation and insurance brokerages, the StatsCan data showed.

TGOD mulls Quebec facility sale, possible listing on CSE for U.S. entry

The Green Organic Dutchman released a wide-ranging corporate update on Thursday. The Toronto-based company said it has closed the first round of bidding on its Valleyfield facility in Quebec - a year after it suspended production at the building - and expects to close its sale by the end of June. TGOD said it already made $2.6 million in various asset sales to date. The company is also eyeing a U.S. market entry, with a potential listing on the Canadian Securities Exchange as well as adding a board member with U.S. experience. Lastly, TGOD said it has retained Canaccord Genuity to advise on a possible sale or spinoff of its HemPoland subsidiary.

Ontario Cannabis Store launches new craft badge for smaller producers

Ontario's cannabis wholesaler and online retailer launched a new craft designation Thursday aimed at boosting sales for smaller cannabis producers. The craft badge – which has been in the works at the Ontario Cannabis Store for quite some time – applies to products which have been made by a company that hand-trimmed, hang-dried, hand-packaged, and grew its cannabis in a facility that produces less than 10,000 kilograms of dried flower per year. The classification includes 20 producers and only applies to dried flower and pre-rolls, although it could add additional categories in the future, MJBizDaily reports.

- GTEC Holdings: First quarter 2021 revenue down 15 per cent to $1.97 million, $199,000 in adjusted EBITDA loss, compared to a $5,000 gain a year earlier. (Release)

- Fire & Flower: Fourth quarter revenue up 157 per cent to $43.2 million, $1.5 million in adjusted EBITDA, compared to a $5.2 million loss a year earlier. (Release)

- Khiron Life Sciences: Fourth quarter revenue little was changed to $2.5 million, $4.4 million in adjusted EBITDA loss, compared to a $6.3 million loss a year earlier. (Release)

- Gage Growth: Fiscal 2020 revenue was US$39.9 million, compared to US$1.9 million in 2019. It reported a US$29.8 million net loss, compared to a US$75 million loss a year earlier. Gage forecast it would generate about US$18 million in Q1 2021 revenue, with sales nearly doubling in the forthcoming quarter. (Release)

- Auxly Cannabis: Fourth quarter revenue was $18.3 million, compared to $3.2 million a year earlier. It reported a $6.1 million adjusted EBITDA loss, compared to a $10.5 million loss a year earlier. (Release)

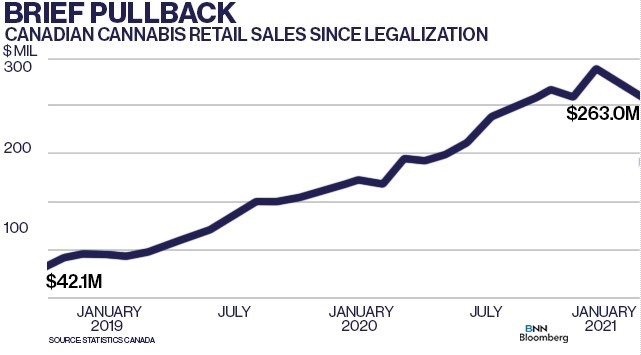

Analyst Call of the Week - Canadian cannabis retail sales

CANNABIS SPOT PRICE: $5.77 per gram -- This week's price is up 0.8 per cent from the prior week, according to the Cannabis Benchmark’s Canada Cannabis Spot Index. This equates to US$2,114 per pound at current exchange rates.

WEEKLY BUZZ

|