Apr 9, 2021

Cannabis Canada Weekly: Canopy Growth's $435M deal on Supreme Cannabis shows interest in premium pot

, BNN Bloomberg

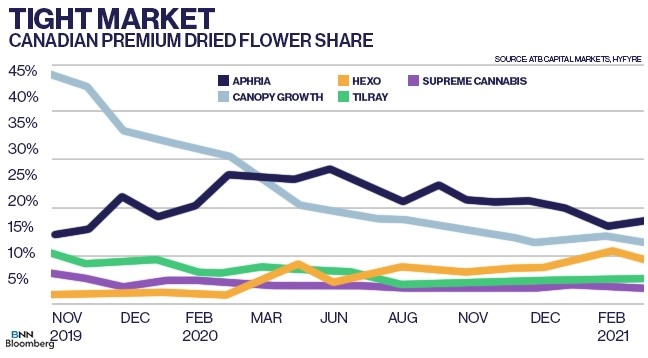

Canopy Growth buying rival Supreme Cannabis in deal worth $435M

Canopy Growth's $435M deal for Supreme Cannabis highlights consumer interest in premium segment

Organigram plugs missing gap in portfolio with $22M deal for Winnipeg candy maker

Organigram Holdings filled in a missing piece of its product portfolio after announcing it acquired Edibles & Infusions Corporation (EIC), a Winnipeg-based candy manufacturer for $22 million. The deal comes with an additional $13 million in payments dependent on if certain financial milestones are hit. EIC is led by James Fletcher, also the CEO of Cavalier Candies, which has been making confectionery products for over 100 years. Jefferies Analyst Owen Bennett said in a note that the deal adds to its "impressive" portfolio and addresses a need to supply the 'soft chew' side of its edibles offerings, which accounts for about 75 per cent of that category's sales across the country. Organigram expects to have its first sales of EIC manufactured soft chews around its fiscal fourth quarter.

VP Harris to pause on U.S. legalization efforts, Schumer expected to unveil reform bill soon The pathway for U.S. legalization got slightly muddier over the past week following comments made by Vice President Kamala Harris in an interview with the San Francisco Chronicle. "We haven’t yet taken that on,” because the administration has been focused on tackling the coronavirus pandemic, Harris told the newspaper. Still, Senate Majority Leader Chuck Schumer continues to push forward on his legalization bill, which he recently told Politico should come out "soon". The bill, which is being written along with fellow Senators Cory Booker and Ron Wyden, will move forward in Congress (once it's introduced) despite no assurance it will be signed into law by President Joe Biden, Schumer told Politico. Meanwhile, another federal lobbying group supporting cannabis legalization has emerged, this one with the unlikely bedfellows of Snoop Dogg and the Koch Brothers.

Mexico Senate aims to push debate on cannabis decriminalization to Sept.Mexico's plans to decriminalize cannabis hit a snag on Thursday after the country's Senate majority leader said a debate on a pro-decriminalization bill may need to be postponed, Reuters reports. The bill, which was already approved by Mexico's lower house, could instead be picked up by the Senate in September. Mexico's Supreme Court, which initially wanted a decriminalization bill passed back in September, would need to approve the debate's extension. Once decriminalized, cannabis could be worth as much as US$3.2 billion to the country's economy.

Califari, Merida Capital to develop digital cannabis art to be sold as NFTs

It was only a matter of time before cannabis and the emerging non-fungible token (NFT) space collided. New York-based Califari is partnering with private equity firm Merida Capital Holdings to develop a platform that will sell one-of-a-kind pieces of cannabis art. The company will introduce five digital cards in time for 4/20 that will showcase artists' interpretation of cannabis strains including Grand Daddy Purple and OG Kush. While the NFT wave has certain nabbed investors' attention, there are some signs that the NFT bubble may have already popped.

Analyst Call of the Week - Aphria

Aphria reports its fiscal third-quarter on Monday, with analysts expecting the company to report $163 million in revenue, while posting $14.9 million in adjusted EBITDA. Alliance Global Partners Analyst Aaron Grey raised his 12-month price target on Aphria's stock to $26 from $20 with a "buy" rating on the stock ahead of the quarterly results to account for a higher valuation ratio over the next year. Grey does note that Aphria's sales should come down by 4 per cent sequentially to about $167 million as a result of COVID-19 lockdowns on customer purchases but notes it could return to positive revenue growth given its brand strength in the market. Separately, two proxy advisory firms recommended Aphria and Tilray shareholders vote in favour of the merger between the two companies. The deal is expected to close by the end of the month.

For more on Aphria, click here.

CANNABIS SPOT PRICE: $5.73 per gram -- This week's price is down 0.7 per cent from the prior week, according to the Cannabis Benchmark’s Canada Cannabis Spot Index. This equates to US$2,095 per pound at current exchange rates.

WEEKLY BUZZ

|