Jul 2, 2021

Five key takeaways from Ontario's annual cannabis report

Ontario annual cannabis report signals further store closures, strength in legacy market

Five key takeaways from Ontario's annual cannabis report

The Ontario Cannabis Store released its annual report looking at the state of the province's cannabis market earlier this week. The report is chock-full of interesting tidbits and nuggets of information which will likely be pored over by industry observers looking for guidance on where the $2.6-billion cannabis market is heading. Given that federal regulators and Statistics Canada don't provide such a detailed look at how sales of cannabis fare in the country, and given also that Ontario is the biggest retail market in Canada and has a highly influential role within the broader industry, this report is the best indicator of how policymakers view the market. Simply put, Ontario's view on the cannabis industy matters.

An interview request with interim Ontario Cannabis Store Chief Executive Officer David Lobo was declined, citing the “interim” status of his position.

Here's five interesting items that we were able to glean from the report:

Legacy market stubbornly persists: The OCS estimates that 44.1 per cent of the province's cannabis sales came from the legal market by the fiscal fourth quarter (which ended March 2021), with the rest occurring among illicit channels. That's slightly up from the 43.1 per cent observed in the prior quarter, and a sign that the transitioning of customers from the legacy market to the legal one has slowed down considerably. While a bevy of new cannabis stores will likely keep that transition happening, the slower pace suggests illicit operators continue to flourish despite ongoing enforcement in the industry.

Store closures are (probably) coming: You may not be the only one wondering about the concentration of some legal pot stores in parts of the province, particularly in Toronto. Lobo notes in his annual letter that the industry's rapid growth “will likely result in some retailers being faced with increased competition and a crowded marketplace, which could result in some closures and market right-sizing.” While some areas may benefit from a clustering of cannabis retailers according to some academics, the province continues to take a market-based approach on retail, with no plans to restrict or reduce the amount of licensed pot stores. Lobo goes on to say that retailers will need to "further drive a relentless focus on targeted consumer segments and differentiating themselves from others."

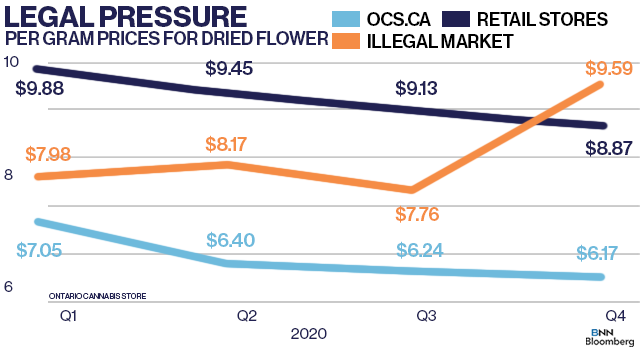

Prices keep dropping: The legal market continues to make strides in pricing, with the average price per gram sold by the OCS online hitting $6.17 at the end of March compared to $7.05 at the beginning of April 2020. Meanwhile, retail prices fell to $8.87 from $9.88 during that same time frame. Interestingly the average price of a gram of cannabis in the illicit market soared to $9.59 at the end of March from $7.98 in April 2020; the OCS says the increase might be the result of illicit sellers pushing more expensive, premium products and the removal of some websites illegally selling cannabis online. When it comes to the "value" end of cannabis, however, the OCS found consumers are buying slightly more premium products as retail store associates influence more people to purchase higher-priced offerings.

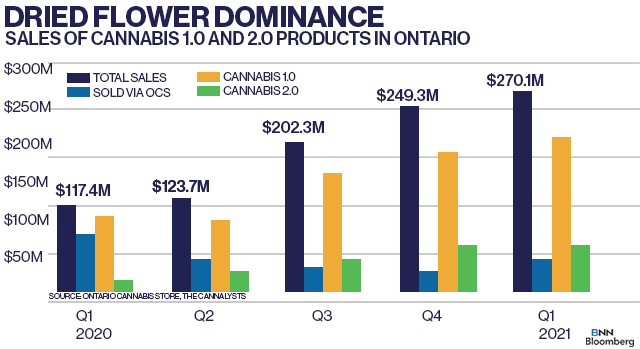

Flower continues to dominate: Despite the availability of a wide-range of innovative cannabis products, the vast majority of pot sales in Ontario remain dried flower and pre-rolls. Roughly 71 per cent of all sales came from these two categories, according to independent analysts at The Cannalysts. They also said in a report to clients that the dried flower category remains competitive among retailers and producers alike, while pre-roll sales likely saw a boost due to "impulse/convenience" purchases at retail stores.

Does anyone like pot drinks?: Despite all the hoopla, sales of most Cannabis 2.0 products continue to grow at a modest pace. Topical product sales saw a 12 per cent quarterly rise, but only amounted to about $4.5 million for the entire year. Concentrates, a category that includes products such as resin, hash and shatter, saw a steady 16 per cent rise in sales from the prior quarter, but totalled only $17.5 million or about three per cent of the year's total sales. More surprising was how infused beverages performed over the year; while producers have spent millions developing pot drinks, they only represent two per cent of the entire market or $12.8 million in sales and The Cannalysts report sees sales growth dropping by six per cent in the quarter.

TOP NEWS OF THE WEEK

Cannabis producers begin to seed U.S. medical research efforts

New York-based Clever Leaves said in a release it would give US$25 million in cannabis products to any firm licensed to help "advance scientific research into the potential medical benefits of cannabinoids." The company will earmark up to 250,000 bottles of pharma-grade cannabis oils or five tons of medical cannabis flowers to research firms that aim to develop new therapies. It said it already partnered with Biopharmaceutical Research Company (BRC), a pharmaceutical manufacturing and analytical firm focused on the production of cannabis for researchers across the U.S. BRC is one of the first groups in the U.S. to receive approval from the Drug Enforcement Administration to cultivate cannabis for scientific research purposes. Separately, Segra International said it completed the first export of cannabis plants to BRC from Canada, but didn't disclose the size of the shipment.

U.S. Supreme Court Justice Thomas spurs legalization chatter with questions of legality of current American cannabis laws

U.S. Supreme Court Justice Clarence Thomas made waves throughout the industry earlier this week after stating in a decision not to hear a tax-related appeal by a Colorado medical marijuana dispensary that the country's cannabis laws no longer make sense. "A prohibition on interstate use or cultivation of marijuana may no longer be necessary or proper to support the federal government's piecemeal approach," he wrote in the ruling, according to NBC News. He added that the court’s ruling in 2005 upholding federal laws making cannabis possession illegal may now be out of date. Raymond James Analyst Rahul Sarugaser highlighted the disclosure in a note to clients, particularly emphasizing how Thomas views the current federal laws governing cannabis as “the government [being now] content to allow states to act 'as laboratories.’”

Apple to allow cannabis companies to offer mobile labs in legal markets

Apple has now allowed cannabis businesses to offer mobile apps on its App Store, reversing a decision made to accommodate companies that operate in markets where marijuana is deemed legal. The move, first reported by TechCrunch earlier this month, means that cannabis-related apps must be restricted to areas where cannabis is legal and that the program must be "submitted by a legal entity that provides the services, and not by an individual developer." The decision will likely allow companies like Pax to offer mobile apps for users looking to connect their vape devices to an app, as well as cannabis delivery services, Marijuana Moment reports.

Quarterly Results Wrap: WeedMD, High Tide

Here's a summary of some of the cannabis industry companies that reported quarterly results this week:

- WeedMD: First quarter revenue down 15.5 per cent to $10.3 million, $432,100 in an adjusted EBITDA loss, compared to a $2.5 million loss a year earlier. (Release)

- High Tide: Second quarter revenue up 99 per cent to $40.9 million, $4.7 million in adjusted EBITDA, compared to a $1.8 million gain a year earlier. (Release)

- SpeakEasy Cannabis Club: Third quarter revenue up 27 per cent from the prior quarter to $925,550, $7.4 million in a net loss, compared to a $233,971 loss a year earlier. (Release)

- 1933 Industries: Third quarter revenue up 32 per cent to $$2.6 million, $1.4 million in adjusted EBITDA, compared to a $3.1 million loss a year earlier. (Release)

ANALYST NOTE OF THE WEEK - Stifel outlook on May sales

Stifel Analyst Andrew Carter takes a look at the latest Headset data for the Canadian cannabis market, which represents about two thirds of the total market. The data underscores that Canada's cannabis industry remains increasingly competitive with more entrants, outperformance from smaller producers and continued price compression. Headset sees sales in four Canadian provinces rising about 91 per cent in May from the same period a year earlier, while revenue should climb by about five per cent from April, Carter said. He added that he estimates Canada should see annual sales climb north of $4 billion this year and that it should reach $6 billion over the next two years. Interestingly, Carter notes that Ontario's retail market is "past the point of saturation in many areas," while the average sales per store in the province is below $2 million, amongst the lowest in the country. Quebec, which has a provincially-owned retail model, is at the top, with its retail stores generating more than $10 million in revenue annually.

CANNABIS SPOT PRICE

$5.47 per gram

-- This week's price is down 1.5 per cent from the prior week, according to the Cannabis Benchmark’s Canada Cannabis Spot Index. This equates to US$2,008 per pound at current exchange rates.

WEEKLY BUZZ

"I am human"

-- U.S. sprinter Sha’Carri Richardson’s tweet in response to being suspended for one month from the Olympic team after testing positive for THC. Richardson said in an interview with the Today Show that she consumed cannabis to help cope with the death of her biological mother. Richardson will be able to compete in the 100-metre relay race, but is not eligible for the 100-metre race in Tokyo later this month.