Oct 9, 2021

Cannabis Canada Weekly: Sundial buys Alcanna; Tilray CEO sees 'ankle biters' nipping at market share

Sundial Growers to buy Alcanna for $346M

Questions emerge following Sundial's deal to buy Alcanna for $346M in stock

Alberta-based cannabis producer Sundial Growers Inc. made a splash late Thursday after announcing it would buy liquor-and-pot retailer Alcanna Inc. for $346 million in an all-stock deal.

However, the deal raises some questions on how the producer - perhaps better known for being spotlighted as a meme-stock than for its products in the Canadian market - will abide by provincial regulations.

Sundial said Thursday it will issue about 405 million shares to acquire Alcanna, which operates 171 liquor stores and has a 63 per cent stake in Nova Cannabis, a pot shop retailer with 62 locations across Alberta, Saskatchewan, and Ontario. The deal is expected to close as early as Dec., pending various provincial regulatory approvals, and would give Sundial an additional $16.4 million in annual cash flow, while incurring another $15 million in annual EBITDA savings.

The acquisition would also place Sundial firmly atop the Canadian cannabis retail sector with it able to either own or operate through a franchise agreement 170 stores. Placing Nova Cannabis under its control would see Sundial's brands enjoy "significant incremental shelf space", the company said in a presentation deck.

However, current Ontario regulations forbid licensed producers from owning more than 25 per cent of a retailer's voting shares and more than 50 per cent of the beneficial interest of the fair value of a store. While some companies have found a novel workaround to that restriction, namely through employing a franchise model that Canopy Growth Inc.'s Tokyo Smoke uses with the Katz Group, it is unknown how Sundial plans to manage the seven Nova Cannabis-owned stores that operate in Ontario.

"We will structure the combined business to be compliant with all laws and regulations in each jurisdiction in which we operate," said Sophie Pilon, head of corporate communications at Sundial, in an email.

A representative from the Alcohol and Gaming Commission of Ontario said it hasn't received an application for transfer of sale from the licensee yet to "properly assess their eligibility". A statement from Nova Cannabis said the company will work with Sundial and provincial regulators "to ensure the Company remains fully compliant with the various provincial regulatory frameworks".

As well, there was some unusual trading activity at Alcanna in the weeks leading up to Thursday's announcement. In the release announcing the deal, Sundial and Alcanna signed a letter of intent (LOI) on Sept. 1 before formally putting out a statement on Thursday.

Since then, Alcanna's stock steadily rose 18 per cent. On Sept. 15, the company put out a statement after receiving a request from the Investment Industry Regulatory Organization of Canada (IIROC), which oversees trading activity in Canada, based on recent trading activity. Alcanna confirmed in the statement that it was "in early-stage discussions with another company with respect to a potential transaction" but cautioned there was "no assurance" a deal would happen.

When asked if there was a possible leak of the LOI, Alcanna Chief Executive Officer James Burns said "it is what it is" but wasn’t aware of whether that trading activity was a coincidence or if an investor caught wind of the deal before its announcement.

"There certainly seems to be smoke there but whether or not there's fire there, I don't know," he said in an interview Friday.

Burns also declined to comment on how Sundial would structure its retail operations in Ontario to abide by regulations in that province.

An IIROC spokesperson said the organization does not disclose to the public any of the discussions it has with listed companies or comments on the existence of any investigations into active matters. A spokesperson with the Alberta Securities Commission was "unable to comment on the existence, or nature of any investigation" into Alcanna's trading activity.

THIS WEEK'S TOP STORIES

Tilray sees pot sales jump 38% despite missing Q1 expectations

Tilray reported mixed first-quarter results on Thursday with both revenue and profit figures coming in below expectations, while still posting a 38 per cent rise in cannabis sales. Tilray said it made US$168 million in Q1 revenue, up 43 per cent from a year earlier, while its adjusted EBITDA rose 58 per cent to US$12.7 million. Tilray CEO Irwin Simon spoke to BNN Bloomberg and reiterated how the company's market share - estimated to be about 16 per cent of the Canadian market - has been challenged by "ankle biters" or in other words, smaller producers with little share that may struggle to compete on price with the pot giant. The remarks led to an outcry by a small but vocal group of Canadian cannabis industry observers who criticized the "ankle biter" comments, stating the CEO may be out of touch with the realities of the marketplace.

New Ontario bill makes pot retail delivery permanent

Ontario has given the green light to making cannabis delivery by private-sector retailers in the province permanent after first allowing the service to happen temporarily back in April 2020 and then again several months later. The measure is part of legislation the Ontario government is proposing to help reduce red tape within a number of sectors. High Tide CEO Raj Grover said in a statement that the move will help legal retailers better compete with illicit market operators and do so in a "a safe and secure manner".

Justin Bieber to lend name to new U.S. pre-roll brand

Stratford, Ont.-native and international superstar Justin Bieber sang that he "gets his weed in California" in his recent hit Peaches, making his partnership with Los Angeles-based company Palms to sell a pre-roll brand that much more appropriate. Palms will sell a seven-pack of pre-rolls with the "Peaches" brand for US$32 at locations in Nevada and California. Bieber isn't the first musician to lend his name to a cannabis company (there are far too many to list here) but his target demographic - Gen Z and millennials - make up almost 40 per cent of the cannabis market, according to Bloomberg News. A portion of sales from the Bieber-branded products will be earmarked for charity.

Former U.S. AG sees pathway for cannabis decriminalization

Former U.S. Attorney General Eric Holder said that the U.S. is "clearly on the path to decriminalizing marijuana" on a federal level, according to a report by Marijuana Moment. Holder, who served in the Obama Administration, spoke at a drug panel held at Ohio State University on Thursday, arguing that federal cannabis reform is "increasingly inevitable". "Now with regard to decriminalization, we are clearly on the path to decriminalizing marijuana,” he said, according to Marijuana Moment. "You know it’s going to happen. We are on a glide path now." Meanwhile, the IRS moved to support state-wide but federally illegal cannabis businesses, a move that should support solving complex tax compliance issues for those companies.

Analysts cut Q2 revenue targets for Canopy Growth

BMO Capital Markets Analyst Tamy Chen is cutting her sales expectations for Canopy Growth, according to a report in Yahoo Finance Canada. Chen is lowering her forecast on Canopy Growth's second-quarter sales estimate to $130 million from $172 million as early data figures indicate that sales in big markets like Ontario, Alberta and B.C. are slowing down on a monthly basis. Chen's sales expectations mirror similar downgrades from other analysts including Piper Sandler ($133 million from $168 million) and Cantor Fitzgerald ($135 million). Canopy will release its fiscal second-quarter on Nov. 9.

ANALYST NOTE - ATB on large Canadian LPs market share

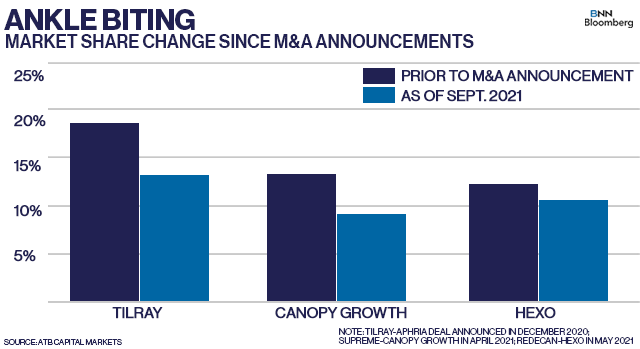

ATB Capital Markets Analyst Frederico Gomes said that larger Canadian cannabis producers have lost market share since announcing a string of deals aimed at boosting their presence in the fast-moving domestic market. For example, the deal to combine Aphria and Tilray resulted in a 20 per cent market share position at the time it was announced, but now the company now has a roughly 15 per cent share. Gomes said as a result of those moves, M&A may be "a distraction detrimental to acquirers’ core cannabis operations". He notes that other cannabis producers that have eschewed M&A deals in exchange for market share have lower capital allocation and integration risks and may as a result, be more efficient operators. Gomes said that M&A should only be pursued if companies will be able to acquire hard-to-build capabilities that bolster some strategic benefit such as entering a new geographic market or launching into a new product category.

CANNABIS SPOT PRICE: $5.12 per gram -- This week's price is down 0.7 per cent from the prior week, according to the Cannabis Benchmark’s Canada Cannabis Spot Index. This equates to US$1,844 per pound at current exchange rates.

WEEKLY BUZZ:

US$121.7 million

- The amount of cannabis sold in Illinois in September, about US$6 million shy of a new monthly record, according to the state's Department of Financial and Professional Regulation.