Oct 14, 2021

Canopy Growth aims for gummies dominance with Wana deal

Canopy Growth Corp. is buying Colorado-based cannabis edibles maker Wana to boost the pot giant's presence in the fast-moving segment in both the U.S. and Canadian marijuana markets.

Canopy said it will make an upfront cash payment of US$297.5 million to acquire call options to purchase Wana, which consists of three separate entities - Mountain High Products LLC, Wana Wellness LLC, and The Cima Group LLC. Once the U.S. makes cannabis federally legal, Canopy can choose to exercise those options and will pay 15 per cent of the fair market value of each entity with cash, stock, or a mix of the two, it said in a release.

Wana is one of the biggest cannabis-infused gummy makers in North America, with a leading brand in the U.S.; it holds the top spot in the Canadian gummy market, according to Canopy. The company has a presence in 12 American states and plans to expand to another nine states by the end of next year.

Edible products make up about five per cent of the Canadian cannabis recreational market and generated a total of about $149 million over the past 12 months, according to Hifyre data. In Canada, Wana's gummy brand is licensed by Indiva Ltd. and has generated about $49 million in sales over the past 12 months, the Hifyre data showed.

"As we establish Canopy Growth as the world's leading cannabis company, acquiring the #1 cannabis edibles brand in North America will serve to strengthen our market position in both Canada and the United States," said David Klein, chief executive officer at Canopy Growth, in the release.

"The right to acquire Wana secures another major, direct pathway into the U.S. THC market upon federal permissibility, and in Canada we'll be adding the top-ranked cannabinoid gummies to our industry-leading house of brands."

Canopy has sought out deals to boost its market share across several categories in the Canadian cannabis market. In April, the Smiths Falls, Ont.-based company acquired Ace Valley for an undisclosed sum to increase its share in the premium vapes, pre-roll joints, and gummies categories; while it paid $435 million to acquire Supreme Cannabis Company Inc. to bolster its premium dried flower offerings.

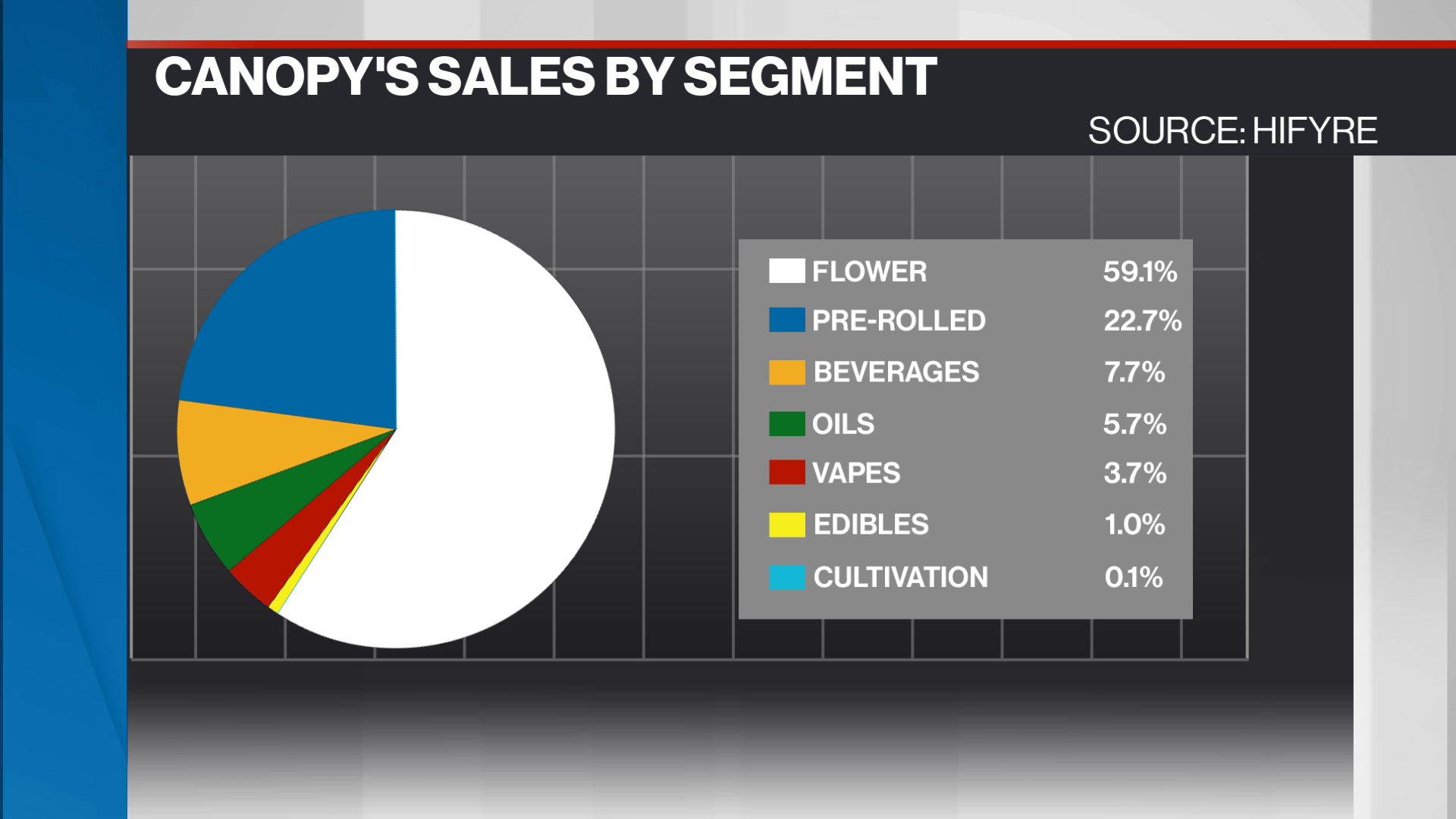

Canopy only sees about one per cent of its total cannabis revenue coming from its own edibles products, the smallest amount amongst all categories it has a presence in, according to Hifyre. Dried flower represents about 59 per cent of its total sales, the Hifyre data showed.

Cowen Analyst Vivien Azer said in a report to clients on Thursday she was "encouraged" by Canopy's strategy of diversifying its product mix ahead of its formal presence in the U.S. cannabis market.

"The deal is an attractive complement to Canopy Growth’s existing positioning with Acreage Holdings and TerrAscend which, while they do have their own wholesale branding, also have retail footprints that Wana will likely leverage as the pure-play brand looks to further penetrate the New York and New Jersey markets," Azer said in the report