New US Home Sales Jump to Highest Level Since September

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

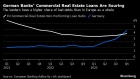

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Chinese mainland investors increased their portion of total turnover of Hong Kong stocks to a record daily average in April, with the latest measures to bolster the city’s position potentially boosting their purchases.

Mar 24, 2021

, BNN Bloomberg

RBC Economics is wading into the debate over Canada’s red-hot residential real estate markets, urging policymakers to put all options on the table when it comes to getting runaway prices under control.

In a research report Wednesday, RBC Senior Economist Robert Hogue said even measures previously considered “sacred cows” should be scrutinized as home prices become further divorced from average incomes and economic fundamentals.

“Many Canadians believe the policy environment guarantees property values will rise indefinitely,” he said. “Policymakers should put everything on the table, including sacred cows like the principal residence exemption from capital gains tax. These considerations will be complex, controversial and no doubt fraught with unintended side-effects.”

Currently, the sale of a primary property is exempt from capital gains taxes, which are only applied to secondary residences like cottages. That’s in contrast to the American system, where an exemption is applied up to US$250,000 for a single home seller and US$500,000 for a married couple.

RBC’s call comes amid an unprecedented run-up in home prices in the nation’s largest cities and outlying areas. Average prices in Vancouver and Toronto now exceed $1 million, but the combination of a lack of affordability in those cities and the pandemic-induced work-from-home movement have caused the heat to leak into the suburbs, with price gains in Toronto bedroom communities like Brampton and Oshawa outpacing those of the city itself.

Further exacerbating the upward price pressure is the lower-for-longer interest rate environment. The Bank of Canada has signaled it will keep its benchmark lending rate at the effective lower bound until at least 2023 in a bid to support Canada’s economic recovery, but the rock-bottom rate also allows prospective homebuyers to pursue larger and larger homes, adding heat to the market.

While the central bank has been extremely accommodative, mortgage rates have been bouncing off their lows as the benchmark five-year bond yield – which underpins mortgage rates – surged above one per cent.

With those rock-bottom rates supporting the rise in prices, Hogue said there are a number of other levers policymakers could pull in order to address the demand side of the housing equation.

“Further tightening of mortgage-lending rules could be necessary if signs of household debt stress emerge,” he said.

“Policy options include a stricter stress test, raising the minimum down payment and lowering the cap on refinancing. One thing is certain: there are no silver bullets. All demand-side options have side-effects and work, at best, for a limited time.”

In light of that limited impact of demand-side solutions, Hogue said policymakers must address limited housing supply and avoid the temptation of introducing potentially popular demand-side incentives until those supply-side measures are in place.

“Without corresponding measures to boost supply, any measures that ultimately heat up demand further—while probably helpful to the first people who take advantage of them—increase the odds of perpetuating problematic price trends and household debt issues.”