Sep 29, 2022

Capricorn Jumps as It Ditches Tullow Merger For NewMed Deal

, Bloomberg News

(Bloomberg) -- Capricorn Energy Plc proposed a merger with NewMed Energy LP, abandoning a tie-up previously agreed with Tullow Oil Plc after shareholders had turned against the deal.

The merger would make the combined company one of the largest upstream energy independents listed in London, according to a statement on Thursday. Under the terms, NewMed shareholders would own almost 90% of the combined venture, with Capricorn shareholders taking the rest. NewMed will pay Capricorn shareholders a special dividend of $620 million.

“The board has engaged in a robust and dynamic process to evaluate options for Capricorn and considered a broad range of external factors and market conditions,” Nicoletta Giadrossi, chair of Capricorn, said. “We believe this is a compelling transaction which combines near-term value realization with ongoing participation and value creation in a world-class gas company.”

Capricorn’s board of directors plans to unanimously recommend the deal with NewMed and unanimously decided to withdraw from the merger with Tullow.

Leaving Tullow “is unsurprising given increasing concerns over valuation and strategic rationale,” said Will Hares, a global energy analyst for Bloomberg Intelligence. “An Israeli offshore gas player offers far more compelling operational, regional, and gas synergies.”

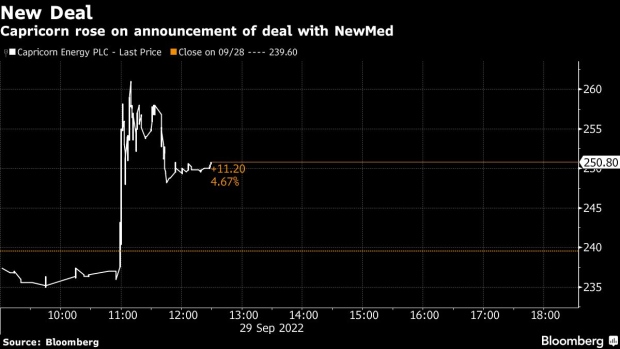

Shares in Capricorn jumped as much as 8.9% in London, with Tullow falling as much as 5.5% after the announcement. A Tullow spokesman declined to comment.

Africa-focused Tullow announced a merger with Capricorn in June, a deal that would have created a $1.9 billion energy firm with assets spread from Ghana to Egypt. Questions followed soon after over the value of the combination.

More than a quarter of Capricorn’s shareholders last month said a proposed merger with Tullow lacked merit, undervalued the company, and that they would vote against the transaction. Tullow Chief Executive Officer Rahul Dhir, who was set to lead the group, continued to promote the merger as recently as two weeks ago, despite the opposition.

The new tie-up will combine NewMed, one of the largest gas producers in the Mediterranean, with Capricorn’s portfolio of production and exploration in countries including the UK, Egypt, Mexico and Suriname. The deal will create a “gas and energy champion” in the Middle East and North Africa, the companies said.

The transaction furthers NewMed’s expansion plans following a tie up with Israel’s Enlight Renewable Energy Ltd. earlier this year.

“We have a shared vision on a disciplined capital allocation framework,” NewMed CEO Yossi Abu said in the statement. The company aims to “significantly increase our production while expanding to the LNG market with the aim of supplying Europe’s growing gas demand.”

Both Capricorn and NewMed shareholders will need to approve the deal at respective general meetings.

(Updates with comment from analyst in fifth paragraph, Tullow’s share drop)

©2022 Bloomberg L.P.