Dec 15, 2019

Carbon Markets Fail to Win Backing at UN Climate Talks

, Bloomberg News

(Bloomberg) -- Envoys from almost 200 countries endorsed a limited set of measures to rein in climate change, shelving efforts to expand carbon markets as a tool to fight global warming.

Delegates at a United Nations meeting in Madrid expressed an “urgent need” to make more ambitious cuts in fossil fuel emissions and advanced work on a mechanism to compensate some of the poorest nations for loss and damages related to climate change.

For a second year, they were unable to agree on the creation of a system of credits for projects that would cut emissions. They also didn’t endorse any language about how spur finance for fighting climate change, one of the pillars of the international discussions that have been running almost three decades.

The delegates from environment and energy ministries stumbled over the details for a new market instrument to rein in pollution. They were trying to work out how to prevent double counting of credits and integrate into the new system an existing mechanism that funnels at least $138 billion into green projects.

The impasse leaves companies that encouraged carbon trading, including the oil major Royal Dutch Shell Plc and the Spanish utility Iberdrola SA, with fewer price signals showing how quickly the cost of pollution is rising.

The meeting was meant to flesh out the last rules needed to implement the 2015 Paris Agreement, under which all nations promised steps to cut greenhouse gas pollution.

The delegates are working toward limiting the Earth’s average temperature increase to 1.5 degrees Celsius since the start of the industrial revolution. Even that would be the biggest shift in the climate since the last ice age ended some 10,000 years ago, and scientists say rising temperatures are already lifting sea levels and causing more violent storms.

“The key polluting countries responsible for 80% of the world’s climate-wrecking emissions stood mute while smaller countries announced they’ll work to drive down harmful emissions in the coming year,” said Jake Schmidt, who is following the talks for the Natural Resources Defense Council, a New York-based research group.

Envoys aimed to elaborate on Article 6 of the Paris deal. That section of the 27-page accord allowed market mechanisms to be used in meeting emissions goals, though it didn’t spell out how those would work.

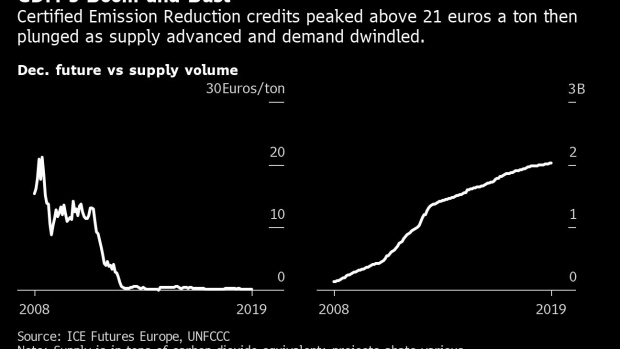

The ambition was to revive the Clean Development Mechanism and other tools that channeled aid to poorer nations for projects that cut emissions. Those projects generated tradable securities representing emissions cuts.

To some extent, the consequences of failure this year are low. Markets were the main agenda item, and many nations and green groups were skeptical about involving those mechanisms. They see carbon trading as a distraction from the broader need for much deeper and faster cuts in emissions, which no market mechanism would force.

“It symbolizes profits for their private sector and the chance to give the appearance that they are meeting their commitments while continuing to pollute and operate business as usual,” said Tina Stege, the climate envoy for the Marshall Islands.

Carbon market advocates were disappointed, saying that agreeing on a system would help put a price on pollution and move industry away from the most damaging fuels.

Failure in Madrid puts a spotlight on the U.K., which is hosting next year’s talks in Glasgow. The agenda there was focused on raising the ambitions of countries to promise deeper cuts than they have set out for the Paris deal. Markets will now complicate that discussion.

“For Glasgow to be a success, we need a clear message that countries will be called to revise and improve their climate action plans,” said Mohamed Adow, director of Power Shift Africa, an environmental group. “If that doesn’t come through, there’s going to be little that we can be able to harvest in Glasgow.”

To contact the reporters on this story: Laura Millan Lombrana in Santiago at lmillan4@bloomberg.net;Jeremy Hodges in London at jhodges17@bloomberg.net

To contact the editor responsible for this story: Reed Landberg at landberg@bloomberg.net

©2019 Bloomberg L.P.