Apr 21, 2023

Cargill Euro Bonds Boomed Despite EU Deforestation Law Risks

, Bloomberg News

(Bloomberg) -- Cargill Inc.’s first euro bond in almost 10 years met with huge demand from investors even though questions remain on how the food trader will align itself with new European Union rules designed to prevent deforestation.

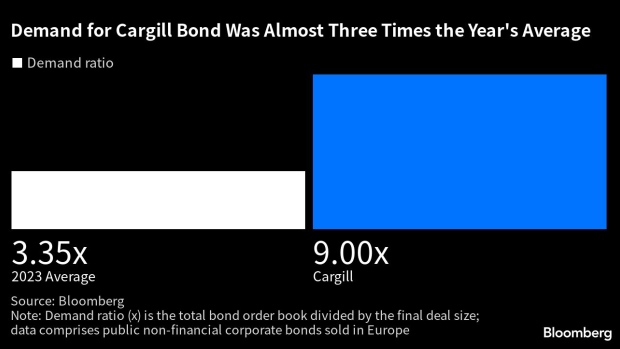

The sale gathered demand that was nine times the size of the offering, the highest for a European corporate bond since January, according to data compiled by Bloomberg.

For investors, the securities were a once-in-a decade opportunity to gain exposure in euros to the largest private company in the US. Cargill is rated investment grade and plays a global role in commodities, making it appealing at a time when fund managers are seeking safer investments in the wake of banking-sector turmoil.

The success of the bond sale is the most recent example of how climate and sustainability considerations take a back seat in a bruised bond market that has turned averse to risk, even when fresh regulation could hurt returns in the long run.

Cargill, which will fall under the scope of the new EU rules that seek to curb imports of products linked to deforestation, hasn’t provided a clear breakdown of how much the measures will cost the company. Cargill shares the EU’s vision of combating deforestation linked to food production and will comply with the legislation, it said in response to a query from Bloomberg News.

“What will you put on the table to achieve your commitments to deforestation and how much is it going to cost? Those are the main questions investors should be asking now,” Stephanie Mielnik, the head of fixed-income research at the Anthropocene Fixed Income Institute, said in an interview this week. “Is there a risk that if it does not comply with the rules, Cargill may not be able to access the European market in future?”

The institute, a nonprofit think tank that aims for a positive impact on climate change through bond markets, published a report before the sale saying that Cargill has clear deforestation and land-use change exposures, with critiques being raised against its activities in soy, palm oil and cocoa. The Cargill bond is one of the first with such high deforestation exposures to come to market in the EU since the bloc reached a deal on the new rules in late 2022, according to the report.

Landmark Deal

European Union lawmakers signed off Wednesday on the mandatory set of rules for companies selling soybeans, beef, coffee and cocoa, among other commodities, to ensure those products don’t originate from lands deforested after 2020. The rules apply to all companies’ suppliers, direct and indirect.

How EU Wants to Stop Deforestation in Your Coffee: QuickTake

The extension of the deal to wooded lands, including Brazil’s Cerrado region — one of Brazil’s main sources of commodities — will be discussed one year after the entry into force. Extending the zero-deforestation pledge to Cerrado, a savanna that is a hive of biodiversity, would affect at least half of Brazil’s soybean acreage versus about 15% in the Amazon region.

The EU regulation may require Cargill to provide supply-chain data that proves zero deforestation since 2020. According to Cargill’s 2022 environmental, social and governance report, the company traces 92% of the total volume purchased of soybeans from Brazil and 88% from Argentina, but the percentage of suppliers directly traced by Cargill is much lower: 58% in Brazil and 54% in Argentina, with partners being responsible for the indirect control.

The company announced in November, along with other 13 food traders, a roadmap to reduce greenhouse gas emissions caused by deforestation in the production of palm oil, cattle and soy. The plan calls for achieving its targets by 2025, before the bond matures in 2030, but still 5 years short of the EU rule of 2020. Cargill as a whole promises to end deforestation in all supply chains in all countries by 2030.

“Our implementation plan for compliance is under way,” a company spokesperson said by email.

Commitments from the 14 companies for the palm-oil and cattle sectors were strong, but fall well short of what is needed for soy production, said Carter Roberts, CEO of World Wildlife Fund in the US.

“For soy, the roadmap includes deforestation but not habitat conversion,” Roberts said. “In so doing, it cherry picks which lands it will cover, leaving out significant parts of the most important landscapes, including 74% of the Cerrado in Brazil where 250 million tons of greenhouse gases are emitted on a yearly basis.”

(Adds WWF comments in the last paragraph, adds chart)

©2023 Bloomberg L.P.