Jan 31, 2020

Caterpillar's 2020 outlook adds more gloom to virus-shaken markets

, Bloomberg News

Caterpillar’s 2020 Profit Outlook Trails Analyst’s Estimates

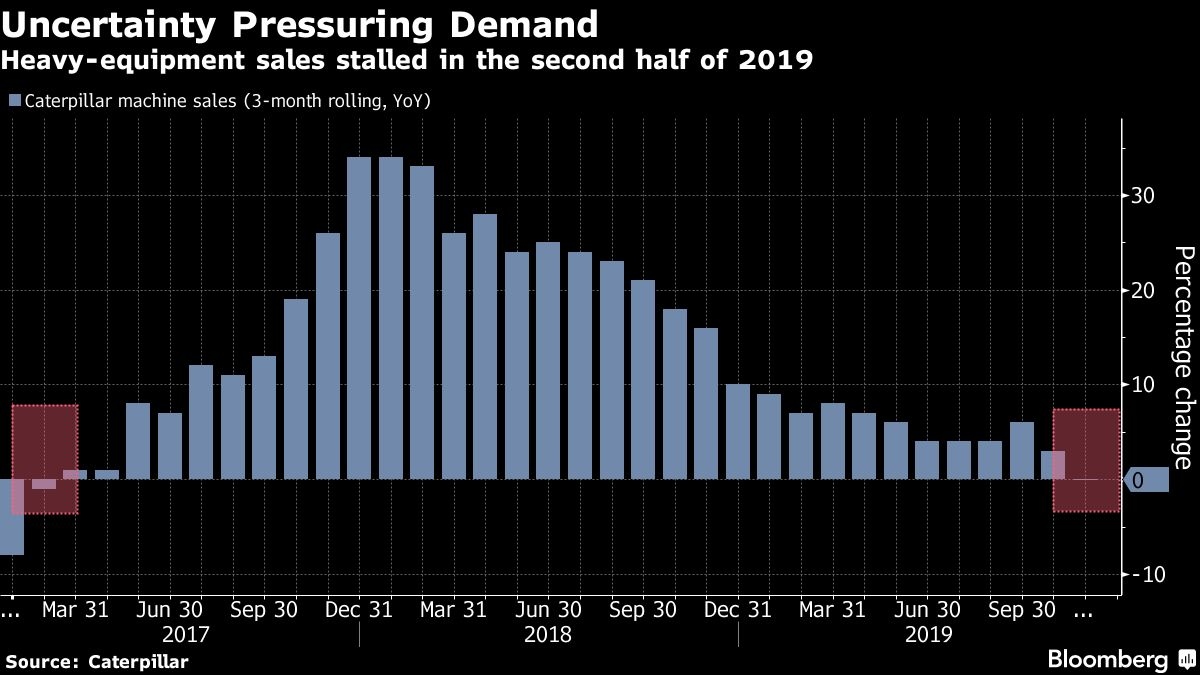

Caterpillar Inc.’s 2020 profit outlook trailed analysts’ estimates, with “further economic uncertainty” expected to pressure sales, adding further gloom to global markets already reeling from the coronavirus.

The heavy-equipment maker expects 2020 profit to be in a range of US$8.50 to US$10 per share. Analysts had forecast US$10.55 on average. Per-share profit in the fourth quarter topped analysts’ estimates.

Shares of Caterpillar have dropped this month after surging last quarter, with markets roiled by the coronavirus at a time when money managers are seeking signs of improvement in the global economy after the U.S.-China trade deal. The outlook may signal further headwinds for machine sales. They’ve been sliding as global manufacturing slumps, business investment declines and miners hold back on spending.

“We expect continued global economic uncertainty to pressure sales to users in 2020 and cause dealers to further reduce inventories,” Chief Executive Officer Jim Umpleby said in a statement Friday.

Caterpillar, considered an economic barometer, has been trying to cut costs and trim inventories as demand in some of its main markets trails production.

The outlook clouds prospects for the company that reported adjusted fourth-quarter earnings of US$2.63 per share, beating the US$2.37 average of estimates compiled by Bloomberg.

“Strong cost control more than offset lower-than-expected end-user demand” helping the company report better-the-expected fourth-quarter results, Umpleby said.

The statement was released before the start of regular trading in New York, where Caterpillar shares slipped 0.3 per cent at 6:56 a.m.