Dec 15, 2019

Caution Abounds Even as Emerging Markets Ready Year-Ending Rally

, Bloomberg News

(Bloomberg) -- Emerging markets are gearing up to ride a risk rally in the final full week of December, with a troika of uncertainties all but lifted from traders’ radars.

There’ll be plenty of caution around, though.

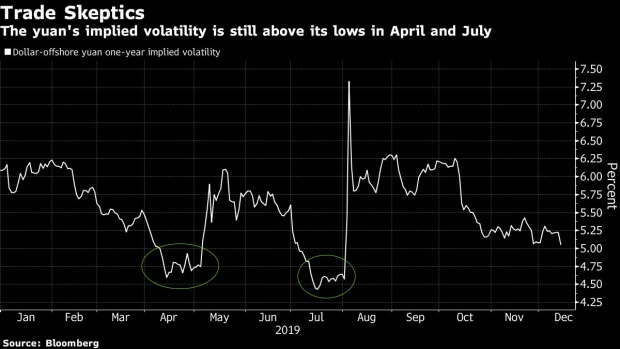

While last week’s meeting of the U.S. Federal Reserve and the U.K. election have been removed from the list of worries, there are sufficient doubts about the progress of the U.S.-China trade negotiations to keep buyers away. And if there’s anything to be gleaned from expected volatility in the Chinese currency, the skeptics are legion. Options-implied one-year volatility for the offshore yuan stood at 5.05% on Friday, above the roughly 4.5% in April and July, a time when traders saw a trade deal as imminent.

While Washington and Beijing agreed the first phase of a trade deal on Friday that will see the U.S. reduce some tariffs and China increase agricultural purchases, broader problems between the world’s two biggest economies seem far from being resolved.

“This is only a short-term solution,” Luciano Jannelli, head of investment strategy at Abu Dhabi Commercial Bank, said in an interview with Bloomberg TV on Sunday. “If you look at the lack of progress on the issue of China’s industrial policy -- it’s subsidizing of specific business lines -- the big issues have not been tackled yet.”

Emerging-market stocks and currencies had their best week since June in the five days through Friday. Investors took heart from the Fed implying it would keep interest rates on hold throughout 2020 and then by signs the U.S. and China were nearing a phase-one deal. Boris Johnson’s election victory on Thursday gave another boost to riskier global assets, given it will probably pave a smoother path for Britain to exit the European Union.

Monetary Decisions

- Three Asian central banks -- Thailand, Indonesia and Taiwan -- will be having their last rate meetings for the year. None of them are expected to cut interest rates, especially after the Fed signaled it will hold through 2020

- Bank of Thailand kicks off a monetary-policy meeting on Wednesday, with all 14 analysts surveyed by Bloomberg expecting it to hold rates at 1.25%. Two rate cuts this year have reduced appetite for currency speculation, Deputy Governor Mathee Supapongse said this month. The baht is the best-performing emerging-market currency this year, after the Russian ruble, with a gain of almost 8%

- Bank Indonesia Senior Deputy Governor Destry Damayanti flagged this month that rates may remain on hold as the authority gauges the impact of 100 basis points of rate cuts since July. The policy rate currently stands at 5%

- Taiwan has kept its benchmark rate at 1.375%, unchanged since 2016

- Mexico’s central bank is expected to cut its key interest rate by a quarter point on Thursday. That would be its fourth reduction in five months. The peso was among the best-performing EM currencies last week, and ranks No. 4 so far this year

- Colombia’s monetary authority will probably keep rates on hold on Friday

Aramco Inflows

- Saudi Aramco gets added to MSCI Inc. and FTSE Russell’s emerging-market equity indexes this week. The inclusion of the energy giant, which was listed in Riyadh on Wednesday, will probably trigger about $1.16 billion of passive flows into the stock, according to Arqaam Capital. EFG-Hermes foresees inflows of as much as $1.24 billion

Data and Minutes

- China releases its industrial production and retail sales data on Monday. The monthly repricing of its loan prime rates is scheduled on Friday. The People’s Bank has been slowly reducing its lending rates to support the economy

- Indonesia publishes November trade figures on Monday, while on Friday Taiwan releases exporter-orders data and Thailand puts out trade figures

- Philippine overseas-workers remittances are due on Monday

- Nigeria is scheduled to release inflation numbers for November on Thursday. Inflation accelerated to 11.6% in October following the government’s decision to close some of its borders to curb smuggling

- Ghana publishes third-quarter GDP numbers on Wednesday

- South Africa is set to announce its budget balance for November on Friday, which will give an indicator about how the economy, which contracted in the third quarter, is faring in this one

- Egypt is scheduled to publish its trade balance for October on Thursday

- Argentina is due to release third-quarter GDP data on Monday that will in all likelihood show the nation was still mired in a recession in the period. Alberto Fernandez’s new government is under mounting pressure to address the struggling economy and a mountain of debt. The peso is the world’s worst-performing currency this year

- On Tuesday, investors will eye Brazil’s central bank minutes, seeking insight into the decision to cut borrowing costs to a record low this month. The bank will also release its fourth-quarter inflation report on Thursday. Brazil’s credit-default swaps dropped last week after S&P Global Ratings changed its outlook to positive

--With assistance from Tomoko Yamazaki and Alec D.B. McCabe.

To contact the reporters on this story: Paul Wallace in Dubai at pwallace25@bloomberg.net;Lilian Karunungan in Singapore at lkarunungan@bloomberg.net;Sydney Maki in New York at smaki8@bloomberg.net

To contact the editors responsible for this story: Alex Nicholson at anicholson6@bloomberg.net, Justin Carrigan, James Amott

©2019 Bloomberg L.P.