Aug 10, 2020

CBD supply seen shrinking as U.S. farmers flee hemp

, Bloomberg News

U.S. farmers appear to be fleeing the hemp market after a rush last year to meet over-hyped CBD demand resulted in plunging prices and warehouses full of unsold supply.

Pricing and data firm Hemp Benchmarks said there’s been a “notable contraction” in permitted hemp production capacity this year, with U.S. licensed acreage down more than 30 per cent from 2019 and indoor and greenhouse square footage falling 64 per cent.

Hemp is a type of cannabis that contains less than 0.3 per cent THC, the compound that gets you high. It’s grown for its CBD, a non-psychoactive ingredient that’s said by proponents to help with everything from sleeplessness to pain, as well as for industrial and food purposes. It was legalized across the U.S. in late 2018, but the Food and Drug Administration still prohibits CBD use in food or dietary supplements.

Hemp Benchmarks said in its July report that it also expects a smaller proportion of 2020’s hemp crop to be grown for CBD, with the rest being used for fiber and grain.

“If proportions of planted and successfully harvested acreage this year are similar to last year, it should result in a substantially smaller supply of CBD and other cannabinoid-rich biomass from this year’s crop, relative to 2019,” the firm said.

This is beginning to affect prices, with “stabilizing rates” in recent months and even “slight upward trends” for some products, like smokable bulk CBD flower and refined hemp oil.

“Whether this trend will hold is uncertain, given that many processors are reportedly sitting on significant amounts of inventory,” Hemp Benchmarks said. In addition, “large amounts of extracted CBD are currently ‘locked up’ in bankruptcy reorganizations and lawsuits, and when such product might be released onto the market again is unknown.”

CBD biomass prices are still far below where they were a year ago, trading in a range of 40 cents to US$1.05 per percentage point of CBD content per pound, compared to over US$4 in July 2019, according to trading platform and benchmark pricing service PanXChange.

CBD Demand

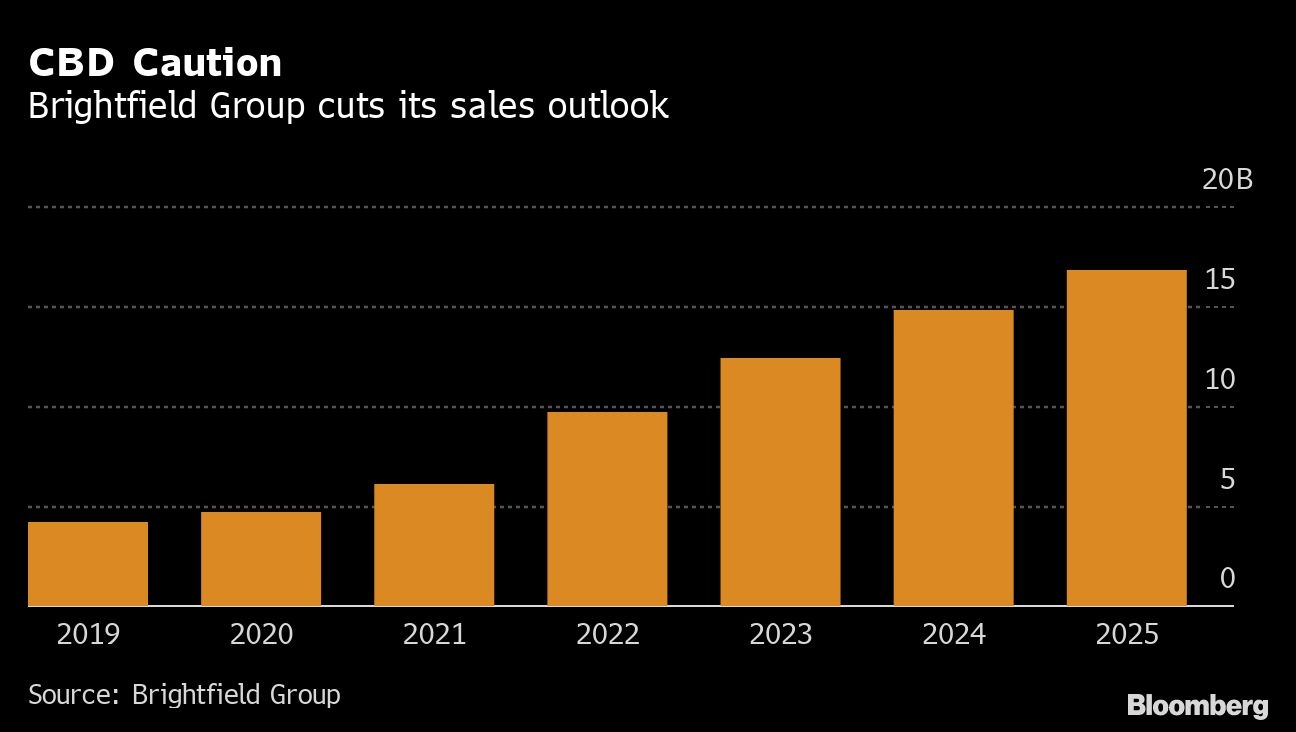

Supply may be shrinking, but demand is too. CBD sales this year are now forecast to be significantly below previous estimates amid fallout from pandemic-related store closures, unemployment and inaction by the FDA on food-related products, according to a recent report from cannabis data firm Brightfield Group.

The U.S. CBD market is now projected to reach US$4.7 billion in sales in 2020, up 14 per cent from 2019; that’s down from a prior forecast of about $8 billion issued last year. Brightfield also significantly reduced its outlook for 2023 to US$12.4 billion from about US$20 billion previously.

Events This Week

MONDAY 8/10

- Canopy Growth Corp. reports quarterly earnings premarket

- Tilray Inc. and Columbia Care Inc. release results after hours

TUESDAY 8/11

- Harvest Health & Recreation Inc., Acreage Holdings Inc. and Neptune Wellness Solutions Inc. report postmarket

- Companies including Curaleaf Holdings Inc., KushCo Holdings Inc. and Jushi Holdings Inc. present at Canaccord Genuity’s Virtual Annual Growth Conference through Aug. 13

WEDNESDAY 8/12

- Trulieve Cannabis Corp. and Aleafia Health Inc. release earnings before markets open

- Green Thumb Industries Inc., Village Farms International Inc. and The Green Organic Dutchman Holdings Ltd. report postmarket

THURSDAY 8/13

- and MediPharm Labs Corp. release results premarket

- Sundial Growers Inc. reports earnings postmarket

FRIDAY 8/14

- Canopy Rivers Inc. reports premarket